Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

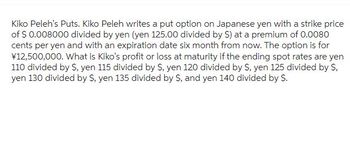

Transcribed Image Text:Kiko Peleh's Puts. Kiko Peleh writes a put option on Japanese yen with a strike price

of $ 0.008000 divided by yen (yen 125.00 divided by $) at a premium of 0.0080

cents per yen and with an expiration date six month from now. The option is for

¥12,500,000. What is Kiko's profit or loss at maturity if the ending spot rates are yen

110 divided by S, yen 115 divided by S, yen 120 divided by $, yen 125 divided by S,

yen 130 divided by S, yen 135 divided by S, and yen 140 divided by S.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Compute for the simple interest earned given the principal P, interest rate r and time t. a) P = 10,000 pesos; r = 5%; t = 3 b) P = 100,000 pesos; r = 20%; t = 7 months c) P = 25,000 pesos; r = 12.5%; t = 165 days (ordinary interest)arrow_forwardWhat should be the value of a Bankers' Acceptance with a $100,000 face value and 79 days until maturity quoted on a discount basis yielding 1.8935% with the current inflation rate of 2.2972? Consider the same question above assuming a $250,000 face value and 279 days until maturity quoted on a discount basis yielding .8935% with the current inflation rate of 1.467?arrow_forwardConsider the following countinuous compunding LIBOR spot rates: 3M (2,2% pa.), 6M (2,3% pa.), 9M (2,6% pa.), 12M (3% pa.). Find a simple compunding rate pa. (interest compounded each 4M) which is equivalent to forward rate pa (under countinuous compunding for period starting from the end of 6M till the end of 9M).arrow_forward

- The figure shows a graph that compares the present values of two ordinary annuities of $900 quarterly, one at 5% compounded quarterly and one at 9% compounded quarterly. Dollars 70000 60000 50000 40 000 30.000 20 000 10000 0 20 40 60 80 100 120 140 Quarters @ (a) Determine which graph corresponds to the 5% rate and which corresponds to the 9% rate. The higher graph is the one at 5% and the lower one is the one at 9% O The lower graph is the one at 5% and the higher one is the one at 9% (b) Use the graph to estimate the difference (in dollars) between the present values of these annuities for 25 years (100 quarters) $1078497arrow_forwardWhat is the regular selling price of an item purchased for $1270 if the markup is 20% of the regular selling price?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education