Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN: 9781337619455

Author: Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

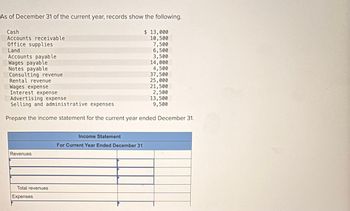

Transcribed Image Text:As of December 31 of the current year, records show the following.

Cash

Accounts receivable

Office supplies

Land

Accounts payable

Wages payable

Notes payable

Consulting revenue

Rental revenue

Wages expense

Interest expense

Advertising expense

Selling and administrative expenses

$13,000

10,500

7,500

6,500

3,500

14,000

4,500

37,500

25,000

21,500

2,500

13,500

9,500

Prepare the income statement for the current year ended December 31.

Revenues

Total revenues

Expenses

Income Statement

For Current Year Ended December 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume that an organization asserts that it has $35 million in net accounts receivable. Describe specifically what management is asserting with respect to net accounts receivable.arrow_forwardCASH SHORT AND OVER ENTRIES Based on the following information, prepare the weekly entries for cash receipts from service fees and cash short and over. A change fund of 100 is maintained.arrow_forwardSCHEDULE OF ACCOUNTS RECEIVABLE From the accounts receivable ledger shown, prepare a schedule of accounts receivable for Gelph Co. as of November 30, 20--.arrow_forward

- SCHEDULE OF ACCOUNTS RECEIVABLE Based on the information provided in Problem 10-11A, prepare a schedule of accounts receivable for Sourk Distributors as of March 31, 20--. Verify that the accounts receivable account balance in the general ledger agrees with the schedule of accounts receivable total.arrow_forwardJoseph Co. reported the following financial information for 2020: Accounts receivable, January 1, 2020 P1,200 Accounts Receivable, December 31, 2020 250 Cash collection from customer on account 1,300 Joseph Co.’s service revenue rendered on account to clients amounted toarrow_forwardComplete the attached excel sheet using the dataarrow_forward

- Need Answer of this Question please get answrarrow_forwardIncome tac was $300,409 for the year. Income tac payable was $28,102 and $42,997 at the beginning and end of the year,reapectively. Cash payants for income tac reportés on the statement pc cash flots usine the direct method la a. $ 285,514 b. 315,304 c. 300,409 d. 371,508arrow_forwardBased on the following information, prepare the weekly entries for cash receipts from service fees and cash short and over. A change fund of $100 is maintained. Date Change Fund Cash Register Receipt Amount Actual Cash Counted General Journal June 1 $100 $330.00 $433.00 GENERAL JOURNAL 8 100 297.00 400.00 DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT 15 100 233.00 331.00 22 100 302.00 396.50 2 29 100 316.00 412.00 3 Required: Prepare the weekly entries for cash receipts from service fees and cash short and over. 5 6 7 8 1,arrow_forward

- The following information (in $ millions) comes from the Annual Report of Saratoga Springs Co. for the year ending 12/31/2021: Year ended 12/31/2021 Net sales $7,949 Cost of goods sold 4,767 Selling and administrative expense 1,909 Interest expense 416 Income before tax 857 Net income 458 12/31/2021 12/31/2020 Cash and cash equivalents $ 975 $ 64 Receivables, net 1,010 664 Inventories 1,055 519 Land, buildings and equipment at cost, net 13,500 3,844 Total assets $ 16,540 $ 5,091 Total current liabilities $ 5,747 $ 2,209 Long-term debt 5,591 2,221 Total liabilities $ 11,338 $ 4,430 Total stockholders' equity $ 5,202 $ 661 Required:Compute the return on assets for 2021. (Round your answer to 1 decimal place.)arrow_forwardPrepare the weekly entries for cash receipts from service fees and cash short and overarrow_forwardRequired information [The following information applies to the questions displayed below.] The cash records and bank statement for the month of July for Glover Incorporated are shown below. GLOVER INCORPORATED Cash Account Records July 1, 2021, to July 31, 2021 Cash Balance Cash Balance July 1, 2021 + Cash Receipts − Cash Disbursements = July 31, 2021 $7,390 $8,630 $10,140 $5,880 Cash Receipts Cash Disbursements Date Desc. Amount Date Check# Desc. Amount 7/9 Sales $ 2,630 7/7 531 Rent $ 1,570 7/21 Sales 3,210 7/12 532 Salaries 2,030 7/31 Sales 2,790 7/19 533 Equipment 4,200 7/22 534 Utilities 970 7/30 535 Advertising 1,370 $ 8,630 $ 10,140 P.O. Box 123878 FIDELITY UNION Member FDIC Gotebo,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub