FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:!

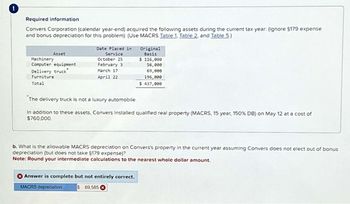

Required information

Convers Corporation (calendar year-end) acquired the following assets during the current tax year: (ignore $179 expense

and bonus depreciation for this problem): (Use MACRS Table 1, Table 2, and Table 5.)

Asset

Machinery

Computer equipment

Delivery truck*

Furniture

Date Placed in

Service

October 25

February 3

March 17

April 22

Original

Basis

$ 116,000

56,000

69,000

196,000

Total

$ 437,000

The delivery truck is not a luxury automobile.

In addition to these assets, Convers installed qualified real property (MACRS, 15 year, 150% DB) on May 12 at a cost of

$760,000

b. What is the allowable MACRS depreciation on Convers's property in the current year assuming Convers does not elect out of bonus

depreciation (but does not take §179 expense)?

Note: Round your intermediate calculations to the nearest whole dollar amount.

Answer is complete but not entirely correct.

MACRS depreciation

$ 69,585

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At the beginning of the year, Anna began a calendar-year business and placed in service the following assets during the year: Date Cost Asset Acquired Basis Computers 1/30 $ 55,000 Office desks 2/15 $ 59,000 Machinery 7/25 $ 102,000 Office building 8/13 $ 436,000 Assuming Anna does not elect §179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) a. What is Anna’s year 1 cost recovery for each asset? b. What is Anna’s year 2 cost recovery for each asset?arrow_forwardNonearrow_forwardNonearrow_forward

- Guide Me Notif UMPI Corporation purchased machinery that was installed and ready for use on January 1, 2018, at a total cost of $285,000. Salvage value was estimated at $45,000. The machinery will be depreciated over five years using the double- declining balance method. For the year 2019 (year 2), UMPI should record depreciation expense on this machinery of ✓ 96,000 57,600 ☐ 68,400 48,000arrow_forwardDS: Required information [The following information applies to the questions displayed below.] Evergreen Corporation (calendar year-end) acquired the following assets during the current year: (Use MACRS Table 1 and Table 2.) Machinery Date Placed in Service October 25 February 3 Computer equipment Used delivery trucke Furniture August 17 April 22 *The delivery truck is not a luxury automobile. Asset Original Basis $ 84,000 20,500 33,500 167,500 b. What is the allowable depreciation on Evergreen's property in the current year if Evergreen does not elect out of bonus depreciation? MACRS depreciationarrow_forward8arrow_forward

- S.arrow_forwardGadubhiarrow_forwardAssume that ACW Corporation has 2022 taxable income of $1,500,000 for purposes of computing the $179 expense. The company acquired the following assets during 2022 (assume no bonus depreciation): Asset Placed in Service Basis Machinery September 12 $470,000 Computer equipment February 10 $ 70,000 Delivery truck August 21 $ 93,000 Qualified real property April 2 $ 1,380,000 (MACRS, 15 year, 150% DB) Total $2,013,000 Question: What is the maximum amount of §179 expense ACW may deduct for 2022? Answer: Question: What is the maximum total depreciation that ACW may deduct in 2022 on the assets it placed in service in 2022?arrow_forward

- Evergreen Corporation (calendar year-end) acquired the following assets during the current year: (Use MACRS Table 1 and Table 2.) Asset Machinery Computer equipment Used delivery truck Furniture Date Placed in Service October 25 February 3 August 17 April 22 Original Basis $ 108,000 38,500 51,500 197,500 *The delivery truck is not a luxury automobile. Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. b. What is the allowable depreciation on Evergreen's property in the current year if Evergreen does not elect out of bonus depreciation and elects out of $179 expense? Depreciationarrow_forwardNonearrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education