Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

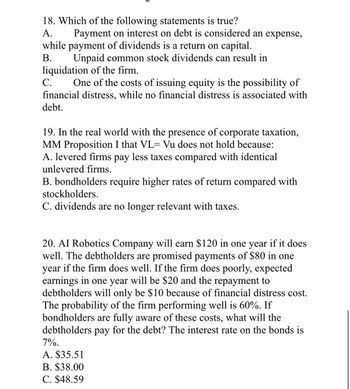

Transcribed Image Text:18. Which of the following statements is true?

A.

Payment on interest on debt is considered an expense,

while payment of dividends is a return on capital.

B.

Unpaid common stock dividends can result in

liquidation of the firm.

C.

One of the costs of issuing equity is the possibility of

financial distress, while no financial distress is associated with

debt.

19. In the real world with the presence of corporate taxation,

MM Proposition I that VL- Vu does not hold because:

A. levered firms pay less taxes compared with identical

unlevered firms.

B. bondholders require higher rates of return compared with

stockholders.

C. dividends are no longer relevant with taxes.

20. AI Robotics Company will earn $120 in one year if it does

well. The debtholders are promised payments of $80 in one

year if the firm does well. If the firm does poorly, expected

earnings in one year will be $20 and the repayment to

debtholders will only be $10 because of financial distress cost.

The probability of the firm performing well is 60%. If

bondholders are fully aware of these costs, what will the

debtholders pay for the debt? The interest rate on the bonds is

7%.

A. $35.51

B. $38.00

C. $48.59

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 3. a. List and describe three types of deferred credits? b. Do they meet the definition of a liability? Of short or long term? c. Why do some accountants not consider them to be a liability? d. Do deferred credits affect liquidity? 4. List and discuss four reasons a company would prefer to issue debt rather than equity securities. 5. When and why should liabilities for each of the following items be recorded on the books of an ordinary business corporation? a. Purchase of goods on account. b. Officers' salaries c. Dividends d. Interest e. Loss contingenciesarrow_forward1- What are the consequences of poor internal equity? 2- What are the consequences of poor external equity? 3- How can pay grades help prevent internal equity problems?arrow_forwardWhich of the following best describes why the predicted incremental earnings arising from a given decision are not sufficient in and of themselves to determine whether that decision is worthwhile? ... O A. They do not tell how the decision affects the firm's reported profits from an accounting perspective. O B. They are not easily predicted from historical financial statements of a firm and its competitors. O C. They do not show how the firm's earnings are expected to change as the result of a particular decision. O D. These earnings are not actual cash flows.arrow_forward

- Which is true of equity financing? It has no fixed maturity date It provides a tax shield It offers creditors no cushion against losses Struggling companies still need to pay dividendsarrow_forwardTrue of False? Contributed capital decreases when the company has a net loss. If your answer is “False”, then explain (in one sentence) why the statement is false.arrow_forwardWhich of the following is NOT an effect of the possibility of bankruptcy? O reduce the possible payoff to stockholders. increase financial distress costs. reduce the interest rate on debt. reduce the current market value of the firm.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education