FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

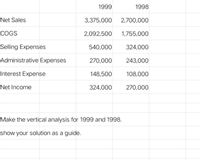

Transcribed Image Text:1999

1998

Net Sales

3,375,000

2,700,000

COGS

2,092,500

1,755,000

Selling Expenses

540,000

324,000

Administrative Expenses

270,000

243,000

Interest Expense

148,500

108,000

Net Income

324,000

270,000

Make the vertical analysis for 1999 and 1998.

show your solution as a guide.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 1 20Y2 20Y1 2 Sales $10,850,000.00 $10,000,000.00 3 Cost of goods sold 6,000,000.00 5,450,000.00 4 Gross profit $4,850,000.00 $4,550,000.00 5 Selling expenses $2,170,000.00 $2,000,000.00 6 Administrative expenses 1,627,500.00 1,500,000.00 7 Total operating expenses $3,797,500.00 $3,500,000.00 8 Income from operations $1,052,500.00 $1,050,000.00 9 Other revenue 99,500.00 20,000.00 10 $1,152,000.00 $1,070,000.00 11 Other expense (interest) 132,000.00 120,000.00 12 Income before income tax $1,020,000.00 $950,000.00 13 Income tax expense 420,000.00 400,000.00 14 Net income $600,000.00 $550,000.00 Marshall Inc. Comparative Balance Sheet December 31, 20Y2 and 20Y1 1 20Y2 20Y1 2 Assets…arrow_forwardPeace Inc. has the following information: Sales P 480,000 Operating expenses 300,000 Net loss (60,000) How much is Peace Inc.'s gross profit if its gross profit is 50% based on sales?A. 260,000B. 180,000C. 240,000D. 280,000arrow_forwardprofit marginarrow_forward

- Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net $ 31,600 88,000 112,500 10,650 281,000 $ 36,250 $ 38,400 62,000 83,800 9,350 249,500 49,500 52,500 4,500 235,000 Total assets $523,750 $440,900 $ 379,900 Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings $128,400 $ 74,750 $ 50,800 97,000 160,500 137,850 98,250 160,500 107,400 81,600 160,500 87,000 $523,750 $440,900 $ 379,900 Total liabilities and equity The company's income statements for the Current Year and 1 Year Ago, follow. 1 Yr Ago $ 620,000 Current Yr For Year Ended December 31 Sales Cost of goods sold other operating expenses Interest expense Income tax expense Total costs and expenses $755,000 $445,450 234,050 11,300 9,550 $390,600 148,800 12,700 8,925 561,025 700,350 $ 54,650 $ 58,975 Net income $4 3.40 $4 %24 3.67 Earnings per share For both…arrow_forwardPeace Inc. has the following information: Sales P 480,000 Operating expenses 300,000 Net loss (60,000) How much is the entity's cost of sales? A. 340,000B. 360,000C. 240,000D. 420,000arrow_forwardNRH Corp.Common-sizeIncome Statement Sales 100% Cost of goods sold 63 Operating expenses 21 Interest expense 5 Income tax 4 Net income 7% Sales $8,000,000 NRH Corp. Common-size Balance Sheet Cash 5% Accounts receivable 20 Inventory 25 PP&E, net 50 Total assets 100% Short-term debt 20% Long-term debt 35 Common equity 45 Total liabilities and equity 100% Total assets $6,000,000 NRH Corp’s current ratio is closest to: 1.90. 1.20. 2.50. NRH Corp’s times interest earned ratio is closest to: 1.6. 7.0. 3.2.arrow_forward

- III MT217_Unit... Period Ending Total Sales ABC Company Income Statement 31-Dec-15 Cost of Goods Sold $485,651,000 365,086,000 31-Dec-14 $476,294,000 358,069,000 31-Dec-13 $475,210,000 350,400,000 Gross Profit 120,565,000 118,225,000 124,810,000 Selling Generall and Adminstrative 93,418,000 91,353,000 90,343,000 Operating Profit 27,147,000 26,872,000 34,467,000 Total Other Income/Expenses Net 113,000 119,000 115,000 Earnings before Interest and Taxes 27,034,000 26,753,000 34,352,000 Interest Expense 2,461,000 2,335,000 2,200,000 Income Before Tax 24,573,000 24,418,000 32,152,000 Income Tax Expense 7,985,000 8,105,000 9,800,000 Net Income from Continuing Ops 16,588,000 16,313,000 22,352,000 Discontinued Operations 285,000 Net Income (Net Profit) $16.303,000 144,000 $16,169,000 182,000 $22,170,000 14,000,000 Shares outstanding Market Share price per share $10.00 $9.00 $8.50 Q ABC Company Balance Sheet Period Ending 2015 2014 2013 Assets Current Liabilities Current Assets Accounts Payable…arrow_forwardYou have been asked by a friend to analyse the following set of financial statements for a small unlisted company that he is considering investing in. Balance Sheets as at 31 December 20X1 20X2 $ $ Shareholders' funds Issued capital 100,000 50,000 150,000 150,000 Retained earnings Total shareholders' funds 57,500 207,500 Represented by: Current assets Bank Accounts receivable Inventory** 149,000 133,000 54,000 45,000 50,000 80,000 53,000 Less Current liabilities Bank 35,000 118,500 Accounts payable Taxes payable 32,000 3,000 37,000 81,000 500 Working capital 114,000 14,500 Non-current assets Land 65,000 Buildings Accum. depreciation Plant & equipment Accum. depreciation Motor vehicles Accum. depreciation Total non-current assets 12,500 (3,500) 30,000 (3,000) 27,000 185,000 (4,000) 181,000 12,500 (4,500) 55,000 (11,000) 9,000 8,000 44,000 36,000 298,000 Non-current liabilities Mortgage (secured) (105,000) 150,000 207,500 Net total assets * Opening debtors for 20X1 was $31,000 *Opening…arrow_forwardShow Trend percentages in the multiple step income format only 20Υ8 20Υ7 Sales $900,000 $725,000 Cost of goods sold 558,000 435,000 Selling expenses 117,000 116,000 Administrative expenses 63,000 65,250 Income tax expense 76,500 58,000arrow_forward

- Suresh Company reports the following segment (department) income results for the year. Department M Department N Department 0 Department P $ 82,000 $ 44,000 $ 78,000 $ 65,000 Sales Expenses Avoidable Unavoidable Total expenses Income (loss) Department Department M Department N Department O Department P Department T 17,300 45,400 57,800 21,600 75, 100 67,000 $ 6,900 $ (23,000) Decision 18,000 5,700 23,700 $ 54,300 21,500 54,300 75,800 $ (10,800) Department T $ 43,000 51,300 20,300 71, 600 $ (28,600) Total $ 312,000 a. If the company plans to eliminate departments that have sales less than avoidable costs, which department(s) would be eliminated? 153,500 159, 700 313, 200 $ (1,200)arrow_forwardTotal Sales of $1,500,000. Gross Profit 40% of Sales. Payroll costs of $257,000, and Expenses are 34% of Total Sales. Calculate Net Profit in dollars.arrow_forwardAnthony Corporation reported the following amounts for the year: Net sales 296,000 Cost of goods sold 138,000 Average inventory 50,000 Anthony's gross profit ratio is: 53.4%. 51.9%. 50.3%. 46.6%. Anthony's average days in inventory is: 70 days. 114 days. 132 days. 151 days. A company's sales equal $60,000 and cost of goods sold equals $20,000. Its beginning inventory was $1,600 and its ending inventory is $2,400. The company's inventory turnover ratio equals: 5 times. 10 times. 20 times. 30 times. [Last question is in the picture attached]arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education