Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

suggest and give true answer for this account questions

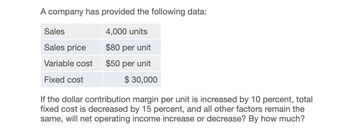

Transcribed Image Text:A company has provided the following data:

Sales

4,000 units

Sales price

$80 per unit

Variable cost

$50 per unit

Fixed cost

$ 30,000

If the dollar contribution margin per unit is increased by 10 percent, total

fixed cost is decreased by 15 percent, and all other factors remain the

same, will net operating income increase or decrease? By how much?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Klamath Company produces a single product. The projected income statement for the coming year is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. 2. Suppose 10,000 units are sold above break-even. What is the operating income? 3. Compute the contribution margin ratio. Use the contribution margin ratio to compute the break-even point in sales revenue. (Note: Round the contribution margin ratio to four decimal places, and round the sales revenue to the nearest dollar.) Suppose that revenues are 200,000 more than expected for the coming year. What would the total operating income be?arrow_forwardA company has prepared the following statistics regarding its production and sales at different capacity levels. Total costs: 1. At what point is break-even reached in sales dollars? In units? (Hint: Use the capacity level to determine the number of units.) 2. If the company is operating at 60% capacity, should it accept an offer from a customer to buy 10,000 units at 3 per unit?arrow_forwardIf a company has fixed costs of $6.000 per month and their product that sells for $200 has a contribution margin ratio of 30%, how many units must they sell in order to break even? A. 100 B. 180 C. 200 D. 2,000arrow_forward

- A company has provided the following data: Sales 4,000 units Sales price $80 per unit Variable cost $50 per unit Fixed cost $ 30,000 If the dollar contribution margin per unit is increased by 10 percent, total fixed cost is decreased by 15 percent, and all other factors remain the same, will net operating income increase or decrease? By how much?arrow_forwardA company has provided the following data: Sales 2,000 units Sales price $50/unit Variable cost $30/unit Fixed cost $25,000 If the variable cost per unit is decreased by 10%, the total fixed cost is increased by 20%, and all other factors remain the same, what will be the effect on operating income? a) It will decrease by $5,000 b) It will decrease by $1,000 c) It will increase by $6,000 d) It will increase by $1,000arrow_forwardA company has return on sales of 15% at sales of $400,000. Its fixed cost are $90,000; variable costs are $25 per unit. A. What are sales in units? Why? How? B. What is contribution margin per unit? Why? How? C. What is income? Why? How?arrow_forward

- provide the answer pls.arrow_forwardA company has provided the following data: Sales 3,000 Units Sales price $ 70 per unit Variable cost $ 50 per unit Fixed cost $ 25,000 If the sales volume decreases by 25%, the variable cost per unit increases by 15%, and all other factors remain the same, operating profit will: decrease by $15,000. decrease by $31,875. increase by $20,625. decrease by $3,125.arrow_forwardQuick answer of this accounting questionsarrow_forward

- Abc ? Accountingarrow_forwardThe X Corp income statement resembles the following after 35,000 units were sold in 2020. Sales = $420,000 / $12 per unit Variable = $192,500 / $5.5 per unit Contribution Margin = $227,500 / $6.5 per unit Fixed Expense $110,000 Net Op Income $117,500 A. What is X Corp. breakeven point in units and dollars? B. What is X Corp. margin of safety in %, units, and dollars?arrow_forwardSolutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College