ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Macmillan Learning

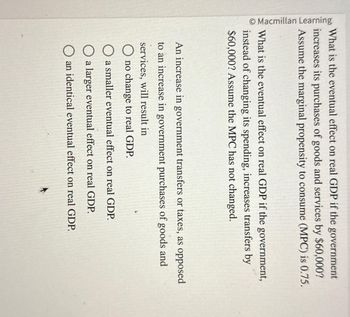

What is the eventual effect on real GDP if the government

increases its purchases of goods and services by $60,000?

Assume the marginal propensity to consume (MPC) is 0.75.

What is the eventual effect on real GDP if the government,

instead of changing its spending, increases transfers by

$60,000? Assume the MPC has not changed.

An increase in government transfers or taxes, as opposed

to an increase in government purchases of goods and

services, will result in

O no change to real GDP.

O a smaller eventual effect on real GDP.

a larger eventual effect on real GDP.

O an identical eventual effect on real GDP.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- pls send me answer of all the parts in details and i will rate you.arrow_forwardIncome is 678 Trillion and consumption is 662 Trillion then income increases to 698 Trillion and consumption increases to 677 Trillion. What will the marginal propensity to consume be?arrow_forwardNeed help what formulas are used to answer questions please show step by step Assume the MPC is 0.75 and policy makers have targeted real GDP to decrease by $300 billion. By how much must taxes be increased to achieve this goal? Assume the MPC is 0.70 and the government increases spending on public school programs by $20 billion. What is the value of the initial impact on real GDP? What is the value of the total impact on real GDP?arrow_forward

- Question 3 of 16 Income and consumption changes for five people are shown in the table. Given this information, rank the marginal propensities to consume (MPC) for the five people from largest to smallest. Largest MPC Smallest MPC Answer Bank Bert Doug Eli Carter Al Name Income change Consumption change Al +$5,000+$5,000 +$3,000+$3,000 Bert +$2,500+$2,500 +$800+$800 Carter +$1,000+$1,000 +$800+$800 Doug −$2,500−$2,500 −$1,750−$1,750 Eli −$5,000−$5,000 −$2,000−$2,000arrow_forward3. When the following event occurs, the change in Real GDP = Event: The government increases its education funding by $60 billion; the marginal propensity to consume is 0.6. the multiplier.arrow_forwardMacroeconomics: Assuming marginal propensity to consume is 0.5. If there is a shock to the economy that increases investment spending by 200 billion dollars what will the total Change to GDP be? (Ignore taxes and imports)arrow_forward

- Explain the effects of the following actions on equilibrium income, assuming that the marginal propensity to consume is 0.8 A. Government purchases rise by $40 billion B. Taxes fall by $40 billion.arrow_forwardHow does the marginal propensity to consume (MPC) determine how GDP responds to policy changes? If we want MPC to be high, what implications does this have for how we should design policies?arrow_forwardIn an economy the value of Marginal propensity to save Is 0.21 Calculate the value of Marginal propensity to consumearrow_forward

- What is the consumption function? What is the marginal propensity to consume? What does an upward-sloping consumption function mean?arrow_forwardThe tax rate is 0.4. The marginal propensity to import is 0.5 . When real GDP increases from $20,000 to $20,198, consumption increases from $18,000 to $18,050. What is the marginal propensity to consume?arrow_forwardThe tax cuts of 2017 increased the 2018 disposable income of households by roughly $200 billion. If the MPC were 0.65, Instructions: Enter your responses as a whole number. a. how much of this windfall was initially saved? $ billion b. how much AD stimulus resulted over time after all multiplier effects? $ billion When I work through (b), I get the answer of 1300 billion, but it state it is incorrect.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education