ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

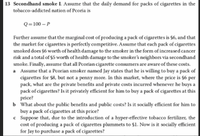

Transcribed Image Text:13 Secondhand smoke L Assume that the daily demand for packs of cigarettes in the

tobacco-addicted nation of Pcoria is

Q=100 – P

Further assume that the marginal cost of producing a pack of cigarettes is $6, and that

the market for cigarettes is perfectly competitive. Assume that each pack of cigarettes

smoked does §6 worth of health damage to the smoker in the form of increased cancer

risk and a total of $5 worth of health damage to the smoker's neighbors via secondhand

smoke. Finally, assume that all Pcorian cigarette consumers are aware of these costs.

a Assume that a Pcorian smoker named Jay states that he is willing to buy a pack of

cigarettes for $8, but not a penny more. In this market, where the price is $6 per

pack, what are the private benefits and private costs incurred whenever he buys a

pack of cigarettes? Is it privately efficient for him to buy a pack of cigarettes at this

price?

b What about the public benefits and public costs? Is it socially efficient for him to

buy a pack of cigarettes at this price?

c Suppose that, due to the introduction of a hyper-effective tobacco fertilizer, the

cost of producing a pack of cigarettes plummets to $1. Now is it socially efficient

for Jay to purchase a pack of cigarettes?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Please answer. Thank you!arrow_forwardConsider the market for trees in a public park. These trees are a public good that give benefits to multiple groups of people, as described below. Each Marginal Willingness to Pay curve represents the aggregation of all the individuals in that group, and those groups make decisions collectively. Additionally, the cost of planting trees is given. Consider Q to be the number of trees in the park. Note that no one is ever worse off from additional trees. Arborists: MWTP = 2000 – 5Q Total WTP = 2000Q - 2.5Q2 Environmentalists: MWTP = 1500 – 10Q Total WTP = 1500Q – 5Q2 Casual Park Visitors: MWTP = 800 – 10Q Total WTP = 800Q – 5Q2 Park Haters: MWTP = 500 – 50Q Total WTP = 500Q – 25Q2 MC = 1400 Total Cost = 1400Q (a) If the government does not intervene into the market, how many trees will be planted? (b) What is the socially…arrow_forward5arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardJohn is a 55-year-old male smoker, about 50 pounds overweight, who has high blood sugar and drinks to excess. Because of adverse selection in health insurance, Select one: O a. when John gets health insurance, he will be less likely to take care of himself. O b. if John doesn't have health insurance already, he will not be able to get it. O c. when John gets health insurance, he will be more likely to take care of himself. O d. John is more likely to buy health insurance than the average person since premiums are based on the average risk. O e. John is less likely to buy health insurance than the average personsince premiums are based on the average risk.arrow_forwardurgntlyarrow_forward

- Demand for medical services is price inelastic (Absolute value of price elasticity of demand is less than 1 and greater than zero). Medical services are different from most other goods and services in that the person who determines the demand (the patient) is not the person who makes the payment (payment is made by the insurance company). How does this affect the price elasticity of demand for medical services (increase it or decrease it)? You may assume that this question only refers to people who have health insurance. Ignore co-payments and deductibles and any other out-of-pocket expenses. Please give an explanation.arrow_forwardSuppose that one course of treatment costs $500,000. If given to patient A, it will increase life expectancy by one month; for patient B, by two months; for patient C, by three months; and for patient D, by four months. The marginal cost per additional year of life for the patient most likely to benefit is and the marginal cost per additional year of life for the patient least likely to benefit is O $500,000; $2 million $1.5 million; $6 million $200,000; $500,000 O $2 million; $500,000 $6 million; $1.5 millionarrow_forwardPlease answer the question and show complete solution. Thank you!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education