ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

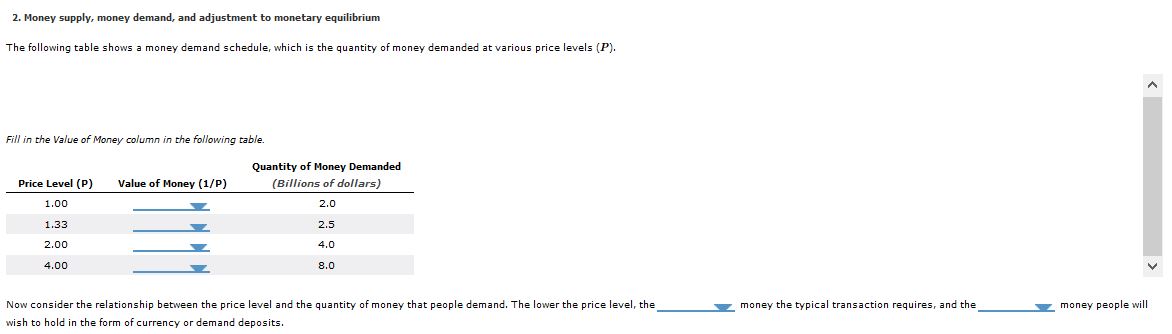

Transcribed Image Text:2. Money supply, money demand, and adjustment to monetary equilibrium

The following table shows a money demand schedule, which is the quantity of money demanded at various price levels (P).

Fill in the Value of Money column in the following table.

Quantity of Money Demanded

Price Level (P)

Value of Money (1/P)

(Billions of dollars)

1.00

2.0

1.33

2.5

4.0

2.00

4.00

8.0

Now consider the relationship between the price level and the quantity of money that people demand. The lower the price level, the

Y money the typical transaction requires, and the

y money people will

wish to hold in the form

currency or demand deposits.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- INTEREST RATE (Percent) 3 6 Suppose the money market for some hypothetical economy is given by the following graph, which plots the money demand and money supply curves Assume the central bank in this economy (the Fed) fixes the quantity of money supplied. Suppose the price level decreases from 90 to 75. Shift the appropriate curve on the graph to show the impact of a decrease in the overall price level on the market for money. 18 Money Supply 15 12 0 0 10 20 30 Money Demand 40 50 60 MONEY (Billions of dollars) Money Demand Money Supply Ⓡarrow_forwardAn increase in the money supply creates A. An excess supply of money that is eliminated by rising prices B. An excess supply of money that is eliminated by falling prices C. An excess demand for money that is eliminated by rising prices D. An excess demand for money that is eliminated by falling pricesarrow_forward1.Explain the quantity theory Answer the following questions: of money. Make sure to explain the relationship between money demand, money supply, and quantity of money.arrow_forward

- QUESTION 3 When a customer takes cash from a drawer in his home and deposits it into his saving account, the composition of the money supply will change immediately and the size of the money supply may eventually change. Illustrate and explain the process by which this action may change the money supply in economy. ***END OF QUESTION PAPER*** States) E Accessibility: Investigatearrow_forward#27 You saved $900 in currency in your piggy bank to purchase a new iPhone. The $900 you kept in your piggy bank illustrates money’s function as a _______. The iPhone’s price is posted as $900. The $900 price illustrates money’s function as a _____. You use the $900 to purchase the iPhone. This transaction illustrates money’s function as a ______. a medium of exchange, unit of account, store of value b medium of exchange, store of value, unit of account c store of value, medium of exchange, unit of account d store of value, unit of account, medium of exchangearrow_forward(Figure: A Money Market) The accompanying figure Equilibrium in the Money Market shows the money market in equilibrium at an interest rate of r2. Holding the money supply constant, which of the following might cause the interest rate in the market to decrease to r1? A) The inflation rate falls to historically low levels. B) Higher payroll taxes cause employers to pay workers cash under the table. C) There is a significant increase in the stock market. D) A recession decreases real GDP.arrow_forward

- Suppose there is an increase in money supply, as a result interest rates will Multiple Choice rise and the quantity of money will increases. fall and the quantity of money will remain constant. rise and the quantity of money will decrease. fall and the quantity of money will increases.arrow_forward2arrow_forwardAm.101.arrow_forward

- 14arrow_forward3. Changes in the money supply The following graph represents the money market for some hypothetical economy. This economy is similar to the United States in the sense that it has a central bank called the Fed, but a major difference is that this economy is closed (and therefore does not have any interaction with other world economies). The money market is currently in equilibrium at an interest rate of 2.5% and a quantity of money equal to $0.4 trillion, designated on the graph by the grey star symbol. INTEREST RATE (Percent) 4.5 4.0 6 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0 Money Demand + 0.1 Money Supply 0.3 0.5 0.6 MONEY (Trillions of dollars) 0.2 0.7 0.8 New MS Curve New Equilibrium ? Suppose the Fed announces that it is lowering its target interest rate by 75 basis points, or 0.75 percentage points. To do this, the Fed will use open- market operations to the money by the public. Use the green line (triangle symbol) on the previous graph to illustrate the effects of this policy by placing…arrow_forwardHow does an increase in price level affect the money market? a. Money demand increases b. Money supply decreases c. Money demand decreases d. Money supply increasesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education