FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

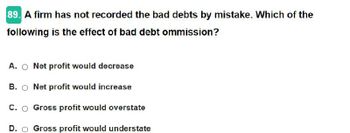

Transcribed Image Text:89. A firm has not recorded the bad debts by mistake. Which of the

following is the effect of bad debt ommission?

A. O Net profit would decrease

B. Net profit would increase

C. O Gross profit would overstate

D. Gross profit would understate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company accounts for possible bad debts using the allowance method. When an actual bad debt occurs, what effect does it have on the accounting equation? O Decreases asscts and decreases stockholders' equity. O Increases assets and increases stockholders' equity. O Decreases assets and decreases liabilities. O No effect on the accounting equation.arrow_forwardWhich of the following is incorrect about debt financing? A. Debt financing always generates excess returns which benefits equity investors b. One benefit of debt financing is that interest on most debt is fixed c. One benefit of debt financing is that interest is a tax deductible expense d. It increases financial leveragearrow_forwardHigh interest coverage ratio does not indicate O a. The ability to pay future dividends O b. No other answer is true O c. The ability to pay interest O d. The percentage of operating profit paid as an interestarrow_forward

- how do companies account for bad debt? Why would they use an allowance account instead of directly crediting A/R? What are the various methods of accounting for bad debt? Describe the differences in how the expense is calculated.arrow_forwardWant Both the Correct Answerarrow_forwardIs debt good for a company? Why or Why not?arrow_forward

- When close to the zone of insolvency, managers have an incentive to gamble. This is known as Question options: a) an agency cost of debt that covenants cannot attenuate b) an agency cost of equity known as fraudulent conveyance c) an agency cost of debt that negative covenants can attenuate d) an agency cost of debt that positive covenants can attenuatearrow_forwardWhat si the financial manipulation? How does it involves a considerable decrease in the number of days sales outstanding?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education