Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

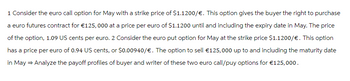

Transcribed Image Text:1 Consider the euro call option for May with a strike price of $1.1200/€. This option gives the buyer the right to purchase

a euro futures contract for €125,000 at a price per euro of $1.1200 until and including the expiry date in May. The price

of the option, 1.09 US cents per euro. 2 Consider the euro put option for May at the strike price $1.1200/€. This option

has a price per euro of 0.94 US cents, or $0.00940/€. The option to sell €125,000 up to and including the maturity date

in May → Analyze the payoff profiles of buyer and writer of these two euro call/puy options for €125,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please answer it with no descriptions or details, with the question numbers and answers, the exact way it should go on according to the red regulations, thank you!arrow_forward(a) Suppose a trader takes a position on June 5th 2021, in one September 2021 EURO (EUR) future contract at USD1.3094/EUR. The trader holds the position until the last day of trading when the spot price is USD1.2939/EUR. This will be the final settlement price because of price convergence. The trader has EUR125,000 for this investment. (i) If the trader had a long position and he was a speculator, calculate his profit or loss for the position above. (ii) If the trader had a short position and he was a speculator, calculate his profit or loss for the position above. (iii) If the trader had a long position and he was a hedger, calculate his profit or loss for the position above. (iv) If the trader had a short position and he was a hedger, calculate his profit or loss for the position above. (b) Discuss factors that you would consider in evaluating the political risk associated before making FDI in a foreign country.arrow_forwardChoose all expressions that accurately complete the statement below: Writing a European call option on £10,000 at a strike price of $1.80/£ and a premium of $0.02/£: Group of answer choices Obligates the optionholder to purchase £10,000 for $18,000 USD. Will be profitable for the seller when the price of the GBP exceeds the put-call parity rate. Obligates the writer to sell £10,000 on the expiration date if the optionholder chooses to exercise. Allows the optionholder to exercise the option at any point up to the expiration date. Earns the seller a premium of $200.arrow_forward

- A trader purchased an at the money 1 year OTC put option on the DAX index for a cost of Eur 10000. What is the traders minimum potential credit Exposure to the counter part over the term of the tradearrow_forward4. An American put option to sell a British pound for dollars has a strike price of $1.5 and a time to maturity of 1 year. The volatility of the pound/dollor exchange rate is 15% per annum, the dollar interest rate is 6%, the British pound interest rate is 7%, per annum, and the current exchange rate is 1.52. Use a three-step binomial tree to value the option.arrow_forwardJune 2021 Mexican peso futures contract has a price of $0.05197 per MXN. You believe the spot price in June will be $0.05831 per MXN. MXN500,000 is the contract size of one MXN contract. Required: What speculative position would you enter into to attempt to profit from your beliefs? Calculate your anticipated profits, assuming you take a position in three contracts. What is the size of your profit (loss) if the futures price is indeed an unbiased predictor of the future spot price and this price materializes?arrow_forward

- 5. The European call option on Asset Q that expires in one year has strike price $32 and option price $4. The forward price of Asset Q in one year is $36. The annual continuously compounded interest rate is 0.08. Find the price of the put option on Asset Q with strike price of $32.arrow_forwardA trader in the United States has a portfolio of derivatives on the Australian dollar with a delta of 456. The USD and AUD risk free interest rates are 5% and 8%. What position in a one-year forward contract on the Australian dollar creates a delta-neutral position? Question options: Long 494.0 Short 494.0 Short 394.0 None of the abovearrow_forwardToday's price of Microsoft (MSFT) is $150 per share. A retail investor purchases an at-the-money European put option on MSFT with a maturity of one year. She pays a premium of $14.11. The c.c. risk-free interest rate is one percent. What is the potentiality value of the option? Round your answer to three decimal places.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education