FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Valet Seating Company is currently selling 3,200 oversized bean bag chairs a month at a price of $74 per chair. The variable cost of each chair sold includes $35 to purchase the bean bag chairs from suppliers and a $5 sales commission. Fixed costs are $13,000 per month. The company is considering making several operational changes and wants to know how the change will impact its operating income.

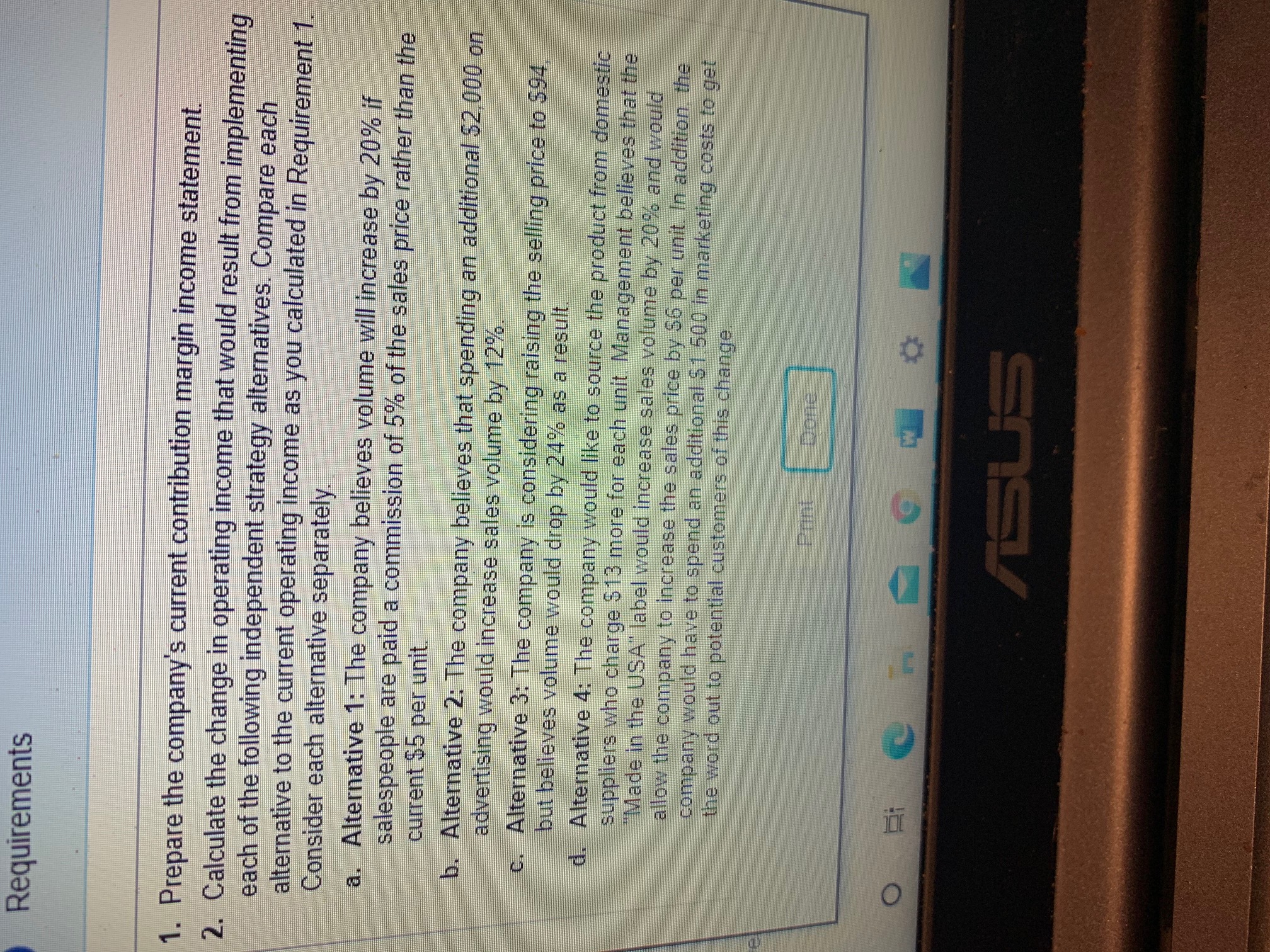

Transcribed Image Text:1. Prepare the company's current contribution margin income statement.

2. Calculate the change in operating income that would result from implementing

each of the following independent strategy alternatives. Compare each

alternative to the current operating income as you calculated in Requirement 1.

