Concept explainers

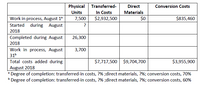

1. What is the percentage of completion for (a) transferred‐in costs and direct

materials in beginning work‐in‐process inventory, and (b) transferred‐in costs

and direct materials in ending work‐in‐process inventory?

2. Calculate total costs assigned to completed and transferred out units to

Finished Goods and working process ending units in the testing department,

using the current

each step of the five‐step approach and your calculations clearly.

3. Suppose that Maxion Jantaş uses the FIFO method instead of the weighted‐

average method in all of its departments. Further assume that following

changes under the FIFO method are; total transferred‐in costs of beginning

work in process on August 1 are $2,881,875 (instead of $2,932,500) and that

total transferred‐in costs added during August are $7,735,250 (instead of

$7,717,500). Using the FIFO process‐costing method and the given

assumptions, repeat part 2

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- ! Required information [The following information applies to the questions displayed below.] For many years, Thomson Company manufactured a single product called LEC 40. Then three years ago, the company automated a portion of its plant and at the same time introduced a second product called LEC 90 that has become increasingly popular. The LEC 90 is a more complex product, requiring 0.60 hours of direct labor time per unit to manufacture and extensive machining in the automated portion of the plant. The LEC 40 requires only 0.20 hours of direct labor time per unit and only a small amount of machining. Manufacturing overhead costs are currently assigned to products on the basis of direct labor-hours. Despite the growing popularity of the company's new LEC 90, profits have been declining steadily. Management is beginning to believe that there may be a problem with the company's costing system. Direct material and direct labor costs per unit are as follows: Direct materials Direct labor…arrow_forwardWhich three items must ALWAYS be the same number on a production cost report? Group of answer choices Total column of the “Total costs, month of” row; Total column of the “Total Costs” row in the “Costs” section; and Total column of the “Total Costs” row in the “Cost Reconciliation” section. Total units in production, Total units under the “physical units” column, and Total units under the “materials – equivalent units” column. Unit costs for materials, labor, and manufacturing overhead. Ending WIP inventory amounts for materials, conversion costs, and total costs.arrow_forwardIdentifying Cost Drivers. Palisades Company identified the activities listed in the following as being most important (step 1 and step 2 of activity-based costing), and it formed cost pools for each activity: 1. Purchasing raw materials 2. Inspecting raw materials 3. Storing raw materials 4. Maintaining production equipment 5. Setting up machines to produce batches of product 6. Testing finished products Required: Perform step 3 of the activity-based costing process by identifying a possible cost driver for each activity.arrow_forward

- When using the weighted-average method of process costing, total equivalent units produced for a given period equal: Which of the followubg below is correct and why 1. The number of units started and completed during the period plus the number of units in beginning work in process plus the number of units in ending work in process. 2. The number of units in beginning work in process plus the number of units started during the period plus the number of units remaining in ending work in process times the percentage of work necessary to complete the items. 3. The number of units in beginning work in process times the percentage of work necessary to complete the items plus the number of units started and completed during the period plus the number of units started this period and remaining in ending work in process times the percentage of work necessary to complete the items. 4. The number of units transferred out during the period plus the number of units remaining in ending work in…arrow_forwardPlease follow the directions seen in the picture.arrow_forwardConcepts and Terminology From the choices presented in parentheses, choose the appropriate term for completing each of the following sentences: Sentence a. An example of factory overhead is b. Direct materials costs combined with direct labor costs are called c. Long-term plans are called d. Advertising costs are usually viewed as plans. costs. costs. e. The management process by which management monitors operations by comparing actual and expected results is f. The plant manager's salary would be considered to the product. g. The salaries of factory supervisors are normally considered a cost.arrow_forward

- In process costing, costs are accounted for by a. year. b. process. c. job. d. batcharrow_forwardHow is activity-based cost allocation useful to management for control and evaluation of the performance of a department? List three points only and briefly discuss them. Why is it necessary for the cost accountant to determine the percentage of completion in the ending work in process inventory at the end of the period? Briefly explain.arrow_forwardHow would I start a Production Cost Report. Should I use the refined weighted average method to start or should I use this formula? Units completed / and transferred out + Equivalent units of ending work in process-Materials= Equivalent Units of Production Materials?arrow_forward

- In a process costing system, the purpose of a production cost report is to allocate production costs incurred in a process to which of the following? Group of answer choices To finished goods inventory To the units completed and transferred to the next process and incomplete units left in the ending work-in-process inventory account To direct costs and indirect costs To individual jobs completed during a periodarrow_forwardWhen computing the cost per equivalent unit under the wighted-average method of process costing, the cost per equivalent unit for direct material is computed by dividing the total direct-material cost by the total equivalent units. True or False?arrow_forwardActivity-based costing (ABC) is a costing technique that uses a two-stage allocation process. Which of the following statements best describes these two stages? Multiple Choice Direct costs are allocated to the production departments based on a predetermined overhead rate. The costs are assigned to departments, and then to the products based upon their use of activity resources. The costs are assigned to activities, and then to the products based upon their use of the activities. Indirect costs are assigned to activities, and then to the products based upon the direct cost resources used by the activities.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education