ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

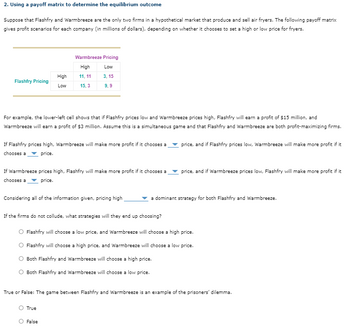

Transcribed Image Text:2. Using a payoff matrix to determine the equilibrium outcome

Suppose that Flashfry and Warmbreeze are the only two firms in a hypothetical market that produce and sell air fryers. The following payoff matrix

gives profit scenarios for each company (in millions of dollars), depending on whether it chooses to set a high or low price for fryers.

Flashfry Pricing

High

Low

For example, the lower-left cell shows that if Flashfry prices low and Warmbreeze prices high, Flashfry will earn a profit of $15 million, and

Warmbreeze will earn a profit of $3 million. Assume this is a simultaneous game and that Flashfry and Warmbreeze are both profit-maximizing firms.

Warmbreeze Pricing

High

Low

11, 11

3,15

15,3

9,9

If Flashfry prices high, Warmbreeze will make more profit if it chooses a

chooses a price.

If Warmbreeze prices high, Flashfry will make more profit if it chooses a

chooses a price.

Considering all of the information given, pricing high

If the firms do not collude, what strategies will they end up choosing?

O True

False

price, and if Flashfry prices low, Warmbreeze will make more profit if it

✓price, and if Warmbreeze prices low, Flashfry will make more profit if it

a dominant strategy for both Flashfry and Warmbreeze.

O Flashfry will choose a low price, and Warmbreeze will choose a high price.

O Flashfry will choose a high price, and Warmbreeze will choose a low price.

O Both Flashfry and Warmbreeze will choose a high price.

O Both Flashfry and Warmbreeze will choose a low price.

True or False: The game between Flashfry and Warmbreeze is an example of the prisoners' dilemma.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 4. Two firms face the following payoff matrix, where each is choosing whether to charge a low or high price: Firm 1 Low (2,0) (0,7) High Firm 2 Low (1,2) High (6,6) Is there any pure-strategy Nash equilibrium? What is the mixed-strategy Nash equilibrium?arrow_forwardonly typed solutionarrow_forward6. Consider the simultaneous move pricing game below. Which of the following statements is true concerning this game? a. The game has a dominant strategy (DSSC) solution b. The game has an iterated dominance (IESDS) solution c. The game has more than 1 Nash equilibrium d. None of the above statements are true Firm A Firm B H M L H 30,30 38,12 33,0 M 11,34 18,14 23,1 L 2,24 6,17 14,8arrow_forward

- First 4 blanks: high/low Last blank: is not/isarrow_forwardThe payoff matrix in the figure to the right shows the payoffs for a pricing game. If you were firm A, which strategy would you choose? Firm A should A. price high because this is their maximin strategy. B. price low because this is their tit-for-tat strategy. C. price high because this is their dominant strategy. D. price low because this is their dominant strategy. E. price low because this maximizes profits of both firms. Firm B's dominant strategy is to price If this game were repeated a large number of times and you were firm A and you could change your strategy, what might you do? Firm A should O A. use a tit-for-tat strategy by responding in kind to firm B's play. B. use a maximin strategy by maximizing the minimum gain that can be earned. C. use a tit-for-tat strategy by selecting a price that minimizes firm B's profits. D. use a maximin strategy by by responding in kind to firm B's play. E. use a tit-for-tat strategy by maximizing the minimum gain that can be earned. C Price…arrow_forward◄ Search 12:47 PM Sun Nov 12 ← Note Nov 12, 2023 Uptown's price strategy The Nash equilibrium occurs when High Low LED RareAir's price strategy High $12 $15 The more favorable outcome would be for $12 Tt ✪ $6 B Low $6 D $8. $15 $8 S O both firms have an incentive to deviate from this strategy given the strategy of the competing firm. It is shown by the dominant strategy of cell A. 92% neither firm has an incentive to deviate from this strategy given the strategy of the competing firm. It is shown by the dominant strategy of cell D. O one firm consistently has an incentive to deviate from this strategy given the strategy of the competing firm. It is shown by the high-price strategy of cell B. O one firm consistently has an incentive to deviate from this strategy given the strategy of the competing firm. It is shown by the high-price strategy of cell C. O the firms to collude and use the high-price strategy but this strategy requires cooperation. O one firm to take the lead and let the…arrow_forward

- QUESTION 13 Consider a market where two firms (1 and 2) produce differentiated goods and compete in prices. The demand for firm 1 is given by D₁(P₁, P2) = 140 - 2p1 + P2 and demand for firm 2's product is D2 (P1, P2) 140 - 2p2 + P1 Both firms have a constant marginal cost of 20. What is the Nash equilibrium price of firm 1? (Only give a full number; if necessary, round to the lower integer; no dollar sign.)arrow_forwardConsider the payoff matrix below representing two firms engaged in Bertrand Competition. Firm A is player 1 and Firm B is player 2. High price Low price High price 10, 12 -1, 13 Low price 12, 2 0, 3 What is Firm A's dominant strategy? Question 14Answer a. High price b. Low price c. Firm A does not have a dominant strategyarrow_forwardQ2arrow_forward

- 6. Using a payoff matrix to determine the equilibrium outcome Suppose that Zipride and Citron are the only two firms in a hypothetical market that produce and sell electric scooters. The following payoff matrix gives profit scenarios for each company (in millions of dollars), depending on whether it chooses to set a high or low price for scooters. Zipride Pricing price. High Low For example, the lower-left cell shows that if Zipride prices low and Citron prices high, Zipride will earn a profit of $13 million, and Citron will earn a profit of $3 million. Assume this is a simultaneous game and that Zipride and Citron are both profit-maximizing firms. Citron Pricing High 9,9 13, 3 If Zipride prices high, Citron will make more profit if it chooses a Low If the firms do not lude, 3, 13 6, 6 If Citron prices high, Zipride will make more profit if it chooses a price. Considering all of the information given, pricing low True False Both Zipride and Citron will choose a low price. strategies…arrow_forward2. Consider the following game. Assume that this game is played simultaneously and without collusion. The two companies are choosing between two strategies: go international or stay national. The outcomes of each strategy for each company are given the following payoff matrix: a) Find Nash equilibrium in this game. Interpret the equilibrium you found. b) What is the Chipco's dominant strategy, if it has one? How shall Chipco's payoffs change for it to not have a dominant strategy anymore?arrow_forwardConsider the payoff matrix below representing two firms engaged in Bertrand Competition. Firm A is player 1 and Firm B is player 2. High price Low price High price 10, 12 -1, 13 Low price 12, 2 0, 3 What is Firm A's dominant strategy? Question 14Answer a. High price b. Low price c. Firm A does not have a dominant strategyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education