ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

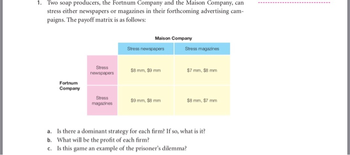

Transcribed Image Text:1. Two soap producers, the Fortnum Company and the Maison Company, can

stress either newspapers or magazines in their forthcoming advertising cam-

paigns. The payoff matrix is as follows:

Maison Company

Stress newspapers

Stress magazines

Stress

newspapers

$8 mm, $9 mm

$7 mm, $8 mm

Fortnum

Company

Stress

magazines

$9 mm, $8 mm

$8 mm, $7 mm.

a. Is there a dominant strategy for each firm? If so, what is it?

b. What will be the profit of each firm?

c. Is this game an example of the prisoner's dilemma?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- please do the questions and the chocies for the last question is (high, low) thankyou!!arrow_forwardThe payoff matrix in the figure to the right shows the payoffs for a pricing game. If you were firm A, which strategy would you choose? Firm A should A. price high because this is their maximin strategy. B. price low because this is their tit-for-tat strategy. C. price high because this is their dominant strategy. D. price low because this is their dominant strategy. E. price low because this maximizes profits of both firms. Firm B's dominant strategy is to price If this game were repeated a large number of times and you were firm A and you could change your strategy, what might you do? Firm A should O A. use a tit-for-tat strategy by responding in kind to firm B's play. B. use a maximin strategy by maximizing the minimum gain that can be earned. C. use a tit-for-tat strategy by selecting a price that minimizes firm B's profits. D. use a maximin strategy by by responding in kind to firm B's play. E. use a tit-for-tat strategy by maximizing the minimum gain that can be earned. C Price…arrow_forwardExercise A.2 . Sinergy and Dinaco are the only two companies in a high-tech industry. They are faced with the following matrix of results when deciding their research budget: After analizing the graph, answer the following questions... a) Does Sinergy have a dominant strategy? Reason your answer. b) Does Dinaco have a dominant strategy? Reason your answer. c) Is there a Nash equilibrium in this scenario? Reason your answer.arrow_forward

- Consider the payoff matrix below representing two firms engaged in Bertrand Competition. Firm A is player 1 and Firm B is player 2. High price Low price High price 10, 12 -1, 13 Low price 12, 2 0, 3 What is Firm A's dominant strategy? Question 14Answer a. High price b. Low price c. Firm A does not have a dominant strategyarrow_forwardCalculate the Herfindahl index for a duopoly market where each firm has equal market. Calculate the Herfindahl index for a three-firm oligopoly market in which one firm hasa 80% market share and the other firms each have 10% market share. iii. Calculate the Herfindahl index for a 10-firm oligopoly in which each firm has equal market shares. iv. Which of the above markets is the least competitive? Justify your position.arrow_forwardConsider the payoff matrix below representing two firms engaged in Bertrand Competition. Firm A is player 1 and Firm B is player 2. High price Low price High price 10, 12 -1, 13 Low price 12, 2 0, 3 What is Firm A's dominant strategy? Question 14Answer a. High price b. Low price c. Firm A does not have a dominant strategyarrow_forward

- Please no written by hand solution Suppose two firms compete in quantities (Cournot). Market demand is given by P = 260 − 2Q, where Q = q1 + q2. Both firms have constant MC = AT C = 20.a. Solve for the Cournot equilibrium and find the Cournot equilibrium profits for each firm.b. Now suppose the two firms formed a cartel. What would be the profits for each firm then?c. If firm 2 sticks to the cartel agreement (quantity), then what is the best response for firm 1 (if firm 1 were to deviate)? Find the profits for firm 1 from deviating.d. How large must the probability-adjusted discount factor be in order for the cartel to be stable?e. How would the answer to part d. change if the two firms were competing in prices (Bertrand)?Please answer all steps, because no too much detailed answers required.arrow_forwardConsider two cigarette companies, PM Inc. and Brown Inc. If neither company advertises, the two companies split the market. If they both advertise, they again split the market, but profits are lower, since each company must bear the cost of advertising. Yet if one company advertises while the other does not, the one that advertises attracts customers from the other. Refer to Scenario 17-3. What is PM Inc.'s dominant strategy? to advertise only if Brown Inc. does not advertise to refrain from advertising, regardless of whether Brown Inc. advertises to advertise, regardless of whether Brown Inc. advertises to advertise only if Brown Inc. advertisesarrow_forward2. Consider the following game: Soapy Inc. and Suddies Inc. are the only producers of soap powder. They collude and agree to share the market equally. If neither firm cheats on the agreement, each makes $1 million profit. If either firm cheats, the cheat makes a profit of $1.5 million, while the complier incurs a loss of $0.5 million. If both cheat, they break even. Neither firm can monitor the other's actions. a) Construct the payoff matrix. b) What is the dominant strategy? c) What is the nash equilibrium for this game?arrow_forward

- 5. To advertise or not to advertise Suppose that Creamland and Dairy King are the only two firms that sell ice cream. The following payoff matrix shows the profit (in millions of dollars) each company will earn depending on whether or not it advertises: Dairy King Advertise Doesn't Advertise Advertise 8, 8 15, 2 Creamland Doesn't Advertise 2, 15 11, 11 For example, the upper right cell shows that if Creamland advertises and Dairy King doesn't advertise, Creamland will make a profit of $15 million, and Dairy King will make a profit of $2 million. Assume this is a simultaneous game and that Creamland and Dairy King are both profit-maximizing firms. If Creamland decides to advertise, it will earn a profit of $ million if Dairy King advertises and a profit of $ million if Dairy King does not advertise. If Creamland decides not to advertise, it will earn a profit of $ million if Dairy King advertises and a profit of $ million if Dairy King does not advertise. If Dairy King advertises,…arrow_forwardTo advertise or not to advertise Suppose that Creamland and Dairy King are the only two firms that sell ice cream. The following payoff matrix shows the profit (in millions of dollars) each company will earn depending on whether or not it advertises: Dairy King Advertise Doesn't Advertise Creamland Advertise 10, 10 18, 2 Doesn't Advertise 2, 18 11, 11 For example, the upper right cell shows that if Creamland advertises and Dairy King doesn't advertise, Creamland will make a profit of $18 million, and Dairy King will make a profit of $2 million. Assume this is a simultaneous game and that Creamland and Dairy King are both profit-maximizing firms. If Creamland decides to advertise, it will earn a profit of _________ million if Dairy King advertises and a profit of ________ million if Dairy King does not advertise. If Creamland decides not to advertise, it will earn a profit of __________ million if Dairy King advertises and a profit of _________…arrow_forwardDeviating from the collusive outcome Please check the image there is a graph Mays and McCovey are beer-brewing companies that operate in a duopoly (two-firm oligopoly). The daily marginal cost (MC) of producing a can of beer is constant and equals $0.60 per can. Assume that neither firm had any startup costs, so marginal cost equals average total cost (ATC) for each firm. Suppose that Mays and McCovey form a cartel, and the firms divide the output evenly. (Note: This is only for convenience; nothing in this model requires that the two companies must equally share the output.) Place the black point (plus symbol) on the following graph to indicate the profit-maximizing price and combined quantity of output if Mays and McCovey choose to work together. When they act as a profit-maximizing cartel, each company will produce cans $ and charge $ per can. Given this information, each firm earns a daily profit of $ , so the daily total industry…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education