FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

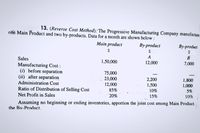

Transcribed Image Text:13. (Reverse Cost Method): The Progressive Manufacturing Company manufacture:

one Main Product and two by-products. Data for a month are shown below:

Main product

Ву-product

2$

Ву-product

Sales

A

B

1,50,000

12,000

7,000

Manufacturing Cost :

(i) before separation

(ii) after separation

Administration Cost

75,000

23,000

12,000

2,200

1,800

1,500

1,000

Ratio of Distribution of Selling Cost

85%

10%

5%

Net Profit in Sales

20%

15%

10%

Assuming no beginning or ending inventories, apportion the joint cost among Main Product

the Bv-Product.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- David Manufacturing, which uses the high-low method for estimating cost function, makes a product called Kwan. The company incurs three different manufacturing cost types (A, B, and C) and has a relevant range of operation between 4,000 units and 10,000 units per month. Per-unit costs at two different activity levels for each cost type are presented below. Type A Type B Type C Total 5,000 units $7 $12.60 $4 $23.60 7,500 units $7 $8.40 $3 $18.40 Required: a) Classify each of the costs (A, B, and C) as either fixed or variable or semi-variable b) Write down a linear cost function that expresses the behavior of Shum's total manufacturing cost as a function of # of units produced. c) If Shum produces 10,000 units, what would be the total cost of manufacturing? d) If all fixed costs (or fixed components of costs) decrease by 10% and all variable costs (or variable components of costs) decrease by 10%, what would be the total cost of manufacturing for an activity level of production of 8,000…arrow_forwardThe manufacturing costs of Calico Industries for three months of the year are provided below: Total Cost Production (units) April $113,700 281,300 May 80,700 165,900 June 105,000 243,500 Using the high-low method, the variable cost per unit and the total fixed costs are a.$2.90 per unit and $3,212 b.$0.29 per unit and $32,123 c.$0.52 per unit and $16,062 d.$5.22 per unit and $3,212arrow_forwardMenk Corporation has provided the following information: Cost per Unit Cost per Period Direct materials $ 6.80 Direct labor $ 3.80 Variable manufacturing overhead $ 2.00 Fixed manufacturing overhead $ 20,200 Sales commissions $ 0.50 Variable administrative expense $ 0.40 Fixed selling and administrative expense $ 10,100 Required: a. If 5,220 units are sold, what is the variable cost per unit sold? Note: Round "Per unit" answer to 2 decimal places. b. If 5,220 units are sold, what is the total amount of variable costs related to the units sold? c. If 5,220 units are produced, what is the total amount of manufacturing overhead cost incurred? a. Variable cost per unit sold b. Total variable costs c. Total manufacturing overhead costarrow_forward

- XYZ, Inc. reports the following information for November: Sales Revenue $800,000 Variable Cost of Goods Sold 110,000 Fixed Cost of Goods Sold 45,000 Variable Selling and Administrative Costs 100,000 Fixed Selling and Administrative Costs 70,000 Calculate the gross profit for November using absorption (traditional) costing. Question 18Select one: A. $ 730,000 B. $690,000 C. $700,000 D. $645,000arrow_forwardDeliveries to the retailers Sh.so 2,400,000 Set-up costs 6,000,000 Purchase order costs 3,600,000 Total overheads 12,000,000 All director labor is paid at $ 5 per hour. The company holds no inventories. Required: a. Calculate the total profit on each of General Motor's three types of products using each of the following methods: 1. The existing method based upon labor hours 2. Activity based costingarrow_forwardA company’s standard product cost is $9 per unit. Actual production costs were $11 per unit. The firm made 20 units and sold 17 units. The firm’s cost of goods sold was Select one: a. $220. b. $187 c. $153 d. $180arrow_forward

- The manufacturing costs of Mocha Industries for 3 months of the year are as follows: Total Cost ProductionApril $58,354 1,870 units May $61,504 2,620 June $66,460 3,800 Using the high-low method, determine the (a) variable cost per unit and (b) the total fixed costs. Round "Cost per unit" answer to two decimal places. a. Variable cost per unitb. Total fixed costsarrow_forwardThe manufacturing costs of Barretto Enterprises for three months of the year follow: Total Costs Units Produced July $495,000 3,100 units August 551,000 6,600 September 535,000 4,800 Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost. a. Variable cost per unit $fill in the blank 1 b. Total fixed cost $fill in the blank 2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education