Consider each alternative separately.

a. Alternative 1: The company believes volume will increase by 20% if

salespeople are paid a commission of 5% of the sales price rather than the

current $5 per unit.

b. Alternative 2: The company believes that spending an additional $2,000 on

advertising would increase sales volume by 12%.

C. Alternative 3: The company is considering raising the selling price to $94

but believes volume would drop by 24% as a result.

d. Alternative 4: The company would like to source the product from domestic

suppliers who charge S13 more for each unit. Management believes that the

"Made in the USA" label would increase sales volume by 20% and would

allow the company to increase the sales price by $6 per unit. In addition, the

company would have to spend an additional $1.500 in marketing costs to get

the word out to potential customers of this change.

Transcribed Image Text:Requirement 1. Prepare the company's current contribution margin income statement. (Use parentheses or a minus sign for an operating loss.)

Valet Seating Company

Contribution Margin Income Statement

Sales revenue

Variable expenses:

Cost of goods sold

Operating expenses

Contribution margin

Fixed expenses

Operating income (loss)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mary Willis is the advertising manager for Bargain Shoe Store. She is currently working on a major promotional campaign. Her ideas include the installation of a new lighting system and increased display space that will add $19,000 in fixed costs to the $128,000 currently spent. In addition, Mary is proposing that a 5% price decrease ($20 to $19) will produce a 20% increase in sales volume (20,000 to 24,000). Variable costs will remain at $12 per pair of shoes. Management is impressed with Mary’s ideas but concerned about the effects that these changes will have on the break-even point and the margin of safety.arrow_forward"Disk City, Inc., is a retailer for digital video disks. The projected net income for the current year is $200,000 based on a sales volume of 200,000 video disks. Disk City has been selling the disks for $16 each. The variable costs consist of the $10 unit purchase price of the disks and a handling cost of $2 per disk. Disk City’s annual fixed costs are $600,000. Management is planning for the coming year, when it expects that the unit purchase price of the video disks will increase 30 percent. (Ignore income taxes.). "Required: 1.Calculate Disk City’s break-even point for the current year in number of video disks. 2.What will be the company’s net income for the current year if there is a 10 percent increase in projected unit sales volume? 3.What volume of sales (in dollars) must Disk City achieve in the coming year to maintain the same net income as projected for the current year if the unit selling price remains at $16? 4.In order to cover a 30 percent increase in…arrow_forwardMcGilla Golf is evaluating a new line of golf clubs. The clubs will sell for $950 per set and have a variable cost of $415 per set. The company has spent $150,000 for a marketing study that determined the company will sell 50,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 9,000 sets of its high-priced clubs. The high-priced clubs sell at $1,450 and have variable costs of $590. The company also will increase sales of its cheap clubs by 12,000 sets. The cheap clubs sell for $475 and have variable costs of $210 per set. The fixed costs each year will be $9.4 million. The company has also spent $1 million on research and development for the new clubs. The plant and equipment required will cost $29.4 million and will be depreciated on a straight-line basis to a zero salvage value. The new clubs also will require an increase in net working capital of $2.4 million that will be returned at the end of the project. The tax rate is 24…arrow_forward

- The Knot manufactures men’s neckwear at its Spartanburg plant. The Knot is considering implementing a JIT production system. The following are the estimated costs and benefits of JIT production: a. Annual additional tooling costs $250,000 annually. b. Average inventory would decline by 80% from the current level of $1,000,000. c. Insurance, space, materials-handling, and setup costs, which currently total $400,000 annually, would decline by 20%. d. The emphasis on quality inherent in JIT production would reduce rework costs by 25%. The Knot currently incurs $160,000 in annual rework costs. e. Improved product quality under JIT production would enable The Knot to raise the price of its product by $2 per unit. The Knot sells 100,000 units each year. The Knot’s required rate of return on inventory investment is 15% per year. Q. Calculate the net benefit or cost to The Knot if it adopts JIT production at the Spartanburg plant.arrow_forwardPatricia Johnson is the advertising manager for Crane Shoe Store. She is currently working on a major promotional campaign. Her ideas include the installation of a new lighting system and increased display space that will add $14,760 in fixed costs to the $177,120 currently spent. In addition, Patricia is proposing that a 10 % price decrease ($30 to $27) will produce a 20% increase in sales volume (16,400 to 19,680). Variable costs will remain at $12 per pair of shoes. Management is impressed with Patricia's ideas but are concerned about the effects that these changes will have on the break-even point and the margin of safety. Calculate the current break-even point in units, and compare it with the break-even point in units if Patricia's ideas are used. Current break-even point Break-even point if Patricia's ideas are used units unitsarrow_forwardJ. Smythe, Inc., manufactures fine furniture. The company is deciding whether to introduce a new mahogany dining room table set. The set will sell for $7,600, including a set of eight chairs. The company feels that sales will be 2,050, 2,200, 2,750, 2,600, and 2,350 sets per year for the next five years, respectively. Variable costs will amount to 49 percent of sales and fixed costs are $1.94 million per year. The new dining room table sets will require inventory amounting to 7 percent of sales, produced and stockpiled in the year prior to sales. It is believed that the addition of the new table will cause a loss of sales of 450 dining room table sets per year of the oak tables the company produces. These tables sell for $4,900 and have variable costs of 44 percent of sales. The inventory for this oak table is also 7 percent of sales. The company believes that sales of the oak table will be discontinued after three years. J. Smythe currently has excess production capacity. If the…arrow_forward

