Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

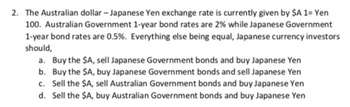

Transcribed Image Text:2. The Australian dollar - Japanese Yen exchange rate is currently given by $A 1= Yen

100. Australian Government 1-year bond rates are 2% while Japanese Government

1-year bond rates are 0.5%. Everything else being equal, Japanese currency investors

should,

a. Buy the $A, sell Japanese Government bonds and buy Japanese Yen

b. Buy the $A, buy Japanese Government bonds and sell Japanese Yen

c. Sell the $A, sell Australian Government bonds and buy Japanese Yen

d. Sell the $A, buy Australian Government bonds and buy Japanese Yen

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Using the currency cross rate table, convert C$300.00 to Japanese yen. Canadian dollar U.S. dollar Euro Japanese yen British pound Australian dollar Canadian U.S. Euro Japanese British Australian dollar dollar yen pound dollar 1.5792 0.0129 2.2735 1.1601 0.0078 1.6624 0.0083 1.4355 197.1834 1.4103 0.7091 0.6332 0.8620 77.5194 128.2051 120.4819 0.4399 0.6015 0.6966 1.1012 1.4945 1.7319 C$300.00 will purchase Japanese yen. (Round to the nearest yen as needed.) 0.0051 0.0126 2.4907 0.9081 0.6691 0.5774 79.4098 0.4015arrow_forwardNonearrow_forwardRequired: A bank is quoting the following exchange rates against the dollar for the Swiss franc and the Australian dollar: SFr/$ 1.5988 - 98 A$/$ 1.7281 - 91 An Australian firm asks the bank for an A$/SFr quote. What cross-rate would the bank quote? Note: Round your answers to 4 decimal places. Cross-rate Bid Price Ask Pricearrow_forward

- The following is information on interest-rates and exchange rates for Australia and the U.K. being quoted by ANZ bank (assume there are no bid-ask spreads, for simplicity). The spot exchange rate for the number of AUD (Australian dollars) per GBP (British pound) is 1.8005. The annualized 6 month interest-rate in Australia (respectively, the U.K.) is 10% (respectively, 8%). Using the formula given in class, what is the 6 month forward exchange rate (consistent with no arbitrage) expressed as the number of AUD per GBP? Assume 6 months is exactly 0.5 years. Give your answer to 4 decimal places (because Canvas only accepts 4 decimal places).arrow_forwardThe theory of purchasing power parity (PPP) states that in the long-run exchange rates between two countries adjusts so that the price of an identical good is the same when expressed in the same currency. A scanner sells for $65.45 in the United States. The exchange rate between the U.S. dollar and the Swiss franc (SFr) is $0.8245 per Swiss franc. Assuming that PPP holds true, how much does the same scanner cost in Switzerland? SFr 95.26 SFr 83.35 SFr 99.23 SFr 79.38arrow_forwardSuppose Dassie Bank quoted the exchange rate of Singapore dollar in US$ at $0.60, the pound rate in US$ at $1.50, and the pound rate in Singapore dollars at S$2.6. For a US resident having $1,000 to do triangular arbitrage, she/he will end up withAnswerUS dollars after the arbitrage.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education