FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Dineshbhai

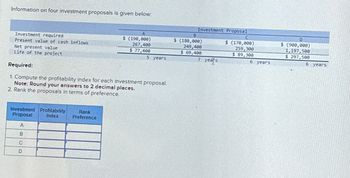

Transcribed Image Text:Information on four investment proposals is given below.

A

Investment required

Net present value

Present value of cash inflows

$ (190,000)

267,400

$ 77,400

Life of the project

5 years

Required:

1. Compute the profitability index for each investment proposal

Note: Round your answers to 2 decimal places.

2. Rank the proposals in terms of preference.

Investment Profitability

Proposal Index

Rank

Preference

A

B

C

D

B

Investment Proposal

$ (180,000)

249,400

$ 69,400

7 years

C

$ (170,000)

259,300

$ 89,300

6 years

D

$ (900,000)

1,197,500

$ 297,500

6 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Information on four investment proposals is given below: Investment required Present value of cash inflows Net present value Life of the project Required: 1. Compute the project profitability index for each investment proposal. (Round your answers to 2 dec 2. Rank the proposals in terms of preference. Propoza! A B C D COLONINST Index $(60,000) $(130,000) $(140,000) $(2,100,000) 86,600 181,100 213,900 2,803, 200 703,200 $ 26,600 $ 51,100 $ 73,900 $ 5 years 7 years 6 years 6 years Kana Preference Q Search k < Prev D 4 of 7 SUS N THEarrow_forwardHaresharrow_forwardiarrow_forward

- Information on four investment proposals is given below: Investment required. Present value of cash inflows Net present value Life of the project Answer is complete but not entirely correct. Profitability Index Investment Proposal ABCO A В Required: 1. Compute the profitability index for each investment proposal. (Round your answers to 2 decimal places.) 2. Rank the proposals in terms of preference. с D 3 0.41 0.38 0.50 0.33 Rank Preference A $ (240,000) 337,300 $ 97,300 Second Third First Fourth ✓ ✔ 5 years Investment Proposal $ (73,500) 110,250 $36,750 B $ (105,000) 144,900 $ 39,900 7 years 6 years $ (126,000). 168,000 $ 42,000 6 yearsarrow_forwardPreference Ranking Information on four investment proposals is given below Required: 1. Compute the project profitability index for each investment proposal. 2. Rank the proposals in terms of preference.:arrow_forwardssarrow_forward

- A project has the following cash flows set out below. What is the profitability index of this project if the relevant discount rate is 2 percent? Enter your final answer to two decimal places. Year Cash flow 0 -1,745 1 537 2 2,066 3 3,912arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardProfitability index. Given the discount rate and the future cash flow of each project listed in the following table, . use the Pl to determine which projects the company should accept. What is the Pl of project A? i Data Table (Round to two decimal places.) (Click on the following icon o in order to copy its contents into a spreadsheet.) Cash Flow Project A -%241,900,000 $150,000 $350,000 Project B Year 0 $2,300,000 $1,150,000 $950 000 $750,000 $550,000 Year 1 Year 2 Year 3 $550,000 Year 4 $750,000 $950,000 4% Year 5 $350.000 Discount rate 18% Print Donearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education