FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

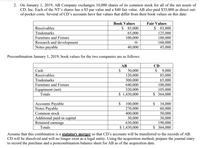

Transcribed Image Text:2. On January 1, 2019, AB Company exchanges 10,000 shares of its common stock for all of the net assets of

CD, Inc. Each of the NT's shares has a $5 par value and a $40 fair value. AB also paid $35,000 as direct out-

of-pocket costs. Several of CD’s accounts have fair values that differ from their book values on this date:

Book Values

Fair Values

$ 85,000

65,000

100,000

$ 83,000

125,000

180,000

160,000

45,000

Receivables

Trademarks

Furniture and Fixture

Research and development

Notes payable

-0-

40,000

Precombination January 1, 2019, book values for the two companies are as follows:

AB

CD

9,000

85,000

65,000

100,000

105,000

$ 364,000

Cash

$

50,000

120,000

300,000

640,000

$

Receivables

Trademarks

Furniture and Fixture

Equpiment (net)

320,000

Totals

$ 1,430,000

Accounts Payable

Notes Payable

Common stock

Additional paid-in capital

Retained earnings

2$

100,000

$

34,000

60,000

50,000

30,000

190,000

$ 364,000

270,000

400,000

30,000

630,000

$ 1,430,000

Totals

Assume that this combination is a statutory merger so that CD’s accounts will be transferred to the records of AB.

CD will be dissolved and will no longer exist as a legal entity. Using the acquisition method, prepare the journal entry

to record the purchase and a postcombination balance sheet for AB as of the acquisition date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2024, Nana Company paid $100,000 for 6,300 shares of Papa Company common stock. The ownership in Papa Company is 10%. Nana Company does not have significant influence over Papa Company. Papa reported net Income of $51,000 for the year ended December 31, 2024. The fair value of the Papa stock on that date was $50 per share. What amount will be reported in the balance sheet of Nana Company for the Investment in Papa at December 31, 2024? Multiple Choice O O $270,000 $315,000 $255,000 $240,000arrow_forwardOn February 1, 2019, Wild Bill Corporation repurchases 810 shares of its outstanding common stock for $9 per share. On March 1, 2019, Wild Bill sells 260 shares of treasury stock for $12 per share. On May 10, 2019, Wild Bill sells the remaining 550 shares of its treasury stock for $6 per share. Required: Prepare the journal entries to record these transactions. 2019 Feb. 1 fill in the blank 2 fill in the blank 4 (Record purchase of treasury shares) Mar. 1 fill in the blank 6 fill in the blank 7 fill in the blank 9 fill in the blank 10 fill in the blank 12 fill in the blank 13 (Record reissue of treasury shares) May 10 fill in the blank 15 fill in the blank 16 fill in the blank 18 fill in the blank 19 fill in the blank 21 fill in the blank 22 fill in the blank 24 fill in the blank 25 (Record reissue of treasury shares)arrow_forwardS16-9 On January 6, 2023, Ling Corp. paid $5,000,000 for its 40 percent investment in True World Inc. Assume that on December 31 that same year, True World earned net income of $1,800,000 and paid cash dividends of $800,000. What method should Ling Corp. use to account for the investment in True World Inc.? Give your reason. Ignore any brokerage commission expenses. Post to the Investment in True World Inc. Common Shares T- account. What is its balance after all the transactions are posted? Journalize these three transactions on the books of Ling Corp. Include an explanation for each entry.arrow_forward

