Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:O

18.27%

22.70%

31.49%

25.35%

21.58%

Transcribed Image Text:3

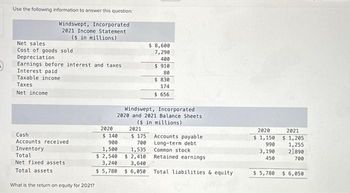

Use the following information to answer this question:

Windswept, Incorporated

2021 Income Statement

($ in millions)

Net sales

Cost of goods sold

Depreciation

Earnings before interest and taxes

Interest paid

Taxable income

Taxes

Net income

Cash

Accounts received

Inventory

Total

Net fixed assets

Total assets

What is the return on equity for 2021?

2020

$ 8,600

7,290

400

$910

80

$ 830

174

$ 656

Windswept, Incorporated

2020 and 2021 Balance Sheets

($ in millions)

2021

$ 175

700

1,5357

$ 2,410

3,640

$6,050

$ 140

900

1,500

$ 2,540

3,240

$5,780

Accounts payable

Long-term debt

Common stock

Retained earnings

Total liabilities & equity

2020

$ 1,150

990

3,190

450

$ 5,780

2021

$ 1,205

1,255

21890

700

$ 6,050

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Financial statements for Askew Industries for 2024 are shown below (in thousands): 2024 Income statement Net sales Cost of goods sold Gross profit Operating expenses Interest expense Income tax expense Net income Assets Cash $ 9,400 (6,400) 3,000 (2,200) (240) (224) $ 336 Bonds payable Common stock Retained earnings Comparative Balance Sheets. Accounts receivable Inventory Property, plant, and equipment (net) Liabilities and Shareholders' Equity Current liabilities December 31 2024 $ 640 640 840 2,400 $ 4,520 $ 1,340 1,600 640 940 $ 4,520 2023 $ 540 440 640 2,500 $4,120 $ 1,090 1,600 640 790 $ 4,220 Required: Calculate the following ratios for 2024 Note: Consider 365 days a year. Do not round intermediate calculations and round your final answers to 2 decimal places.arrow_forwardUse the following information for Taco Swell, Incorporated, (assume the tax rate is 24 percent): Sales Depreciation Cost of goods sold Other expenses Interest Cash Accounts receivable Short-term notes payable Long-term debt Net fixed assets Accounts payable Inventory Dividends 2020 $ 18,549 2,416 5,890 Cash flow from assets Cash flow to creditors Cash flow to stockholders 1,371 1,130 GA 8,696 11,528 1,714 29,180 72,861 6,293 20,492 2,179 For 2021, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. $ $ $ 2021 $ 18,888 2,524 6,771 1,198 1,345 9,367 13,602 1,681 35,329 77,730 6,760 21,902 2,354 -1,538.80 -4,804.00 7,250.00arrow_forwardBased on the above information, analyze the changes in the company's profitability and liquidity, in addition to the management of accounts receivable and inventory from 2022 to 2024. (Round answers to 1 decimal place, eg 13.5% or 13.5.) 2023 Sales Cost of goods sold Gross margin Other expenses Income taxes Net income Current ratio Quick ratio A/R turnover Average collection period Inventory turnover Days to sell inventory Debt to equity Return on assets 2022 Return on equity % 2022 % % 2022 :1 :1 times days times days 56 2023 % % % 2023 times days times days 2024 Based on the above information, analyze the company's use of leverage from 2022 to 2024. (Round answers to 1 decimal place, eg 15.1%) % 2024 % % % 2024arrow_forward

- Use the following information for Ingersoll, Inc. Assume the tax rate is 21 percent. 2019 $18,798 2,494 6,741 1,183 Sales Depreciation Cost of goods sold Other expenses Interest Cash Accounts receivable Short-term notes payable Long-term debt Net fixed assets Accounts payable Inventory Dividends 2018 $17,049 2,386 5,740 1,350 Cash flow from assets Cash flow to creditors Cash flow to stockholders 1,115 1,330 8,681 9,277 11,498 13,512 1,684 1,651 29,090 35,254 72,792 77,640 6,275 6,670 20,441 21,872 2,029 2,324 For 2019, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forward1arrow_forwardUsing functions , complete the “Aggregated Data” worksheet using the “Statementof Income” worksheet.arrow_forward

