Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What am I missing?

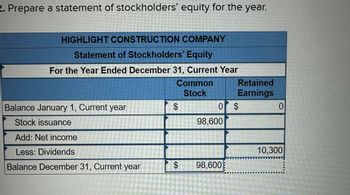

Transcribed Image Text:2. Prepare a statement of stockholders' equity for the year.

HIGHLIGHT CONSTRUCTION COMPANY

Statement of Stockholders' Equity

For the Year Ended December 31, Current Year

Common

Retained

Stock

Earnings

Balance January 1, Current year

$

0 $

0

Stock issuance

98,600

Add: Net income

Less: Dividends

10,300

Balance December 31, Current year

$

98,600

![[The following information applies to the questions displayed below.]

Assume that you are the president of Highlight Construction Company. At the end of the first year of operations

(December 31), the following financial data for the company are available:

Cash

Receivables from customers (all considered collectible)

Inventory of merchandise (based on physical count and priced at cost)

Equipment owned, at cost less used portion

Accounts payable owed to suppliers

Salary payable (on December 31, this was owed to an employee who will be paid on January 10)

Total sales revenue

Expenses, including the cost of the merchandise sold (excluding income taxes)

Income tax expense at 30% x pretax income; all paid during the current year

Common stock (December 31)

Dividends declared and paid during the current year

(Note: The beginning balances in Common stock and Retained earnings are zero because it is the first year of

operations.)

$ 26,400

12,400

80,000

42,200

47,140

1,900

122,000

88,200

?

98,600

10,300](https://content.bartleby.com/qna-images/question/10b5500b-af9e-44d2-8ab3-e2516e4dde77/ce4425bf-85ef-42af-90ad-ac7b5acb8c03/sd2h23_thumbnail.jpeg)

Transcribed Image Text:[The following information applies to the questions displayed below.]

Assume that you are the president of Highlight Construction Company. At the end of the first year of operations

(December 31), the following financial data for the company are available:

Cash

Receivables from customers (all considered collectible)

Inventory of merchandise (based on physical count and priced at cost)

Equipment owned, at cost less used portion

Accounts payable owed to suppliers

Salary payable (on December 31, this was owed to an employee who will be paid on January 10)

Total sales revenue

Expenses, including the cost of the merchandise sold (excluding income taxes)

Income tax expense at 30% x pretax income; all paid during the current year

Common stock (December 31)

Dividends declared and paid during the current year

(Note: The beginning balances in Common stock and Retained earnings are zero because it is the first year of

operations.)

$ 26,400

12,400

80,000

42,200

47,140

1,900

122,000

88,200

?

98,600

10,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- The income statement, statement of retained earnings, and balance sheet for Somerville Company are as follows: Includes both state and federal taxes. Brief Exercise 15-20 Calculating the Average Common Stockholders Equity and the Return on Stockholders Equity Refer to the information for Somerville Company on the previous pages. Required: Note: Round answers to four decimal places. 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardStatement of stockholders equity; net loss Selected accounts from the ledger of Restoration Arts for the fiscal year ended April 30, 20Y5, are as follows: Prepare a statement of stockholders equity for the year.arrow_forwardRatio of liabilities to stockholders equity and times interest earned The following data were taken from the financial statements of Hunter Inc. for December 31 of two recent years: The income before income tax expense was 480,000 and 420,000 for the current and previous years, respectively. A. Determine the ratio of liabilities to stockholders equity at the end of each year. Round to one decimal place. B. Determine the times interest earned ratio for both years. Round to one decimal place. C. What conclusions can be drawn from these data as to the companys ability to meet its currently maturing debts?arrow_forward

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Required: 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardCompute the amount of liabilities for Company E at the beginning of the year. End of Year $ Assets Equity, beginning of year Add: Stock issuances Add: Net income 115,920 Less: Cash dividends Equity, end of year Beginning of Year Assets $ = = = 101,010 = $ $ $ Liabilities + 91,576 + 6,500 8,642 15,142 11,000 24,344 Liabilities 101,010 + + GA $ Equity 24,344 Equityarrow_forwardCalculate the return on common stockholders equity of this financial accounting questionarrow_forward

- Presented below are data for XYZ Corp. Assets, January 1 Liabilities, January 1 Stockholders' Equity, Jan. 1 Dividends Common Stock, Dec. 31 2023 2024 4,560 ? ? 2,736 2 2,750 570 646 608 650 Stockholders' Equity, Dec. 31 ? 2,266 Net Income 684 Net income for 2024 is O $484 loss. O $162 loss O $162 income. O $120 income. $484 income. $120 loss.arrow_forwardAssuming that total assets were $8,037,000 at the beginning of the current fiscal year, determine the following: When required, round to one decimal place. a. Ratio of fixed assets to long-term liabilities b. Ratio of liabilities to stockholders' equity c. Asset turnover d. Return on total assets e. Return on stockholders' equity f. Return on common stockholders' equity % % %arrow_forwardThe income statement is a financial summary of the firm's operating results during a specified period Select one: O True O False on age CHAPTER 5- STOCK VALL ctivities CH3 Jump to...arrow_forward

- Prepare the shareholders’ equity section of the balance sheet of Colton Company at the end of the second year of operationsarrow_forwardStatement of stockholders’ equity; net loss Selected accounts from the ledger of Restoration Arts for the fiscal year ended April 30, 20Y5, are as follows: Common Stock May 1 (20Y4) 10,000 July 1 7,500 Retained Earnings Dividends Apr. 30 31,200 May 1 (20Y4) 475,500 July 31 (20Y4) 1,250 Apr. 30 5,000 Apr. 30 5,000 Oct. 31 1,250 Jan. 31 1,250 Apr. 30 (20Y4) 1,250 Prepare a statement of stockholders’ equity for the year ended April 30, 20Y5. Restoration Arts Statement of Stockholders’ Equity For the Year Ended April 30, 20Y5 Common Stock Retained Earnings Total $ $ $ $ $ $arrow_forwardharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning