ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

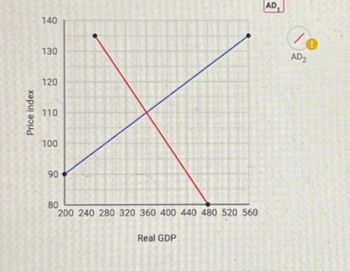

The graph below shows, the aggregate demand and supply for the economy of Etrusca.

a. Draw AD2 on the graph below assuming an increase of $60 in aggregate demand. Plot only the endpoints of the curve below

b. What is the new level of equilibrium GDP ?

c. What is the new equilibrium price level?

d. How much is the reduction in GDP due to the crowding out effect?

Transcribed Image Text:140

AD

/0

AD2

130

Price index

120

110

100

90

96

80

80

200 240 280 320 360 400 440 480 520 560

Real GDP

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- hi there is another picture as wellarrow_forwardCourse: Macroeconomic - IS-LM Model Prove mathematically the following: Given an increase in the proportional tax on income(t), what happens to the level of output and to the tax?" . Hint: for demostration, use the IS general function for a closed economy Y = C + I + G, where C = a + c*YD and YD = Y + TR - Y*t (where t = proportional income tax) and realize changes i.e., from "t1" to "t2"arrow_forwardMacroeconomics: Assuming marginal propensity to consume is 0.5. If there is a shock to the economy that increases investment spending by 200 billion dollars what will the total Change to GDP be? (Ignore taxes and imports)arrow_forward

- SRAS PL2 PL AD2 AD REAL GDP The Aggregate Demand Model shows an increase in Aggregate Demand or an increase in GDP. Which Fiscal Policy Action would cause this change O Raise Taxes & Cut Government Spending O Decrease Taxes & Government Spending O Increase Taxes & Government Spending O Cut Taxes and Increase Government Spending PRICE LEVELarrow_forwardthe question is true or false: "An increase in business investment spending has the same effect on the level of ad as an increase in the same amount of government spending" can you explain what the answer is? Would they equal each other out?arrow_forwardTOPIC: Crowding Out.arrow_forward

- US President Collin Hawkins is concerned about the economy. He orders the Treasury to issue direct stimulus payments to citizens in an effort to prevent a recession. On average citizens save 20% of their income. The total of this stimulus amount is $1.3 trillion USD. What is the multiplier? What is the total economic impact of this injection? $ "instead of using 'O's, simply note the number using "m", "b", or "t" for 'million, "billion, or 'trillion. For example if your answer is "$56,100,000,000", you should instead type "$56.1b"arrow_forwardSuppose an economy had aggregate demand components with the following relationships: Consumption spending, C=140+.60*(DY) Investment spending,I=25+.15*Y Government Spending, G= 0 Net Export Spending,X=0 Tax collections, Tx=0 a. What is the equilibrium income for this economy? b. If the government decided to increase G spending by 6, what would be the new equilibrium income for this economy? c. If instead the government decided to reduce Tx (taxes) by 10, what would be the new equilibrium income for the economy? d. If instead the government decided to increase G spending and Increase Tx (taxes) by 20, what would be the new equilibrium for this economy?arrow_forwardWhen households cut back on their spending, then in the short run we tend to see the price level ______ and equilibrium output __________. fall; fall rise; fall rise; rise fall; risearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education