Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

answer in detail with concept introduction explanation calculation concept introduction steps correctly and completely in detail answer in text

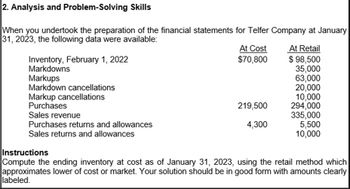

Transcribed Image Text:2. Analysis and Problem-Solving Skills

When you undertook the preparation of the financial statements for Telfer Company at January

31, 2023, the following data were available:

Inventory, February 1, 2022

Markdowns

Markups

Markdown cancellations

Markup cancellations

Purchases

Sales revenue

Purchases returns and allowances

Sales returns and allowances

At Cost

$70,800

At Retail

$ 98,500

35,000

63,000

20,000

10,000

219,500

294,000

335,000

4,300

5,500

10,000

Instructions

Compute the ending inventory at cost as of January 31, 2023, using the retail method which

approximates lower of cost or market. Your solution should be in good form with amounts clearly

labeled.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- how to do my income statementarrow_forwardPrepare the company’s Statement of profit or loss for the year ended 31st December 2018 and its Statement of financial position as at that date, in accordance with IAS 1 Presentation of Financial Statements.arrow_forwardNeed help with this questionarrow_forward

- Please provide correct answer accounting questionarrow_forwardistructions alance sheet for Sandpiper Corporation as of December 31, 2020 using column 2 3 for nets, sub-totals, & totals on the 4-column accounting paper provided online. e the units, tens, hundreds, thousands, etc. in the proper mini column, and leave o commas are necessary when you use the accounting paper properly. Dollar signs f the column and after a total line. o present the following ratios to the nearest tenth: ratio, Debt to assets ratio, Ratio of fixed assets to long-term liabilities, Ratio of total ders' equityarrow_forwardAccounts Receivable as of December 31, 2020 should amount to: *A. 180,000B. 330,000C. 525,000D. 555,000arrow_forward

- Apply mathematical skills around cost structures and appropriate equations to answer the following, inclusive of all associated workings to maximise marks: The inventory value for the financial statements of Zyon for the year ended 31st Oct 2022 was based on an inventory count on 3rd Nov 2022, which gave a total inventory value of $836,200.Between 31st Oct and 3rd Nov, the following transactions took place:Purchases of goods $8,600. Sales of goods (profit margin 35% on sales $14,000). Goods returned by Zyon to supplier $878. What adjusted figure should be included in the financial statements for inventories at 31st Oct 2022 to nearest hundred?arrow_forwardThe following selected account balances were taken from Buckeye Company's general ledger at January 1, 2019 and December 31, 2022: Accounts receivable Inventory Sales revenue Cost of goods sold January 1 $126,000 $163,000 The following information was taken from Buckeye Company's 2022 income statement: Salaries expense Income tax expense Net income December 31 $139,000 131,000 $967,250 $429, 240 $211,390 $ 97,986 $228,634 Calculate the average number of days that elapse between Buckeye Company buying their inventory from suppliers and then selling the inventory to customers.arrow_forwardWhen you undertook the preparation of the financial statements for Cullumber Company at January 31, 2026, the following data were available: Inventory, February 1, 2025 Markdowns, net Markups, net Normal spoilage Abnormal spoilage Purchases Sales revenue Purchases returns and allowances Sales returns and allowances Estimated future returns related to January 2026 sales At Cost At Retail $106,600 $126,000 15,900 55,400 10,600 21,266 12,700 232,800 311,900 355,100 4,700 5,700 10,600 4,500 Compute the ending inventory at cost as of January 31, 2026, using the retail method which approximates lower-of-cost-or-market. (Round cost to retail ratio to 2 decimal places, e.g. 15.25% and final answer to O decimal places, e.g. 5,125.) Ending inventory at lower-of-cost-or-market $arrow_forward

- Answer the whole pagearrow_forwardPERFORM A LIQUIDITY AND PROFITABILITY ANALYSIS ON THE FOLLOWING COMPANY UTILIZING THE FOLLOWING RATIOS: INVENTORY TURNOVER DAYS INVENTORY ON HAND statement of operations 12 Months Ended Jul. 31, 2020 Jul. 31, 2019 Revenues: Revenues $ 1,497,826,000 $ 1,684,392,000 Costs and expenses: Operating expense - personnel, vehicle, plant and other 493,055,000 468,868,000 Operating expense - equipment lease expense 33,017,000 Equipment lease expense, preadoption 33,073,000 Depreciation and amortization expense 80,481,000 78,846,000 General and administrative expense 45,752,000 59,994,000 Non-cash employee stock ownership plan compensation charge 2,871,000 5,693,000 Asset impairments 0 0 Loss on asset sales and disposals 7,924,000 10,968,000 Operating income 148,670,000 113,028,000 Interest expense (192,962,000) (177,619,000) Loss on extinguishment of debt (37,399,000) Other income (expense), net (460,000) 369,000 Loss before income taxes…arrow_forwardNeed Tutor Helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning