FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

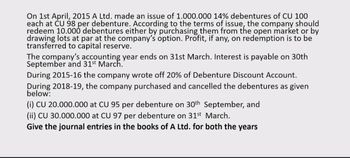

On 1st April. 2015 A Ltd. made an issue of 1.000.000 14% debentures of CU 100 each at CU 98 per debenture. According to the terms of issue, the company should redeem 10.000 debentures either by purchasing them from the open market or by drawing lots at par at the company's option. Profit, if any, on redemption is to be transferred to capital reserve.

The company's accounting year ends on 31st March. Interest is payable on 30th September and 31st Marc

During 2015-16 the company wrote off 20% of Debenture Discount Account.

During 2018-19, the company purchased and cancelled the debentures as given below:

(i) CU 20.000.000 at CU 95 per debenture on 30th September, and (ii) CU 30.000.000 at CU 97 per debenture on 31st March.

Give the journal entries in the books of A Ltd. for both the years

Transcribed Image Text:On 1st April, 2015 A Ltd. made an issue of 1.000.000 14% debentures of CU 100

each at CU 98 per debenture. According to the terms of issue, the company should

redeem 10.000 debentures either by purchasing them from the open market or by

drawing lots at par at the company's option. Profit, if any, on redemption is to be

transferred to capital reserve.

The company's accounting year ends on 31st March. Interest is payable on 30th

September and 31st March.

During 2015-16 the company wrote off 20% of Debenture Discount Account.

During 2018-19, the company purchased and cancelled the debentures as given

below:

(i) CU 20.000.000 at CU 95 per debenture on 30th September, and

(ii) CU 30.000.000 at CU 97 per debenture on 31st March.

Give the journal entries in the books of A Ltd. for both the years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For the next two items: A company sold a factory on January 1, 2016 for P7,000,000. The entity received a cash down payment of P1,000,000 and a 4-year, 12%note for the balance. The note is payable in equal annual payments of principal and interest of P1,975,400 payable on December 31 of each year until 2019. 20. What is the interest income for 2017? a. 840,000 b. 720,000 c. 569,352 d. 975,400 21. What is the carrying amount of the note receivable on December 31, 2017? a. 4,500,000 b. 4,744,600 c. 3,338,552 d. 4,025,600 E D1 c00 000arrow_forwardOn 1.1.2005, Fast computers Ltd. Issued 20,00,000 6% debentures of Rs. 100 each at a discount of 4% redeemable at a premium of 5% after three years. The amount was payable as follows:On application Rs. 50 per debenture balance on allotment.Record the necessary Journal entries for issue of debentures.arrow_forwardCleopatra Ltd offers $400 million of debentures, which is payable on application. The Interest rate on debentures is 8.5% per annum, payable annually. By 15 March 2020, application is received for $450 million debenture. The debentures are allotted on 1May2020, which coincides with Cleopatra Ltd’s financial year-end. Additional debenture application money is returned on 1June2020. Required: Prepare the journal entries to record the issue of the debenture on 1 May2020and annual interest payments on 30April2021 and 30 April 2022.arrow_forward

- Leon Acrobats lent $12,174 to Donaldson, Inc., accepting Donaldson's 2-year, $15,000, zero-interest-bearing note. The implied interest rate is 11%. Prepare Leon's journal entries for the initial transaction, recognition of interest each year, and the collection of $15,000 at maturity. (Round answers to O decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles and Explanation (To record the initial transations) (To record the recognition of interest in year one) (To recognize the interest in year 2) Debit Credit [] |||||arrow_forwardMarco Chemical Ltd. supply their products in returnable drums which are charged at $ 20 each. Customers returning the drums with in a month are credited with $ 18. The company's procedure is to retain of the drums. Following particulars are available from the books : 18 in deposit account till the date of expiry of the option period for return 8,000 Drums returned by customers 16,000 Returnable drums as on 1-4-2014 Drums in stock as on 1-4-2014 Drums purchased during 2014-15 at $ 15 per drum 2,88,000 15,000 in 2014-15 Drums returnable on 31-3-2015 20,000 Drums scrapped in 2014-15-sold for $ 10,000 Drums sent to customers 2,000 during 2014-15 All drums as on 31-3-2014 and 31-3-2015 are to be valued at $ 10 each. All the amount due in respect of drums have been collected from the customers. 00,000 You are asked to show the Ledger Accounts for the year 2014-15 : (a) Drums A/c (b) Drums Debtors A/c.arrow_forwardOn 1 January 2019, Azzurri Berhad sold a stock item with a cost of RM50,000 to Mancini Berhad. The terms of the sale include a five-yearly instalment of RM15,000, each payable at the end of every year. The cash selling price of the stock is RM60,000. An effective interest rate of 7.931% should be used in any calculations With reference to relevant Malaysian Financial Reporting Standards (MFRS), prepare the respective journal entries for the years ended 31 December 2019 and 31 December 2020arrow_forward