- On December 31, 2019, Akron, Inc., purchased 5 percent of Zip Company's common shares on the open market in exchange for $15,500. On December 31, 2020, Akron, Inc., acquires an additional 25 percent of Zip Company's outstanding common stock for $94,000. During the next two years, the following information is available for Zip Company: Common Stock Fair Value (12/31) $321,000 376,000 478,000 Dividends Income Declared 2019 $79,000 89,000 $6,200 15,800 2020 2021 At December 31, 2020, Zip reports a net book value of $280,000. Akron attributed any excess of its 30 percent share of Zip's fair over book value to its share of Zip's franchise agreements. The franchise agreements had a remaining life of 10 years at December 31, 2020. a. Assume Akron applies the equity method to its Investment in Zip account: 1. What amount of equity income should Akron report for 2021? 2. On Akron's December 31, 2021, balance sheet, what amount is reported for the Investment in Zip account? b. Assume Akron uses…arrow_forwardLexington Co. has the following securities outstanding on December 31, 2017 (its first year of operations). Cost Fair Value Greenspan Corp. stock $20,000 $19,000 Summerset Company stock 9,500 8,800 Tinkers Company stock 20,000 20,600 $49,500 $48,400 During 2018, Summerset Company stock was sold for $9,200, the difference between the $9,200 and the “fair value” of $8,800 being recorded as a “Gain on Sale of Investments.” The market price of the stock on December 31, 2018, was Greenspan Corp. stock $19,900; Tinkers Company stock $20,500.Instructions(a) What justification is there for valuing equity securities at fair value and reporting the unrealized gain or loss as part of net income?(b) How should Lexington Co. report this information in its financial statements at December 31, 2017? Explain.(c) Did Lexington Co. properly account for the sale of the Summerset Company stock? Explain.(d) Are there any additional entries necessary for Lexington Co. at December 31,…arrow_forwardOn January 15, 2020 bieber co purchased 30,000 shares of Hand Co. at $35 per share, paying $10,000 in commissions to the broker of the deal. On March 17, 2020, Hand Co. paid a cash dividend of $2.50 per share. The fair value of the Hand Co. stock at the end of 2020 was $38 per share. During 2020, Hand Co. had net income of $3,000,000. Prepare the journal entries for Bieber Co. for the above transaction assuming the amount of shares purchased represents 40% of Hand Co. outstanding stock.arrow_forward

- On April 15, 2023, Rizzo Inc. purchased 34,500 shares of Hernandez, Inc. for $22 per share (passive interest). During the year Rizzo Inc. sold 4,500 shares of Hernandez, Inc. for $25 per share. Rizzo Inc. started operations on January 1, 2023. At December 31, 2023 the market price of Hernandez, Inc.’s stock was $19 per share. What is the total amount of unrealized gain (loss) that Rizzo Inc. will report through its income statement for the year ended December 31, 2023 related to its investment in Hernandez, Inc. stock?arrow_forwardOn December 31, 2019, Akron, Inc., purchased 5 percent of Zip Company's common shares on the open market in exchange for $15,600. On December 31, 2020, Akron, Inc., acquires an additional 25 percent of Zip Company's outstanding common stock for $97,000. During the next two years, the following information is available for Zip Company: Income Dividends Declared Common StockFair Value (12/31) 2019 $312,000 2020 $85,000 $7,900 388,000 2021 94,000 16,000 487,000 At December 31, 2020, Zip reports a net book value of $298,000. Akron attributed any excess of its 30 percent share of Zip's fair over book value to its share of Zip's franchise agreements. The franchise agreements had a remaining life of 10 years at December 31, 2020. Assume Akron applies the equity method to its Investment in Zip account: What amount of equity income should Akron report for 2021? On Akron’s December 31, 2021, balance sheet, what amount is reported for the Investment in Zip account?arrow_forwardDuring 2019, Honeymooners Companies issued 4,000 preferred shares with par value of $ 1 to $ 11 each. Each preferred share can be exchanged (convert), at the option of the holder (investor), for three Honeymooners common shares with par value of $ 2. In April 2020, all preferred shares were exchanged. At the time of the exchange, how much must Honeymooners credit to the contributed capital account in excess of par value of commons? Select one: to. $ 44,000 b. $ 0 c. $ 40,000 d. $ 20,000arrow_forward

- Godoarrow_forwardDineshbhaiarrow_forwardS&L Financial buys and sells securities which it classifies as available-for-sale. On December 27, 2021, S&L purchased Coca-Cola bonds at par for $884,000 and sold the bonds on January 3, 2022, for $ 890,000. At December 31, the bonds had a fair value of $881,000, and S&L has the intent and ability to hold the investment until fair value recovers. Prepare journal entries to record (a) any unrealized gains or losses occurring in 2021 and (b) the sale of the bonds in 2022, including recognition of any unrealized gains in 2022 prior to sale and reclassification of amounts out of OCI.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education