ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

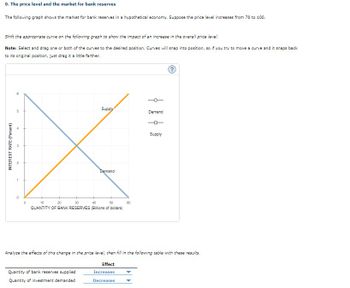

Transcribed Image Text:9. The price level and the market for bank reserves

The following graph shows the market for bank reserves in a hypothetical economy. Suppose the price level increases from 70 to 100.

Shift the appropriate curve on the following graph to show the impact of an increase in the overall price level.

Note: Select and drag one or both of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps back

to its original position, just drag it a little farther.

INTEREST RATE (Percent)

5

20

19

0

0

Supply

Demand

10

20

30

40

50

QUANTITY OF BANK RESERVES (Billions of dollars)

Quantity of bank reserves supplied

Quantity of investment demanded

60

Effect

Increases

Decreases

Demand

Supply

Analyze the effects of this change in the price level, then fill in the following table with these results.

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- How does the increase in interest rates raise the chances of a recession? How can we expect the increase in interest rates to affect the consumption of the poorest 20% and richest 20% of households?arrow_forwardWhy do economists insist on emphasizing the difference between money and income? Why is this difference important in macroeconomics?arrow_forwardHW 9 EQ 2) Hey, I need help with the following econ question. Thank you in advance! According to the quantity theory of money, if in a year's time, real GDP grew from $10 trillion to $10.2 trillion, and nominal GDP for the same time period grew from $10 trillion to $10.5 trillion, what is the growth rate of money supply? And the inflation rate?arrow_forward

- suppose the federal reserve needs to bring inflation under control and decides to raise the interest rate by 1 point. Use the graph below to decide on the appropriare course of action if the reserve requirement is 0% but banks like to hold 10% of deposits as reserves and the public likes to hold 3% of their money as casharrow_forwardIn early 2017, policymakers at the Federal Reserve forecast that real GDP during 2017 would increase faster than potential GDP and that the inflation rate for the year would be about 1.9 percent. Source: Federal Open Market Committee, "Advance Release of Table 1 of the Summary of Economic Projections to be Released with the FOMC Minutes," March15, 2017. Fill in the missing values in the table with estimates that are consistent with these forecasts. Assume that the growth rate for real GDP between 2016 and 2017 is 0.32 percentage points higher than the percentage change in potential output between those years (rounded to two decimal places). 2016 2017 Real GDP $16.7 trillion $nothing trillion Potential GDP $16.9 trillion $17.1 trillion GDP Deflator 111.5 nothing (Enter your responses rounded to one decimal place.)arrow_forwardOptions are Increase/Decreasearrow_forward

- The answer choices for the blanks are Blank 1: fall, remain the same, rise Blank 2: remain the same, rise, decline Blank 3: international trade, real balance, interest-ratearrow_forwardThe SARB interest rate has been increasing since the beginning of this year. If the Monetary Policy Committee (MPC) decides to grow the economy. What impact does this have on the borrower, on wages and net exports? What is the overall effect on the economy? Use the relevant graphs.arrow_forwardExplain how increases in the real interest rate affect the quantity of real money balanced demanded. (Graphically illustrate)arrow_forward

- please als do the graphs. thanksssssssssarrow_forward← Consider the figure to the right. What are the three effects of decreases in the price level, and do these generate upward or downward movements along the economy's aggregate demand curve? The three effects of changes in the price level are A. the real-balance effect, the income effect, and the wealth effect. B. the substitution effect, the income effect, and the wealth effect. ⒸC. the real-balance effect, the interest rate effect, and the open economy effect. OD. the real-balance effect, the interest rate effect, and the wealth effect. When the price level falls, these three effects work together to generate downward movements along the economy's aggregate demand curve. 4 Price Level 120 115 110 16 17 18 Real GDP per Year (3 trillions) ADarrow_forwardLet's consider the effects of an introduction of the ATM machines (back in the 1980s). Imagine that the cost of going to the bank and exchange money for bonds or bonds for money is y cookies. Imagine also that the nominal interest rate is R, the price level is P and the REAL income that consumers will want to spend is y. Imagine that the entire yearly income is transferred to their bank accounts at the beginning of the year. Consumers consume continuously throughout the year. (a) What is the TOTAL cost of holding M dollars on average over the year? (Note: the total cost is the sum of the opportunity cost and the cost of going to the bank N times a year). (b) What is the relation between the number of trips to the bank, N, and the average money demand, M? (c) What is the optimal money demand? What are the factors that affect money demand? Explain each factor INTUITIVELY. (d) What is the effect of the introduction of the ATM machine on p? (e) What is the effect of the introduction of the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education