Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

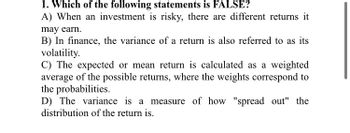

Transcribed Image Text:1. Which of the following statements is FALSE?

A) When an investment is risky, there are different returns it

may earn.

B) In finance, the variance of a return is also referred to as its

volatility.

C) The expected or mean return is calculated as a weighted

average of the possible returns, where the weights correspond to

the probabilities.

D) The variance is a measure of how "spread out" the

distribution of the return is.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The break-even value calculation is similar to the calculation we use for theinternal rate of return. True or false?arrow_forwardHow do you turn an income statement int a forecasted return? And how is it helpful?arrow_forwardWhich of the following statements is CORRECT? a. The SML shows the relationship between companies' required returns and their diversifiable risks. The slope and intercept of this line cannot be influenced by a firm's managers, but the position of the company on the line can be influenced by its managers. b. Suppose you plotted the returns of a given stock against those of the market, and you found that the slope of the regression line was negative. The CAPM would indicate that the required rate of return on the stock should be less than the risk-free rate for a well-diversified investor, assuming investors expect the observed relationship to continue on into the future. c. If investors become less risk averse, the slope of the Security Market Line will increase. d. If a company increases its use of debt, this is likely to cause the slope of its SML to increase, indicating a higher required return on the stock. e. The slope of the SML is determined by the value of beta.arrow_forward

- if asset A has lower volatility than asset B, then it contributes less to the overall volatility when added to a portfolio. True or false?arrow_forwardWhen npv is negative, the discount rate is greater than the actual return on investment. A. True B. Falsearrow_forward1.) Which is false concerning standard deviation? a. The smaller the standard deviation is the less volatile the investment. b. A larger standard deviation means a riskier investment. c. Standard deviation measures the volatility of an investment from the expected losses. 2.) Which is false concerning covariance? a. A negative covariance means that the two variables tend to move in opposite directions, perpendicular to each other. b. A covariance of zero means there is no linear relationship between the two variables. c. A positive covariance means that the variables tend to move together .arrow_forward

- The expected return of a portfolio is simply the weighted average of the expected returns for the individual assets within the portfolio. Group of answer choices True Falsearrow_forwardExamine (i) the relation between market returns and investor sentiment, and (ii) the relation between market returns and conditional volatility. Discuss potential limitations of your work.arrow_forwardd. Interpret your results in (c) above, assuming that the historical average return of 8.5% from the stock is a good benchmark. e. Critically evaluate the strengths and weaknesses of applying the implied rate of return from the RIVM as a proxy of the expected return.arrow_forward

- How is the standard deviation of returns calculated?arrow_forwardThe variance of expected returns is equal to the square root of the expected returns. a. True b. Falsearrow_forwardUnsystematic risk: is compensated for by the risk premium. is measured by standard deviation. is related to the overall economy. can be effectively eliminated by portfolio diversification. is measured by beta.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education