FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

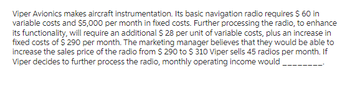

Transcribed Image Text:Viper Avionics makes aircraft instrumentation. Its basic navigation radio requires $ 60 in

variable costs and $5,000 per month in fixed costs. Further processing the radio, to enhance

its functionality, will require an additional $28 per unit of variable costs, plus an increase in

fixed costs of $ 290 per month. The marketing manager believes that they would be able to

increase the sales price of the radio from $ 290 to $ 310 Viper sells 45 radios per month. If

Viper decides to further process the radio, monthly operating income would

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Shue Music Company is considering the sale of a new sound board used in recording studios. The new board would sell for $23,600, and the company expects to sell 1,530 per year. The company currently sells 1,880 units of its existing model per year. If the new model is introduced, sales of the existing model will fall to 1,550 units per year. The old board retails for $22,000. Variable costs are 54 percent of sales, depreciation on the equipment to produce the new board will be $1,695,000 per year, and fixed costs are $2,975,000 per year. If the tax rate is 23 percent, what is the annual OCF for the project? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. OCFarrow_forwardMadetaylor Inc. manufactures financial calculators. The company is deciding whether to introduce a new calculator. This calculator will sell for $130. The company feels that sales will be 18,000, 22,000, 24,000, 22,000, and 18,000 units annually for the next five years. Variable costs will be 21% of sales, and fixed costs are $500,000 annually. The firm hired a marketing team to analyze the product's viability, and the marketing analysis cost $1,250,000. The company plans to manufacture and store the calculators in a vacant warehouse. Based on a recent appraisal, the warehouse and the property are worth $2.5 million after tax. If the company does not sell the property today, it will sell it five years from today at the currently appraised value. This project will require an injection of net working capital at the onset of the project, $250,000. The firm recovers the net working capital at the end of the project. The firm must purchase equipment for $5,000,000 to produce the…arrow_forwardSid's Skins makes a variety of covers for electronic organizers and portable music players. The company's designers have discovered a market for a new clear plastic covering with college logos for a popular music player. Market research indicates that a cover like this would sell well in the market priced at $24.00. Sid's desires an operating profit of 25 percent of costs. Required: What is the highest acceptable manufacturing cost for which Sid's would be willing to produce the cover? (Round your answer to 2 decimal places.)arrow_forward

- Mighty Safe Fire Alarm is currently buying 61,000 motherboards from MotherBoard, Inc. at a price of $63 per board. Mighty Safe is considering making its own motherboards. The costs to make the motherboards are as follows: direct materials, $34 per unit; direct labor, $11 per unit; and variable factory overhead, $14 per unit. Fixed costs for the plant would increase by $80,000. Which option should be selected and why? a.make, $244,000 increase in profits b.buy, $164,090 more in profits c.buy, $80,000 more in profits d.make, $164,090 increase in profitsarrow_forwardBirkenstock is considering adding a new Big Buckle sandal to its current product offerings. Birkenstock expects to price the shoes at $125 per pair. The variable costs to produce one pair are estimated to be: $20 per pair direct materials; $25 per pair direct labor; $5 per pair shipping costs and $5 per pair miscellaneous overhead. The fixed costs for this line of shoes are: $50,000 advertising/promotion; $125,000 manufacturing plant manager salary; $350,000 depreciation expense on manufacturing equipment; and $50,000 other miscellaneous fixed costs. • Birkenstock's best guess is that they will sell 12,000 pairs of Big Buckle sandals in 2021. What is Birkenstock's expected 2021 profit on this product? Type your answer in the first blank below.arrow_forwardNeptune Company has developed a small inflatable toy that it is anxious to introduce to its customers. The company's Marketing Department estimates that demand for the new toy will range between 15,000 units and 35,000 units per month. The new toy will sell for $3 per unit. Enough capacity exists in the company's plant to produce 18,000 units of the toy each month. Variable expenses to manufacture and sell one unit would be $1.00, and incremental fixed expenses associated with the toy would total $22,000 per month. Neptune has also identified an outside supplier who could produce the toy for a price of $1.75 per unit plus a fixed fee of $15,000 per month for any production volume up to 20,000 units. For a production volume between 20,001 and 40,000 units the fixed fee would increase to a total of $30,000 per month. Required: 1. Calculate the break-even point in unit sales assuming that Neptune does not hire the outside supplier. 2. How much profit will Neptune earn assuming: a. It…arrow_forward

- What is the OCF?arrow_forwardMadetaylor Inc. manufactures financial calculators. The company is deciding whether to introduce a new calculator. This calculator will sell for $130. The company feels that sales will be 18,000, 22,000, 24,000, 22,000, and 18,000 units annually for the next five years. Variable costs will be 21% of sales, and fixed costs are $500,000 annually. The firm hired a marketing team to analyze the product's viability, and the marketing analysis cost $1,250,000. The company plans to manufacture and store the calculators in a vacant warehouse. Based on a recent appraisal, the warehouse and the property are worth $2.5 million after tax. If the company does not sell the property today, it will sell it five years from today at the currently appraised value. This project will require an injection of net working capital at the onset of the project, $250,000. The firm recovers the net working capital at the end of the project. The firm must purchase equipment for $5,000,000 to produce the…arrow_forwardSony manufactures and sells television sets. Its assembly division (AD) buys television screens from the screen division (SD) and assembles the TV sets. The SD, which is operating at capacity, incurs an incremental manufacturing cost of $60 per screen. The SD can sell all its output to the outside market at a price of $110 per screen, after incurring a variable marketing and distribution cost of $10 per screen. If the AD purchases screens from outside suppliers at a price of $110 per screen, it will incur a variable purchasing cost of $8 per screen. Sony’s division managers can act autonomously to maximize their own division’s operating income. Required: What is the minimum transfer price at which the SD manager would be willing to sell screens to the AD? What is the maximum transfer price at which the AD manager would be willing to purchase screens from the SD? Now suppose that the SD can sell only 80% of its output capacity of 10,000 screens per month on the open market.…arrow_forward

- Mighty Safe Fire Alarm is currently buying 57,000 motherboards from MotherBoard, Inc., at a price of $63 per board. Mighty Safe is considering making its own boards. The costs to make the board are as follows: direct materials, $33 per unit; direct labor, $12 per unit; and variable factory overhead, $15 per unit. Fixed costs for the plant would increase by $90,000. Which option should be selected and why? Oa. a. buy, $90,000 increase in profits Ob. make, $80,940 increase in profits c. make, $171,000 increase in profits Od. buy, $80,940 increase in profitsarrow_forwardThe Chimes Clock Company sells a particular clock for $40. The variable costs are $23 per clock and the breakeven point is 230 clocks. The company expects to sell 280 clocks this year. If the company actually sells 430 clocks, what effect would the sale of additional 150 clocks have on operating income? Explain your answer. The sale of an additional 150 clocks would operating income by the amount of The total effect would amount toarrow_forwardCrane, Inc., sells two types of water pitchers, plastic and glass. Plastic pitchers cost the company $30 and are sold for $40. Glass pitchers cost $26 and are sold for $47. All other costs are fixed at $280,800 per year. Current sales plans call for 14,000 plastic pitchers and 28,000 glass pitchers to be sold in the coming year. Crane, Inc., has just received a sales catalog from a new supplier that is offering plastic pitchers for $28. What would be the new contribution margin per unit if managers switched to the new supplier? What would be the new breakeven point if managers switched to the new supplier? (Use contribution margin per unit to calculate breakeven units. Round answers to 0 decimal places, e.g. 25,000.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education