Assume the following information: Spot rate of U.S. dollar Quoted Price AUD1.2500/USD 180-day forward rate of U.S. dollar 180-day Australian interest rate (a periodic rate) 180-day U.S. interest rate (a periodic rate) AUD1.2800/USD 4.75% 3.10% A. What USD-denominated percent rate of return can a US investor earn if they attempt covered interest arbitrage? (to two decimal places like 6.54%) B. What AUD-denominated percent rate of return can an Australian investor earn if they attempt covered interest arbitrage? (to two decimal places like 6.54%) C. Given this information, who has a covered interest arbitrage opportunity? Answer either "Australian investors" or "U.S. investors". D. What changes in the 2 quoted prices above would likely occur to eliminate any further possibilities of covered interest arbitrage? (answer with just or 1) Spot rate of U.S. dollar 180-day forward rate of U.S. dollar

Assume the following information: Spot rate of U.S. dollar Quoted Price AUD1.2500/USD 180-day forward rate of U.S. dollar 180-day Australian interest rate (a periodic rate) 180-day U.S. interest rate (a periodic rate) AUD1.2800/USD 4.75% 3.10% A. What USD-denominated percent rate of return can a US investor earn if they attempt covered interest arbitrage? (to two decimal places like 6.54%) B. What AUD-denominated percent rate of return can an Australian investor earn if they attempt covered interest arbitrage? (to two decimal places like 6.54%) C. Given this information, who has a covered interest arbitrage opportunity? Answer either "Australian investors" or "U.S. investors". D. What changes in the 2 quoted prices above would likely occur to eliminate any further possibilities of covered interest arbitrage? (answer with just or 1) Spot rate of U.S. dollar 180-day forward rate of U.S. dollar

Chapter7: International Arbitrage And Interest Rate Parity

Section: Chapter Questions

Problem 35QA

Related questions

Question

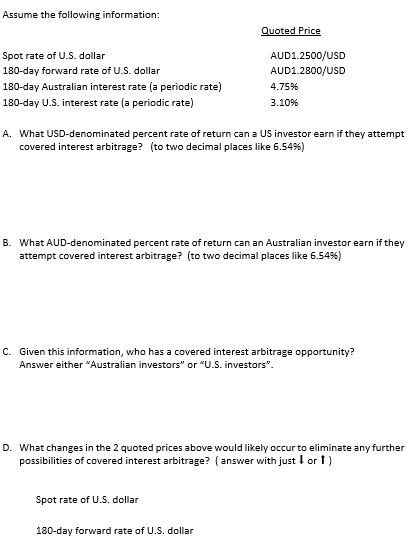

Transcribed Image Text:Assume the following information:

Spot rate of U.S. dollar

Quoted Price

AUD1.2500/USD

180-day forward rate of U.S. dollar

180-day Australian interest rate (a periodic rate)

180-day U.S. interest rate (a periodic rate)

AUD1.2800/USD

4.75%

3.10%

A. What USD-denominated percent rate of return can a US investor earn if they attempt

covered interest arbitrage? (to two decimal places like 6.54%)

B. What AUD-denominated percent rate of return can an Australian investor earn if they

attempt covered interest arbitrage? (to two decimal places like 6.54%)

C. Given this information, who has a covered interest arbitrage opportunity?

Answer either "Australian investors" or "U.S. investors".

D. What changes in the 2 quoted prices above would likely occur to eliminate any further

possibilities of covered interest arbitrage? (answer with just or 1)

Spot rate of U.S. dollar

180-day forward rate of U.S. dollar

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT