Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

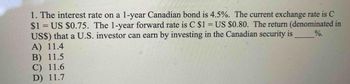

Transcribed Image Text:1. The interest rate on a 1-year Canadian bond is 4.5%. The current exchange rate is C

$1= US $0.75. The 1-year forward rate is C $1= US $0.80. The return (denominated in

US$) that a U.S. investor can earn by investing in the Canadian security is

A) 11.4

%.

B) 11.5

C) 11.6

D) 11.7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose that the U.S. interest rate on one year Treasury notes was 4.5%. We will use this as the annual interest rate in the U.S. And suppose that the interest rate on the one-year German Treasury note was 4.1%. The spot rate is 1.0162 EUR/USD.. And the 3-month forward rate is 1.0188 Eur/USD. Is there an opportunity for covered interest arbitrage? If so, what would be the total profit if we borrowed $20 million for 3 months? A. YES- $27,395.21 would be the profit B. YES- $29,385.41 would be the profit C. YES- $31,695.53 would be the profit D. YES- $33,875.42 would be the profit E. NO- there is no opportunity for a profitarrow_forwardAssume the following information:U.S. investors have $1,000,000 to invest: 1-year deposit rate offered by U.S. banks = 10% 1-year deposit rate offered on British pounds = 13.5% 1-year forward rate of Swiss francs = $1.26 Spot rate of Swiss franc = $1.30 Given this information: A. interest rate parity exists and covered interest arbitrage by U.S. investors results in a yield above what is possible domestically. B. interest rate parity doesn't exist and covered interest arbitrage by U.S. investors results in a yield below what is possible domestically. C. interest rate parity exists and covered interest arbitrage by U.S. investors results in the same yield as investing domestically. D. interest rate parity doesn't exist and covered interest arbitrage by U.S. investors results in a yield above what is possible domestically.arrow_forwarda) Assume the following information: 180‑day U.S. interest rate = 8% 180‑day British interest rate = 9% 180‑day forward rate of British pound = $1.50 Spot rate of British pound = $1.48 Assume that a U.S. exporter will receive 400,000 pounds in 180 days. Would it be better off using a forward hedge or a money market hedge? Substantiate your answer with estimated revenue for each type of hedge. b) As treasurer of a U.S. exporter to Canada, you must decide how to hedge (if at all) future receivables of 250,000 Canadian dollars 90 days from now. Put options are available for a premium of $.03 per unit and an exercise price of $.80 per Canadian dollar (CA$). The forecasted spot rate of the CA$ in 90 days follows: Future Spot Rate Probability (%) $.75 50…arrow_forward

- Given: interest rates are 6% in the U.S. and 15% in the U.K. The spot exchange rate for British pounds is 1.27 $/£ and the 1-year forward rate is F1 - yr = 1.19 $/£. You wish to borrow dollars. a. How can you effectively (synthetically) borrow $100,000 for one year without using the U.S. money market? (List each transaction you would make including the amounts of each currency involved. You may use either continuous compounding or discrete compounding as long as you show your calculations.) b. What is the implied interest rate on your synthetic loan? c. Should you borrow directly or synthetically, and why? d. How could an arbitrageur make a risk-free profit?arrow_forward29) Suppose that the two-year interest rates in Australia and the United States are 4.6% and 0.4% per annum, respectively, and the spot exchange rate between the Australian dollar (AUD) and the US dollar (USD) is 1.0500 USD per one unit of AUD. What is the theoretical forward exchange rate from the perspective of an Australian investor wanting to purchase USD in two years' time? A. 1.0134 AUD per USD. B. 1.0258 AUD per USD. C. 1.0234 AUD per USD..arrow_forwardA 141. Subject:- financearrow_forward

- Suppose you observe the following spot and forward exchange rates between the U.S. dollar ($) and the Canadian dollar (C$): Spot Exchange Rate One-Year Forward Exchange Rate Canadian dollar (U.S. dollar/Canadian dollar) 0.8842 0.9001 The current one-year interest rate on U.S. Treasury securities is 6.89%. If interest rate parity holds, what is the expected yield on one-year Canadian securities of equal risk? 4.75% 4.00% 5.00% 5.75%arrow_forward2arrow_forwardAssume the following information: Spot rate of U.S. dollar Quoted Price AUD1.2500/USD 180-day forward rate of U.S. dollar 180-day Australian interest rate (a periodic rate) 180-day U.S. interest rate (a periodic rate) AUD1.2800/USD 4.75% 3.10% A. What USD-denominated percent rate of return can a US investor earn if they attempt covered interest arbitrage? (to two decimal places like 6.54%) B. What AUD-denominated percent rate of return can an Australian investor earn if they attempt covered interest arbitrage? (to two decimal places like 6.54%) C. Given this information, who has a covered interest arbitrage opportunity? Answer either "Australian investors" or "U.S. investors". D. What changes in the 2 quoted prices above would likely occur to eliminate any further possibilities of covered interest arbitrage? (answer with just or 1) Spot rate of U.S. dollar 180-day forward rate of U.S. dollararrow_forward

- 2. Money Market Hedge on Receivables Assume that Parker Company will receive 200,000 Canadian dollars in 360 days. Assume the following interest rates: 360-day borrowing rate 360-day deposit rate U.S. 6% 4% Canada 5% 3% Assume the forward rate of the Canadian dollar is $.80 and the spot rate of the Canadian dollar is $.78. If Parker Company uses a money market hedge, how much U.S. dollars will it receive in 360 days from its Canadian dollar receivable? (round to whole dollars) (2 points)arrow_forwardAssume the following information (rates are actual 90-day interest rates, not annualized): Spot rate of Canadian dollar S 0.900 90 day forward rate of Canadian dollar $0.890 90-day Canadian interest rate 3.50% 90-day U.S. interest rate 2.40% Given this information, the yield (percentage return) to a U. 5. investor who used covered interest arbitrage would be ( assume the investor invests $1 million). The yield (percentage return) to a Canadian investor who used covered interest arbitrage would be Group of answer choicesarrow_forwardNikularrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education