Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

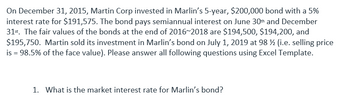

Transcribed Image Text:On December 31, 2015, Martin Corp invested in Marlin's 5-year, $200,000 bond with a 5%

interest rate for $191,575. The bond pays semiannual interest on June 30th and December

31st. The fair values of the bonds at the end of 2016~2018 are $194,500, $194,200, and

$195,750. Martin sold its investment in Marlin's bond on July 1, 2019 at 98 ½ (i.e. selling price

is = 98.5% of the face value). Please answer all following questions using Excel Template.

1. What is the market interest rate for Marlin's bond?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- On April 1, 2020 Everjoy Company purchased $80,000 of Miller Corporation's 6% bonds at a purchase price of 96. At the time of purchase the market rate of interest was 8%. Everjoy Company, whose year end is December 31, expects to hold the bonds until their maturity date 5 years from the date of purchase. Interest on the bonds will be paid every April 1 and October 1 until maturity. What is the carrying value (amortized cost) of the bond that Everjoy Company would report on October 1, 2020? O $78,144 O $77,120 O $79,488 O $77,472 O None of the above.arrow_forwardOn December 1, 2017, Cone Company issued its 10%, $550,000 face value bonds for $640,000, plus accrued interest. Interest is payable on November 1 and May 1. On December 31, 2019, the book value of the bonds, inclusive of the unamortized premium, was $580,000. On July 1, 2020, Cone reacquired the bonds at 98 plus accrued interest. Cone appropriately uses the straight-line method for the amortization because the results do not materially differ from those of the effective interest method.arrow_forwardOn January 1, 2020, Vaughn Corporation issued $5,480,000 of 10% bonds at 101 due December 31, 2029. Vaughn paid $75,000 in bond issue costs when the bonds were issue to the market. These will be amortized over the life of the bond. The premium on the bonds is also being amortized on a straight-line basis over the 10 years. (Straight-line is not materially different in effect from the preferable "interest method".) The bonds are callable at 105 (i.e., at 105% of face amount), and on January 2, 2025, Vaughn called one-half of the bonds and retired them. Ignoring income taxes, compute the amount of loss, if any, to be recognized by Vaughn as a result of retiring the $2,740,000 of bonds in 2025. Loss on redemption $ Prepare the journal entry to record the retirement. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before…arrow_forward

- Oso Company purchased a Costco bond for $40,000 on January 1, 2020 at face value with an interest rate of 3% paid and recorded annually on 12/31. Oso Company treats the bond as an available-for-sale investment. 1. On 12/31/20, Oso Company records ALL the entries related to this investment. The fair value of the bond is $45,000. Assume no entries have been recorded to date after the 1/1/20 purchase. Answer the following questions for Oso: a. How much is the investment valued at on Oso's balance sheet? Why is it valued at this amount? b. How much does Oso's net income change by for all entries recorded on 12/31/20 related to this bond? Include the amount and direction. If no change, write no change. 2. On 12/31/21, Oso Company records ALL the entries related to this investment. The fair value of the bond is $42,000. Assume no entries have been recorded since 12/31/20. Answer the following questions for Oso: a. Record the journal entry for any fair value adjustments that are needed. If no…arrow_forwardOn January 1, 2024, Rupar Retallers purchased $100,000 of Anand Company bonds at a discount of $6,000. The Anand bonds pay 6% interest but were purchased when the market interest rate was 7% for bonds of similar risk and maturity. The bonds pay interest semiannually on June 30 and December 31 of each year. Rupar accounts for the bonds as a held-to-maturity Investment, and uses the effective interest method. In Rupar's December 31, 2024, journal entry to record the second period of Interest, Rupar would record a credit to interest revenue of Multiple Choice O O $3,000 $3,500 $1.300arrow_forwardOn January 1, 2026, Baker Company purchased, as an investment, 5% bonds, having a maturity value of $150,000, for $138,400. The bonds provide the bondholders with a 7% yield. They are dated January 1, 2026, and mature January 1, 2036, with interest receivable June 30 and December 31 of each year. The securities are classified as available-for-sale. January 1, 2026 June 30, 2026 December 31, 2026 June 30, 2027 December 31, 2027 June 30, 2028 December 31, 2028 Schedule of Interest Revenue and Bond Amortization Amortization Cash Received (2.5%) Interest Revenue (3.5%) 3,750 3,750 3,750 3,750 3,750 3,750 4,844 4,882 4,922 4,963 5,005 5,049 The fair value of the bonds at December 31 of each year-end is as follows. 2026 145,000 2027 148,000 2028 152,000 1,094 1,132 1,172 1,213 1,255 1,299 Carrying Value 138,400 139,494 140,626 141,798 143,011 144,266 145,565 a) Prepare the journal entry at the date of the investment purchase. b) Prepare the journal entries to record the interest received on…arrow_forward

- On January 1, 2020, National Retail purchased $100,000 of GEH Company bonds at a discount of $10,000. The GEH bonds pay 6% interest but were purchased when the market interest rate was 8% for bonds of similar risk and maturity. The bonds pay interest semiannually on June 30 and December 31 of each year. National Retail accounts for the bonds as a held-to-maturity investment and uses the effective interest method. In National Retail's December 31, 2020, journal entry to record the second period of interest would include a credit to interest revenue of: $3,000 $3,600 $3,336 d. $7,336 e. $3,624 a. b. C.arrow_forwardOn December 31, 2015, Martin Corp invested in Marlin’s 5-year, $200,000 bond with a 5% interest rate for $191,575. The bond pays semiannual interest on June 30th and December 31st. The fair values of the bonds at the end of 2016~2018 are $194,500, $194,200, and $195,750. Martin sold its investment in Marlin’s bond on July 1, 2019 at 98 ½ (i.e. selling price is = 98.5% of the face value). Assuming the bonds are classified as Trading investment, prepare the journal entries on aforementioned dates.arrow_forwardsanjuarrow_forward

- On January 1, 2017, Sarasota Corporation purchased 331 of the $1,000 face value, 9%, 10-year bonds of Walters Inc. The bonds mature on January 1, 2027, and pay interest annually beginning January 1, 2018. Sarasota purchased the bonds to yield 11%. How much did Sarasota pay for the bonds?arrow_forwardDuring 2023, Culver Inc. purchased 2200, $1000, 7% bonds. The bonds mature on March 1, 2028 and pay interest on March 1 and September 1. The carrying value of the bonds at December 31, 2023 was S 1967500. on September 1, 2024, after the semi-annual interest was received, Brandon sold half of these bonds for $1007000. Culver uses straight-line amortization and has accounted for the bonds under the amortized cost mode.The gain on the sale is $23250 $41850 $0 $4650arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education