FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

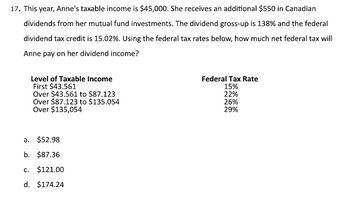

Transcribed Image Text:17. This year, Anne's taxable income is $45,000. She receives an additional $550 in Canadian

dividends from her mutual fund investments. The dividend gross-up is 138% and the federal

dividend tax credit is 15.02%. Using the federal tax rates below, how much net federal tax will

Anne pay on her dividend income?

Level of Taxable Income

First $43.561

Over $43.561 to $87.123

Over $87.123 to $135.054

Over $135,054

a. $52.98

b. $87.36

c. $121.00

d. $174.24

Federal Tax Rate

15%

22%

26%

29%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Manny, a single taxpayer, earns $65,600 per year in taxable income and an additional $12,060 per year in city of Boston bonds. What is Manny's current marginal tax rate for 2021? (Use tax rate schedule.) Multiple Choice 11.23 percent 12.00 percent 12.93 percent 15.34 percent None of the choices are correct.arrow_forwardChuck, a single taxpayer, earns $79,400 in taxable income and $15,300 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) Required: a. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? b. What is his marginal rate if, instead, he had $40,000 of additional deductions? Note: For all requirements, do not round intermediate calculations. Round percentage answers to 2 decimal places. Answer is complete but not entirely correct. a. Marginal tax rate b. Marginal tax rate 24.00% 12.00%arrow_forwardCampbell, a single taxpayer, earns $428,000 in taxable income and $3,400 in interest from an investment in State of New York bonds. (Use the U.S. tax rate schedule.) Required: How much federal tax will she owe? What is her average tax rate? What is her effective tax rate? What is her current marginal tax rate?arrow_forward

- Jamie has taxable income of $45,000. She is single, and her tax rate is 10% on the first $9,525 of the taxable income, 12% on the amount over $9,525 up to $38,700 of the taxable income, and 22% on the remainder. What are Jamie’s tax liability, marginal tax rate, and average tax rate? (Show all work. Round dollar amounts to the nearest cent and percentages to two decimal places.)arrow_forwardJorge and Anita, married taxpayers, earn $155,600 in taxable income and $41,400 in interest from an investment in City of Heflin bonds. Using the U.S. tax rate schedule for married filing jointly, how much federal tax will they owe? What is their average tax rate? What is their effective tax rate? What is their current marginal tax rate? Note: Do not round intermediate calculations. Round your answers to 2 decimal places.arrow_forwardAlexis had a gross income of $92,234 in 2010. What was her net income in 2010? Use the income tax table below to answer the question. 2010 Federal Income Tax Brackets and Tax Rates (Canada) Tax Brackets Tax Rates 15% of taxable income less than or equal to $40,970; plus 22% of taxable income greater $40,970 to $81,941 than $40,970 and less than or equal to $81,941; plus $40,970 or less 26% of taxable income greater $81,941 to $127,021 than $81,941 and less than or equal to $127,021; plus More than $127,021 A 29% of taxable income greater than $127,021arrow_forward

- Please help me !! Note: Tax for Canada !! Question:- Individual J received non-eligible dividends totaling $12,000 in the current year. What is the amount of the federal dividend tax credit?arrow_forwardChuck, a single taxpayer, earns $79,800 in taxable income and $15,900 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) W Required: a. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? b. What is his marginal rate if, instead, he had $40,000 of additional deductions? Note: For all requirements, do not round intermediate calculations. Round percentage answers to 2 decimal places. a. Marginal tax rate b. Marginal tax rate % %arrow_forwardChuck, a single taxpayer, earns $76,800 in taxable income and $11,900 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) Required: If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? What is his marginal rate if, instead, he had $40,000 of additional deductions?arrow_forward

- hrd.3arrow_forwardChuck, a single taxpayer, earns $75,200 in taxable income and $10,200 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) Required: If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? What is his marginal rate if, instead, he had $40,000 of additional deductions? Note: For all requirements, do not round intermediate calculations. Round percentage answers to 2 decimal places.arrow_forwardJohanna resides in Saskatchewan and has taxable income of $85,000 for the current year. Determine her tax payable. Federal Tax rate – 15% Saskatchewan Provincial Tax Rate 10.5% on the portion of your taxable income that is $46,773 or less, plus 12.5% on the portion of your taxable income that is more than $46,773 but not more than $133,638 plus 14.5% on the portion of your taxable income that is more than $133,638.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education