Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

A 141.

Subject:- finance

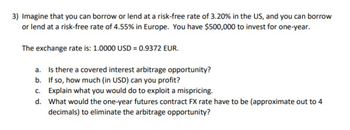

Transcribed Image Text:3) Imagine that you can borrow or lend at a risk-free rate of 3.20% in the US, and you can borrow

or lend at a risk-free rate of 4.55% in Europe. You have $500,000 to invest for one-year.

The exchange rate is: 1.0000 USD = 0.9372 EUR.

a. Is there a covered interest arbitrage opportunity?

b. If so, how much (in USD) can you profit?

c. Explain what you would do to exploit a mispricing.

d.

What would the one-year futures contract FX rate have to be (approximate out to 4

decimals) to eliminate the arbitrage opportunity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 27. Are the following statements true or false, according to IAS1 Presentation of Financial Statements? I. Provisions should be recognized in the statement of financial position. II. A revaluation surplus on non-current assets should be recognized in profit or loss. a. True, True b. False, True c. True, False d. False, Falsearrow_forward13. Fees for managing and protecting a customer"s property is considered under category interest income O non interest income O interest expense non interest expensearrow_forward4. What is the specific citation that describes the disclosure requirements in the notes to the financial statementsfor exit or disposal obligations?arrow_forward

- 27) Which one of the following category prepaid expenses belong to? a. Current asset b. Non-current asset c. Intangible asset d. Current liabilityarrow_forward17) Which one of the following category unearned revenue belong to? a. Current liability b. Limited liability c. Contingent liability d. Lon-term liabilityarrow_forwardWhich concept is applied to net income and other comprehensive income?A. Borrowed CapitalB. Financial CapitalC. Physical CapitalD. Legal Capitalarrow_forward

- Matching Principle Concept How does interest expense associate with revenue?arrow_forwardDetermine if this shall result in recognition of liabilities 16.Sale of goods with product warranty a. yes b. noarrow_forward5. Borrowing costs that are directly attributable to the acquisition or construction of a qualifying asset are accounted for by an SME as a. Outright expenses b. Capitalizable costs c. a or b d. a component of other comprehensive incomearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education