FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

A. 180,000

B. 330,000

C. 525,000

D. 555,000

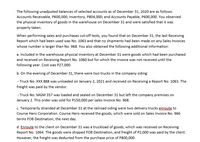

Transcribed Image Text:The following unadjusted balances of selected accounts as of December 31, 2020 are as follows:

Accounts Receivable, P600,000; Inventory, P804,000; and Accounts Payable, P600,000. You observed

the physical inventory of goods in the warehouse on December 31 and were satisfied that it was

properly taken.

When performing sales and purchases cut-off tests, you found that on December 31, the last Receiving

Report which had been used was No. 1063 and that no shipments had been made on any Sales Invoices

whose number is larger than No. 968. You also obtained the following additional information:

a. Included in the warehouse physical inventory at December 31 were goods which had been purchased

and received on Receiving Report No. 1060 but for which the invoice was not received until the

following year. Cost was P27,000.

b. On the evening of December 31, there were two trucks in the company siding:

- Truck No. XXX 888 was unloaded on January 2, 2021 and received on Receiving a Report No. 1063. The

freight was paid by the vendor.

- Truck No. MGM 357 was loaded and sealed on December 31 but left the company premises on

January 2. This order was sold for P150,000 per sales Invoice No. 968.

c. Temporarily stranded at December 31 at the railroad siding were two delivery trucks entoute to

Course Hero Corporation. Course Hero received the goods, which were sold on Sales Invoice No. 966

terms FOB Destination, the next day.

d. Enroute to the client on December 31 was a truckload of goods, which was received on Receiving

Report No. 1064. The goods were shipped FOB Destination, and freight of P2,000 was paid by the client.

However, the freight was deducted from the purchase price of P800,000.

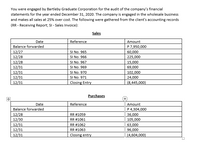

Transcribed Image Text:You were engaged by Bartleby Graduate Corporation for the audit of the company's financial

statements for the year ended December 31, 2020. The company is engaged in the wholesale business

and makes all sales at 25% over cost. The following were gathered from the client's accounting records

(RR - Receiving Report; SI - Sales Invoice):

Sales

Reference

Amount

P 7,950,000

Date

Balance forwarded

12/27

12/28

SI No. 965

SI No. 966

SI No. 967

SI No. 969

60,000

225,000

12/28

12/31

15,000

69,000

12/31

12/31

12/31

SI No. 970

SI No. 971

Closing Entry

102,000

24,000

(8,445,000)

Purchases

Date

Reference

Amount

P 4,304,000

Balance forwarded

12/28

12/30

RR #1059

36,000

RR #1061

105,000

12/31

12/31

RR #1062

63,000

RR #1063

96,000

12/31

Closing entry

(4,604,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What payment should be made on an invoice for $500 dated November 16, carrying terms 4/10, net 30?arrow_forwardTrade receivables (net of allowances of $45 at December 31, 2022 and $37 at December 31, 2021) December 2022: $3,088 December 2021: $2,337 Other receivables (net of allowances of $59 at December 31, 2022 and $49 at December 31, 2021) December 2022: $819 December 2021: $851 Calculate average account receivables. (Also explain if you add/minus/not use net of allowances)arrow_forwardHow do I solve this?arrow_forward

- A credit sale of $3800 is made on April 25, terms 1/10, n/30, on which a return of $300 is granted on April 28. What amount is received as payment in full on May 4? $3465 • $3800 • $3500 Ⓒ $3762arrow_forwardThe maturity value of a $183,600, 11%, 40-day note receivable dated July 3 is a.$185,844 b.$183,600 c.$192,576 d.$203,796arrow_forwardi need the answer quicklyarrow_forward

- Ss.236.arrow_forwardOn January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:Accounts Debit CreditCash $ 25,100Accounts Receivable 46,200Allowance for Uncollectible Accounts $ 4,200Inventory 20,000Land 46,000Equipment 15,000Accumulated Depreciation 1,500Accounts Payable 28,500Notes Payable (6%, due April 1, 2022) 50,000Common Stock 35,000Retained Earnings…arrow_forwardFor attached data table: Request: Make initial entry, from the point of view of the borrower (who receives a loan), separating short- and long-term portion of the loan. Make appropriate entries to be made on 31 August 2023, not forgetting reclassification from long term to short term.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education