FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

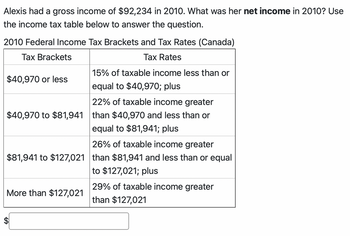

Transcribed Image Text:Alexis had a gross income of $92,234 in 2010. What was her net income in 2010? Use

the income tax table below to answer the question.

2010 Federal Income Tax Brackets and Tax Rates (Canada)

Tax Brackets

Tax Rates

15% of taxable income less than or

equal to $40,970; plus

22% of taxable income greater

$40,970 to $81,941 than $40,970 and less than or

equal to $81,941; plus

$40,970 or less

26% of taxable income greater

$81,941 to $127,021 than $81,941 and less than or equal

to $127,021; plus

More than $127,021

A

29% of taxable income greater

than $127,021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hi, can you explain how does this aspect affects the U.S economy? Tax rates. The new law imposes a new tax rate structure with seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The top rate was reduced from 39.6% to 37% and applies to taxable income above $500,000 for single taxpayers, and $600,000 for married couples filing jointly. The rates applicable to net capital gains and qualified dividends were not changed. The “kiddie tax” rules were simplified. The net unearned income of a child subject to the rules will be taxed at the capital gain and ordinary income rates that apply to trusts and estates. Thus, the child’s tax is unaffected by the parent’s tax situation or the unearned income of any siblings.arrow_forwardUS Tax System Ellen, a single taxpayer, has $160,000 of taxable income plus $30,000 income from tax-exempt bonds. What is her effective tax rate?arrow_forward7.8.26 c),d) Use the spreadsheet federalindividualratehistory.xlsx to answer the questions. It contains a complete history of income tax brackets and rates from the inception of the income tax in 1913 through 2013, in both dollars current in each year and adjusted for inflation (2012 dollars) c) use the 2013 tax tables to compute her tax in 2013. what is her effective tax rate? d) compare her 2003 tax and effective tax rate with her 2013 tax and effective tax rate, taking inflation into account. has her tax gone up, or down, or stayed the same?arrow_forward

- The UK tax gap in 2021 was £35billion or 5.6% of total tax liability. • Required: Identify two factors that contribute to the gross UK tax gap and explain two tax policy/administrative approaches the UK government takes to mitigate the impact and to collect the tax not otherwise voluntarily paid.arrow_forwardSuppose a graduate student earned a gross income of $60,000 in the year 2022 and is a resident of Ontario, Canada. The following information is provided for the calculation of the student's federal and provincial income taxes: Federal tax rates for 2022 are as follows: 15% on the first $49,020 of taxable income 20.5% on the next $49,020 of taxable income (on the amount over $49,020 up to $98,040) 26% on the next $61,536 of taxable income (on the amount over $98,040 up to $159,576) 29% on the next $71,517 of taxable income (on the amount over $159,576 up to $231,093) 33% on the amount over $231,093 Ontario tax rates for 2022 are as follows: 5.05% on the first $47,630 of taxable income 9.15% on the next $47,629 of taxable income (on the amount over $47,630 up to $95,259) 11.16% on the next $62,335 of taxable income (on the amount over $95,259 up to $157,594) 12.16% on the next $70,000 of taxable income (on the amount over $157,594 up to $227,594) 13.16% on the…arrow_forwardPlease help me !! Note: Tax for Canada !! Question:- Individual J received non-eligible dividends totaling $12,000 in the current year. What is the amount of the federal dividend tax credit?arrow_forward

- US Tax Law Taxpayer is single and has the following items: state taxes withheld, $7,500; property taxes $6,000; DMV, $500. His state tax deduction on schedule A would be A. $14,000 B. $13,500 C. $6500 D. $10,000 E. Some other amountarrow_forwardConsider a country that taxes its citizens individually according to the following rate schedule: Taxable Income First $30,000 Over $30,000 up to $60,000 Over $60,000 Marginal Tax Rate 10% 25% 40% Additionally, this country has a 30% surtax on taxes over $10,000. Hannah has $100,000 in total Income, all of which is taxable. She does not qualify for any credits. Accounting for the surtax, what is the combined marginal tax rate associated with Hannah's last dollar earned? [NOTE: If necessary.iplease round your answer to the nearest percent. Enter the whole number corresponding to the percentage rate. Do not enter the percent sign. For example, if your answer is 12 percent, you should enter 12 in the answer space, not 012.) Hannah's combined marginal tax rate is %.arrow_forwardDetails in imagesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education