- What are the firm’s net profit margins for 2018 and 2019? Income Statements ($ in millions) Balance Sheets ($ in millions) 2018 2019 Assets 2018 2019 Sales Revenue $2,580 $2,865 Cash $70 $50 Less: Cost of goods sold $1,060 $1,500 Short-Term investments $35 $9 Less: Operating Expenses $105 $162 Accounts rec. 400 460 Less: Depreciation $85 $80 Inventory 490 556 Earnings before interest and taxes $1,330 $1,123 Total Current Assets $995 $1,075 Less: Interest paid $350 $380 Net fixed assets 1890 1,910 Taxable Income $980 $743 Less: Taxes (40%) $392 $297 Total assets $2,885 2,985 Net income $588 $446 Liabilities and Owner's Equity Dividends (45%) $265 $201 2018 2019 Additions to Retained Earnings $323 $245 Accounts payable $240 $210 Accruals $20 $20 Notes payable 65 74 Total Current…arrow_forwardWhat are the firm's days' sales outstanding for 2018 and 2019? Income Statements ($ in millions) Balance Sheets ($ in millions) 2018 2019 Assets 2018 2019 $1,265 | Cash $780 Short-Term investments $92 | Accounts rec. Sales Revenue $1,180 $35 $20 $660 $20 $5 Less: Cost of goods sold Less: Operating Expenses Less: Depreciation Earnings before interest and taxes Less: Interest paid $75 190 235 $50 Inventory $343 Total Current Assets $40 250 300 $405 $495 $560 $170 $150 | Net fixed assets 990 1,105 Taxable Income $235 $193 Less: Taxes (40%) $94 $77 Total assets $1,485 1,665 Net income $141 $116 Liabilities and Owner's Equity Dividends (45%) Additions to Retained Earnings $63 $52 2018 2019 $78 $64 Accounts payable $125 $100 Accruals $10 $10 Notes payable 35 40 Total Current Liabilities $170 $150 Long-term debt 598 790 Total Liabilities $768 $940 Common stock 554 498 Retained earnings Total Equity Total liab.& equity 163 $227 717 $725 $1,485 $1,665arrow_forwardK McDaniel and Associates, Inc. reported the following amounts on its 2024 income statement: Year Ended December 31, 2024 Net income Income tax expense Interest expense $ 22,950 6,600 3,000 What was McDaniel's times-interest-earned ratio for 2024? OA. 7.65 OB. 10.85 OC. 9.85 OD. 8.65 point(s) possible ...arrow_forward

- Give answer with explanationarrow_forwardHere are simplified financial statements for Phone Corporation in 2020: Net sales Cost of goods sold Other expenses INCOME STATEMENT (Figures in $ millions) Depreciation Earnings before interest and taxes (EBIT) Interest expense Income before tax Taxes (at 21%) Net income Dividends Assets Cash and marketable securities Receivables Inventories Other current assets BALANCE SHEET (Figures in $ millions) Total current assets Net property, plant, and equipment Other long-term assets. Total assets Liabilities and shareholders' equity Payables Short-term debt Other current liabilities Total current liabilities Long-term debt and leases Other long-term liabilities Shareholders' equity Total liabilities and shareholders' equity $ 13,600 4,310 4,162 2,668 $2,460 718 $1,750 368 a. Return on equity (use average balance sheet figures) b. Return on assets (use average balance sheet figures) c. Return on capital (use average balance sheet figures) d. Days in inventory (use start-of-year balance sheet…arrow_forwardHow much net income did Wolf Enterprises earn during 2021? Net income for 2021 was Cost of services sold Accumulated depreciation Selling, general, and administrative expenses Retained earnings, December 31, 2020 $ 14,500 Service revenue 40,800 Depreciation expense Other revenue 6,100 Dividends declared Income tax expense 2,700 Income tax payable 32,400 4,200 700 700 500 1,100arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education