FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

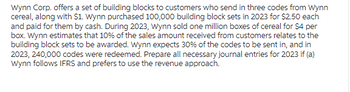

Transcribed Image Text:Wynn Corp. offers a set of building blocks to customers who send in three codes from Wynn

cereal, along with $1. Wynn purchased 100,000 building block sets in 2023 for $2.50 each

and paid for them by cash. During 2023, Wynn sold one million boxes of cereal for $4 per

box. Wynn estimates that 10% of the sales amount received from customers relates to the

building block sets to be awarded. Wynn expects 30% of the codes to be sent in, and in

2023,240,000 codes were redeemed. Prepare all necessary journal entries for 2023 if (a)

Wynn follows IFRS and prefers to use the revenue approach.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Yummy Rice Cereal started a program at the beginning of 2024 in which it would provide an all-star bowl in exchange for four proof-of-purchase box tops. Yummy Rice estimates that 25% of box tops will be redeemed. The bowls cost Yummy Rice $1.10 each. In 2024, 5,240,000 boxes of cereal were sold. By year- end 906,000 box tops had been redeemed. Required: Calculate the premium expense that Yummy Rice should recognize for the year ended December 31, 2024.arrow_forwardHello, Please help me understand how to get the correct answer.arrow_forwardCullumber Company offers a set of building blocks to customers who send in 3 UPC codes from Cullumber cereal, along with 50¢. The block sets cost Cullumber $1.30 each to purchase and 70¢ each to mail to customers. During 2025, Cullumber sold 1,536,000 boxes of cereal. The company expects 30% of the UPC codes to be sent in. During 2025, 153,600 UPC codes were redeemed. Prepare Cullumber's December 31, 2025, adjusting entry. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles and Explanation Premium Expense Premium Liability Debit 307,200 Credit 307,200arrow_forward

- Prepare the journal entries that should be recorded in 2021 relative to the premium plan. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to O decimal places, e.g. 1,525.) Account Titles and Explanation (To record the premium inventory.) (To record the sales.) (To record the expense associated with the sale.) (To record the premium liability.) Debit ||||| Credit IN TO DOarrow_forwardTo stimulate the sales of its Alladin breakfast cereal, Loptien Company places 1 coupon in each box. 5 coupons are redeemable for a premium consisting of a children's hand puppet. In 2026, the company purchases 40,000 puppets at $1.50 each and sells 480,000 boxes of Alladin at $3.75 a box. From its experience with other similar premium offers, the company estimates that 40% of the coupons issued will be mailed back for redemption. During 2026, 115,000 coupons are presented for redemption. Prepare the journal entries that should be recorded in 2026 relative to the premium plan. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles and Explanation Premium Inventory Cash (To record purchase of puppets) Cash Sales Revenue (To record the sales) Premium Expense Premium Inventory (To record…arrow_forwardBeginning the year 2022, the Polk Company began marketing a new beer called “Serbesa”. Each bottle of beer sells for P30. To help promote the product, the management of Polk is offering a special Serbesa beer mug to each customer for every 20 specially marked bottles of Serbesa. Polk estimates that out of the 300,000 bottles of Serbesa sold during 2022, only 30% of the bottle caps will be redeemed. For the year 2022, 5,000 beer mugs were purchased by the company at a total cost of PI40,000. These 5,000 mugs have a total sales value of P200,000. A total of 4,000 mugs were distributed to customers during the year 2022. What amount of unearned revenue for unredeemed premiums should Polk report on its December 31, 2022 statement of financial position? How much additional sales should Polk recognize upon distribution of the 4,000 mugs?arrow_forward

- Beginning the year 2021, the Chicken Wings Manufacturing Company (CWMC) began marketing its iphone XV (pronounced as X Five). Each XV sells for P50,000. To promote and expedite sales of this product, the management of AMC is offering one proof of purchase seal for a special slim transparent case to each customer for every unit of XV purchased. CWMC estimates that out of the units sold during 2021, only 60% of the proof of purchase seals will be redeemed. Sales of XV during 2021 totaled P40 million. For that year, 500 special slim transparent cases were purchased by the company at a total cost of P750,000. These 500 special slim transparent cases have a total sales value of P1,000,000. A total of 256 special slim transparent cases were distributed to customers during the year 2021.How much is the unearned revenue for unredeemed premiums reported in CWMC’s December 31, 2021 statement of financial position?arrow_forwardBest Trim, a manufacturer of lawn mowers, predicts that it will purchase 204,000 spark plugs next year. Best Trim estimates that 17,000 spark plugs will be required each month. A supplier quotes a price of $9 per spark plug. The supplier also offers a special discount option: If all 204,000 spark plugs are purchased at the start of the year, a discount of 2% off the $9 price will be given. Best Trim can invest its cash at 10% per year. It costs Best Trim $260 to place each purchase order. Q. What other factors should Best Trim consider when making its decision?arrow_forwardBest Trim, a manufacturer of lawn mowers, predicts that it will purchase 204,000 spark plugs next year. Best Trim estimates that 17,000 spark plugs will be required each month. A supplier quotes a price of $9 per spark plug. The supplier also offers a special discount option: If all 204,000 spark plugs are purchased at the start of the year, a discount of 2% off the $9 price will be given. Best Trim can invest its cash at 10% per year. It costs Best Trim $260 to place each purchase order. Q. What is the opportunity cost of interest forgone from purchasing all 204,000 units at the start of the year instead of in 12 monthly purchases of 17,000 units per order?arrow_forward

- Best Trim, a manufacturer of lawn mowers, predicts that it will purchase 204,000 spark plugs next year. Best Trim estimates that 17,000 spark plugs will be required each month. A supplier quotes a price of $9 per spark plug. The supplier also offers a special discount option: If all 204,000 spark plugs are purchased at the start of the year, a discount of 2% off the $9 price will be given. Best Trim can invest its cash at 10% per year. It costs Best Trim $260 to place each purchase order. Q. Should Best Trim purchase 204,000 units at the start of the year or 17,000 units each month? Show your calculations.arrow_forwardPlease show your solution.arrow_forwardGlobal Lawn, a manufacturer of lawn mowers, predicts that it will purchase 228,000 spark plugs next year. Global Lawn estimates that 19,000 spark plugs will be required each month. A supplier quotes a price of $11.00 per spark plug. The supplier also offers a special discount option: If all 228,000 spark plugs are purchased at the start of the year, a discount of 4% off the $11.00 price will be given. Global Lawn can invest its cash at 10% per year. It costs Global Lawn $260 to place each purchase order. Read the requirements. Requireme Let's begin t Differer Requirements 1. What is the opportunity cost of interest forgone from purchasing all 228,000 units at the start of the year instead of in 12 monthly purchases of 19,000 units per order? C---- 2. Would this opportunity cost be recorded in the accounting system? Why? 3. Should Global Lawn purchase 228,000 units at the start of the year or 19,000 units each month? Show your calculations. 4. What other factors should Global Lawn…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education