FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

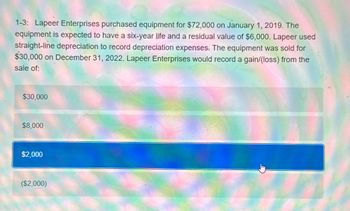

Transcribed Image Text:1-3: Lapeer Enterprises purchased equipment for $72,000 on January 1, 2019. The

equipment is expected to have a six-year life and a residual value of $6,000. Lapeer used

straight-line depreciation to record depreciation expenses. The equipment was sold for

$30,000 on December 31, 2022. Lapeer Enterprises would record a gain/(loss) from the

sale of:

$30,000

$8,000

$2,000

($2,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Salem Company buys a building for $1,000,000 on 1st January 2019. Its estimated useful life in the business is 20 years, after which it will be sold for an estimated residual value of $200,000. Under the Straight-line method of depreciation, Accumulated depreciation at December 31, 2020 will be Multiple Choice O $40,000 $80,000 $200,000arrow_forwardFollowing are the details related to fixed assets of Jackson company as at December 31, 2022: Date of Residual Purchase January 1, 2020 $15,000 April 1, 2015 1,000 Asset Machinery Delivery Van September 30, 2018 Furniture 500 December 31, 2012 Building 25,000 Required: Estimated Useful Life 30 Years 12 Years 8 Years 40 Years Cost $ 550,000 45,000 72,000 1,250,000 Value 1. Calculate the annual depreciation for each of the fixed assets given above. 2. Determine the book value of each fixed asset as on December 31, 2022.arrow_forwardNature's Fit acquired an equipment on January 1, 2020, for $30,000 with an estimated four-year life and $2,000 residual value. Nature's uses straight-line depreciation. Record the gain or loss if the building was sold on December 31, 2022, for $10,000.arrow_forward

- Godoarrow_forwardPresented below is information related to equipment owned by Sunland Company at December 31, 2025. Cost Accumulated depreciation to date Expected future net cash flows Fair value (a) $10,170,000 Sunland intends to dispose of the equipment in the coming year. It is expected that the cost of disposal will be $22,600. As of December 31, 2025, the equipment has a remaining useful life of 4 years. 1,130,000. 7,910,000 5,424,000 Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2025. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List debit entry before credit entry.) Dec. 31 Date Account Titles and Explanation Debit Creditarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education