FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

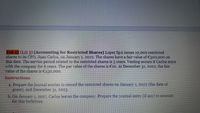

Transcribed Image Text:E16.15 (LO 3) (Accounting for Restricted Shares) Lopez SpAissues 10,0o0 restricted

shares to its CFO, Juan Carlos, on January 1, 2022. The shares have a fair value of C500,000 on

this date. The service period related to the restricted shares is 5 years. Vesting occurs if Carlos stays

with the company for 6 years. The par value of the shares is €10. At December 31, 2022, the fair

value of the shares is C450,000.

Instructions

a. Prepare the journal entries to record the restricted shares on January 1, 2022 (the date of

grant), and December 31, 2023

b. On January 1, 2027, Carlos leaves the company. Prepare the journal entry (if any) to account

for this forfeiture.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- luxco acquires participation on Aprin 1, 2012 for 1000000. This investment is financed by (a) share premium for 100.000é (b) an interest-free shareholder loan for 250000€ and (c) bank loan bearing interest at 5% per annum for the balance. the interest on the bank mentioned above are payable on the last day of each civil quarter (March 31...). Any unpaid accrued interest bear also interest at 5% per annum starting from the day after their due date (from Aprin 1 for interest payable on March 31). Assuming that Luxco does not pay its interest on June 30, 2012, please detail the accounting entries in relation with the booking of interest as Jube 30, 0210 and September 30, 2012 Make the journal entries only for the interestarrow_forwardWedding Cake Ltd. has its shares listed on a securities exchange. It has entered a contractual agreement to issue $10 million of its ordinary shares to Island Ltd. in two years time. The number of shares to be ultimately issued will depend on the market price of the shares in two years time. Should Wedding Cake Ltd. recognise a financial liability or an equity instrument in relation to this agreement?arrow_forward2. On January 1, 2019, AB Company exchanges 10,000 shares of its common stock for all of the net assets of CD, Inc. Each of the NT's shares has a $5 par value and a $40 fair value. AB also paid $35,000 as direct out- of-pocket costs. Several of CD’s accounts have fair values that differ from their book values on this date: Book Values Fair Values $ 85,000 65,000 100,000 $ 83,000 125,000 180,000 160,000 45,000 Receivables Trademarks Furniture and Fixture Research and development Notes payable -0- 40,000 Precombination January 1, 2019, book values for the two companies are as follows: AB CD 9,000 85,000 65,000 100,000 105,000 $ 364,000 Cash $ 50,000 120,000 300,000 640,000 $ Receivables Trademarks Furniture and Fixture Equpiment (net) 320,000 Totals $ 1,430,000 Accounts Payable Notes Payable Common stock Additional paid-in capital Retained earnings 2$ 100,000 $ 34,000 60,000 50,000 30,000 190,000 $ 364,000 270,000 400,000 30,000 630,000 $ 1,430,000 Totals Assume that this combination is…arrow_forward

- On December 31, 2015, Martin Corp invested in Marlin’s 5-year, $200,000 bond with a 5% interest rate for $191,575. The bond pays semiannual interest on June 30th and December 31st. The fair values of the bonds at the end of 2016~2018 are $194,500, $194,200, and $195,750. Martin sold its investment in Marlin’s bond on July 1, 2019 at 98 ½ (i.e. selling price is = 98.5% of the face value). Assuming the bonds are classified as Trading investment, prepare the journal entries on aforementioned dates.arrow_forward(b) Gassy Stores sells $400,000 of 12% bonds on June 1, 2022. The bonds pay interest on December 1 and June 1. The due date of the bonds is June 1, 2026. The market rate of similar investments is 10%. On December 1, 2024, Gassy Stores retired the bond for $400,000. The company closes its books on December 31. Requirements: (Show all workings) I. Calculate the proceeds from the sale of the bond. Clearly show the amount of the premium or discount and state two reasons which support the premium or discount calculated. II. Prepare a bond amortization schedule for the bond’s life III. Prepare all the journal entries for 2022, 2023 & 2024arrow_forward6arrow_forward

- On January 1, 2022, Huff Co. sold P1,000,000 of its 10% bonds for P885,296 to yield 12%. Interest is payable semiannually on January 1 and July 1. What amount should Huff report as interest expense for the six months ended June 30, 2022? a.) P44,266 b.) P50,000 c.) P53,118 d.) P60,000arrow_forwardD1.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education