Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Provide correct option general accounting

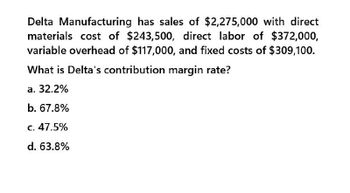

Transcribed Image Text:Delta Manufacturing has sales of $2,275,000 with direct

materials cost of $243,500, direct labor of $372,000,

variable overhead of $117,000, and fixed costs of $309,100.

What is Delta's contribution margin rate?

a. 32.2%

b. 67.8%

c. 47.5%

d. 63.8%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Contribution margin Waite Company sells 250,000 units at 120 per unit. Variable costs are 78 per unit, and fixed costs are 8,175,000. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) operating income.arrow_forwardSuppose that a company has fixed costs of $18 per unit and variable costs $9 per unit when 15,000 units are produced. What are the fixed costs per unit when 12,000 units are produced?arrow_forwardIdentify cost graphs The following cost graphs illustrate various types of cost behavior: For each of the following costs, identify the cost graph that best illustrates its cost behavior as the number of units produced increases: A. Total direct materials cost B. Electricity costs of 1,000 per month plus 0.10 per kilowatt-hour C. Per-unit cost of straight-line depreciation on factory equipment D. Salary of quality control supervisor, 20,000 per month E. Per-unit direct labor costarrow_forward

- Mazoon Company has information on its revenue and costs is as follows: Selling price per unit $70; Variable costs per unit includes: Direct material $16, Direct manufacturing labor $8, Manufacturing overhead $8, and Selling costs $10; Annual fixed costs $85,000. What is the contribution margin percentage? a. 40% b. 52.5% C. 60% d. None of the given answers e. 70%arrow_forwardIf the contribution margin ratio for France Company is 43%, sales are $407,000, and fixed costs are $94,000, the operating income is a.$94,000 b.$81,010 c.$175,010 d.$64,808arrow_forwardMazoon Company has information on its revenue and costs is as follows: Selling price per unit $120; Variable costs per unit includes: Direct material $16, Direct manufacturing labor $8, Manufacturing overhead $8, and Selling costs $10; Annual fixed costs $60,000. What is the contribution margin percentage? O a. 35% O b. 73.3% O C. 80% Od. 65% O e. None of the given answersarrow_forward

- If sales are $815,000, variable costs are 73% of sales, and operating income is $260,000, what is the contribution margin ratio? a.69% b.31% c.73% d.27% The Aleutian Company produces two products, Rings and Dings. They are manufactured in two departments—Fabrication and Assembly. Data for the products and departments are listed below. Product Number ofUnits Labor HoursPer Unit Machine HoursPer Unit Rings 1,180 3 5 Dings 1,920 9 8 All of the machine hours take place in the Fabrication Department, which has an estimated overhead of $84,100. All of the labor hours take place in the Assembly Department, which has an estimated total overhead of $68,600. The Aleutian Company uses departmental overhead rates. The Fabrication Department uses machine hours for an allocation base, and the Assembly Department uses labor hours. What is the overhead cost per unit for Rings? a.$4.10 b.$29.67 c.$61.29 d.$49.26 The following production data were taken from the records…arrow_forwardIf the contribution margin ratio for France Company is 34%, sales were $424,000, and fixed costs were $100,000, what was the income from operations? a.$44,160 b.$100,000 c.$35,328 d.$144,160arrow_forwardVishuarrow_forward

- If sales are $425,000, variable costs are 62% of sales, and operating income is $50,000, what is the contribution margin ratio? a.26.8% b.11.8% c.62% d.38%arrow_forwardSuppose that Patron Company sells a product for $24. Unit costs are as follows: Direct materials $4.98 Direct labor 2.58 Variable factory overhead 1.00 Variable selling and administrative expense 2.00 Total fixed factory overhead is $30,000 per year, and total fixed selling and administrative expense is $11,664. Required: 1. Calculate the variable cost per unit and the contribution margin per unit. 2. Calculate the contribution margin ratio and the variable cost ratio. 3. Calculate the break-even units. 4. Prepare a contribution margin income statement at the break-even number of units. Enter all amounts as positive numbers.arrow_forwarda. Young Company budgets sales of $1,120,000, fixed costs of $55,400, and variable costs of $246,400. What is the contribution margin ratio for Young Company? b. If the contribution margin ratio for Martinez Company is 58%, sales were $561,000, and fixed costs were $234,270, what was the operating income? LEGO %24arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,