- Adams Acrobats lent $17,147 to Donaldson, Inc., accepting Donaldson's 2-year, $20,000, zero-interest-bearing note. The implied interest rate is 8%. Prepare Adams's journal entries for the initial transaction, recognition of interest each year, and the collection of $20,000 at maturity. (Round answers to O decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles and Explanation (To record the initial transations) (To record the recognition of interest in year one) (To recognize the interest in year 2) (To record the collection of the note) Debit Credit INTarrow_forwardOn 1 January 2017, a company which prepares financial statement to 30 June each year buys € 400,000 of 5% loan notes for € 411,225. Interest will be received half-yearly on 30 June and 31 December and the loan notes will be repaid at a premium of 10% on 31 December 2020. The effective rate of interest is 3.5% per half year and the company intends to hold this investment until maturity. Calculate the amount of interest income that should be recognised in the company's financial statements for each of the years to 30 June 2017, 2018, 2019. Also calculate the amount at which the loan notes should be shown in the statementarrow_forwardOn 1 July 2021, a company issues 2500 convertible notes. The notes have a three-year term and are issued at par with a face value of $1000 per note, giving total proceeds at the date of issue of $2.5 million. The notes pay interest at 1.5% p.a. annually in arrears. The holder of each note is entitled to convert the note into 100 ordinary shares of the company at contract maturity. When the notes are issued, the prevailing market interest rate for similar debt (similar term, similar credit status of issuer and similar cash flows) without conversion options is 3% p.a. Hence at the date of issue: Present Value of the principal: $2,287,854.15 Present Value of the interest: $106,072.93 Total contractual Cash Flows $2,393,927.07 Required: Prepare the journal entries for the company to account for the convertible notes for each year ending 30 June as follows: The journal for when the holders exercise their conversion option at the expiration of the contract…arrow_forward

- The following information relates to Arlon Manufacturers which will commence business on 01 January 2024 with R750 000 cash: 1. 2. New machinery and equipment will be purchased on 02 January 2024 for R300 000. A deposit of 20% will be paid immediately. The balance of the debt as well as finance charges of R18 000 will be paid in 12 equal instalments commencing February 2024. Production will commence on 05 January 2024 and 30% of the sales for February's will be manufactured in January. Each month thereafter the production will consist of 70% of the current month's sales and 30% of the following month's sales. 3. Estimated sales at R72 per unit are as follows: 4. January February March April Units 0 8 500 11 000 10 500 Cash sales are expected to comprise 60% of the total sales. A cash discount of 10% will be granted to these customers. The balance of the sales will be on credit. Thirty percent (30%) of the amount owing is expected to be received in the month of the sale and the balance…arrow_forwardOn March 2021, Company A enters a forward rate agreement(FRA) with company B to borrow $1 million at 4% between October 2021 and December 2021(three months). The term structure of interest rates is flat at 5%. The value of the FRA contract for Company A isarrow_forwardOn January 1, 2021, Glanville Company sold goods to Otter Corporation. Otter signed an installment note requiring payment of $21,500 annually for five years. The first payment was made on January 1, 2021. The prevailing rate of interest for this type of note at date of issuance was 10%. Glanville should record sales revenue in January 2021 of: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Multiple Choice $107,500 $81,502 $89,652 None of these answer choices are correct.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education