FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please do not give solution in image format thanku

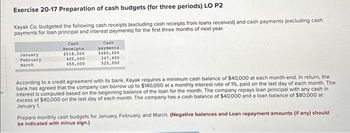

Transcribed Image Text:Exercise 20-17 Preparation of cash budgets (for three periods) LO P2

Kayak Co. budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash

payments for loan principal and interest payments) for the first three months of next year.

January

February

March

Cash

Receipts

$518,000.

405,000

459,000

Cash

payments

$460,400

347,400

525,000

According to a credit agreement with its bank, Kayak requires a minimum cash balance of $40,000 at each month-end. In return, the

bank has agreed that the company can borrow up to $140,000 at a monthly interest rate of 1%, paid on the last day of each month. The

interest is computed based on the beginning balance of the loan for the month. The company repays loan principal with any cash in

excess of $40,000 on the last day of each month. The company has a cash balance of $40,000 and a loan balance of $80,000 at

January 1.

Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should

be indicated with minus sign.)

Transcribed Image Text:K

1

ces

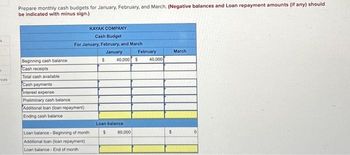

Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should

be indicated with minus sign.)

KAYAK COMPANY

Cash Budget

For January, February, and March

January

$ 40,000 $

Beginning cash balance

Cash receipts

Total cash available.

Cash payments

interest expense

Preliminary cash balance.

Additional loan (loan repayment)

Ending cash balance.

Loan balance Beginning of month

Additional loan (loan repayment)

Loan balance- End of month

Loan balance

$

80,000

February

40,000

$

March

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- True or False: Access controls limit who can change records Group of answer choices True Falsearrow_forwardPlease help me,arrow_forwardPlease don't use chat gpt and other ai other wise I give multiplie downvote Which of the following is sometimes called a currently attainable standard? O a. par b. normal standard O c. theoretical standard d. ideal standardarrow_forward

- How do you access the Power Query interface?arrow_forwardWrite me a human paragraph without using Al about what a memorandoms of understanding is and how it is usedarrow_forwardThe easiest way to change the order in a chart is in the __________. Multiple Choice underlying spreadsheet slicer chart options chart itselfarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education