- Disk City, Inc., is a retailer for digital video disks. The projected net income for the current year is $2,340,000 based on a sales volume of 290,000 video disks. Disk City has been selling the disks for $17 each. The variable costs consist of the $5 unit purchase price of the disks and a handling cost of $2 per disk. Disk City's annual fixed costs are $560,000. Management is planning for the coming year, when it expects that the unit purchase price of the video disks will increase 30 percent. (Ignore income taxes.) Required: 1. Calculate Disk City's break-even point for the current year in number of video disks. (Round your final answer up to nearest whole number.) 2. What will be the company's net income for the current year if there is a 20 percent increase in projected unit sales volume? 3. What volume of sales (in dollars) must Disk City achieve in the coming year to maintain the same net income as projected for the current year if the unit selling price remains at $17? (Do not…arrow_forwardJayzene Griffiths is the newly appointed manager for a fashionable shoe store. Her marketing ideas include the installation of a new lighting system and increased display space that will add $30,000 in fixed costs to the $18,000 currently being spent. In addition, Jayzene is proposing that a 10% decrease ($30.00 to $27.00) will produce a 30% increase in sales volume (5,000 to 6,500). Variable costs will remain at $15 per pair of shoes. Management is impressed with Jayzene’s ideas, but concerned about the effects these changes will have on the breakeven point and margin of safety. Required: Compute the margin of safety ratio for both situations. Prepare CVP income statements for both the current and proposed situations. Would you make changes suggested by Jayzene? Give reasons for your answer.arrow_forwardRainbow Paints operates a chain of retail paint stores. Although the paint is sold under the Rainbow label, it is purchased from an independent paint manufacturer. Guy Walker, president of Rainbow Paints, is studying the advisability of opening another store. His estimates of monthly costs for the proposed location are as follows: Fixed costs: Occupancy costs Salaries Other Variable costs (including cost of paint) $6 per gallon Although Rainbow stores sell several different types of paint, monthly sales revenue consistently averages $10 per gallon sold. Required: a. Compute the contribution margin ratio and the break-even point in dollar sales and in gallons sold for the proposed store. c. Walker thinks that the proposed store will sell between 2,200 and 2,600 gallons of paint per month. Compute the amount of operating income that would be earned per month at each of these sales volumes. a. Contribution margin ratio a. Break-even sales volume in dollars a. Break-even sales volume in…arrow_forward

- yntech makes digital cameras for drones. Their basic digital camera uses $80 in variable costs and requires $1,600 per month in fixed costs. Syntech sells 100 cameras per month. If they process the camera further to enhance its functionality, it will require an additional $50 per unit of variable costs, plus an increase in fixed costs of $1,200 per month. The current price of the camera is $170. The marketing manager is positive that they can sell more and charge a higher price for the improved version. At what price level would the upgraded camera begin to improve operational earnings?arrow_forwardA furniture company manufactures desks and chairs. Each desk requires 29 hours to manufacture and contributes $400 to profit, and each chair requires 19 hours to manufacture and contributes $250 to profit. Due to marketing restrictions, a total of 2000 hours are available. Use Solver to maximize the company’s profit. What is the maximum profit? How many desks and chairs should the company manufacture? Of the 2000 available hours, how many hours will be used?arrow_forwardRaveen Products sells camping equipment. One of the company’s products, a camp lantern, sells for $90 per unit. Variable expenses are $63 per lantern, and fixed expenses associated with the lantern total $135,000 per month. At present, the company is selling 8,000 lanterns per month. The sales manager is convinced that a 10% reduction in the selling price will result in a 25% increase in the number of lanterns sold each month. If proposed changes by sales manager implementted, then How many lanterns would have to be sold at the new selling price to yield a minimum net operating income of $72,000 per month?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education