FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Required:

5. The average per-share sales price of the common stock when issue

$? per share

6. The cost of the treasury stock per share

$? per share

7. The total stockholders' equity

$?

8. The per-share book value of the common stock assuming that there are no dividends in arrears and that the preferred stock can be redeemed at its par value

$? per share

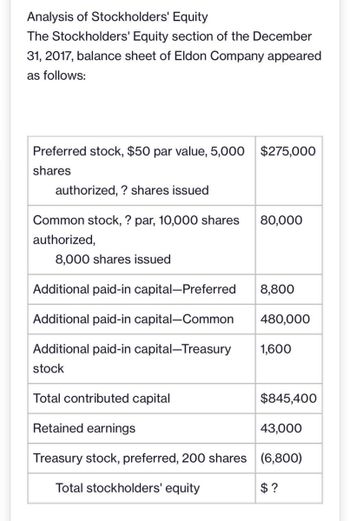

Transcribed Image Text:Analysis of Stockholders' Equity

The Stockholders' Equity section of the December

31, 2017, balance sheet of Eldon Company appeared

as follows:

Preferred stock, $50 par value, 5,000 $275,000

shares

authorized,? shares issued

Common stock, ? par, 10,000 shares 80,000

authorized,

8,000 shares issued

Additional paid-in capital-Preferred

Additional paid-in capital-Common

Additional paid-in capital-Treasury

stock

Total contributed capital

Retained earnings

43,000

Treasury stock, preferred, 200 shares (6,800)

Total stockholders' equity

$?

8,800

480,000

1,600

$845,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- q7- Which of the following statements is true? Select one: a. Trailing P/E is based on the current share price and forward P/E is based on next year's forecast share price. b. Trailing P/E is based on last year's share price and forward P/E is based on the current share price. c. Both trailing and forward P/E are based on the current share price. d. Trailing P/E is based on last year's share price and forward P/E is based on next year's forecast share price. Clear my choicearrow_forwardWhat does it mean when preferred stock has a cumulative feature? A.A dividend must be paid to the preferred stockholders each year. B. A dividend cannot be paid to the common stockholders. C. If dividends were not paid to preferred stockholders in previous years, these dividends must be paid before any dividends are paid to the common stockholders. D. The stockholders have the right to share in extra dividends. Please explain why the option is correct and remaining incorrect in detail explain each and every option in detail with explanationarrow_forwardWhich of the following results in increasing basic earnings per share? Select one: a. Paying more than carrying value to retire outstanding bonds. b. Issuing cumulative preferred stock. c. Repurchase of common shares. d. Issuing a 2:1 stock split. e. All of these increase basic earnings per share.arrow_forward

- ration has outstanding 9,600 shares of $100 par value, 6% preferred stock and 57,000 shares of $10 par value common stock. The preferred stock was issued in January 2020, and no dividends were declared in 2020 or 2021. In 2022, Oriole declares a cash dividend of $307,000. (a) Assume that the preferred are noncumulative. How much dividend will the preferred stockholders receive? Preferred stockholders would receive 2$ How much dividend will the common stockholders receive? Common stockholders would receive 24 (b) Assume that the preferred are cumulative. How much dividend will the preferred stockholders receive? 10:37F 77°F Type here to searcharrow_forwardsharadarrow_forwardplease step by step answer.arrow_forward

- What was the dollar-weighted (money-weighted) rate of return?arrow_forwardCumulative preferred stock O requires dividends in arrears to be paid before the firm can pay dividends on common. O has a right to vote cumulatively. O has a claim to dividends before bonds. Ohas a higher required return than common stock.arrow_forwardb. Cash Common Stock Paid-in Capital in Excess of Par - Common Stock Preferred Stock Paid-in Capital in Excess of Par - Preferred Stockarrow_forward

- 10. When shareholders may elect receive cash in lieu of share dividend, the amount to be charged to retained earnings is equal to the * a. Optional cash dividend b. Fair value of the shares c. Par value of the shares d. Book value of the sharesarrow_forwardCommon versus Preferred Stock Suppose a company has a preferred stock issue and a common stock issue. Both have just paid a $2 dividend. Which do you think will have a higher price, a share of the preferred or a share of the common?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education