FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Guide Me

Notif

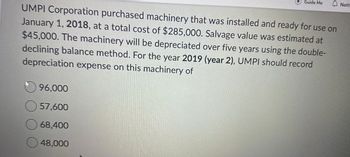

UMPI Corporation purchased machinery that was installed and ready for use on

January 1, 2018, at a total cost of $285,000. Salvage value was estimated at

$45,000. The machinery will be depreciated over five years using the double-

declining balance method. For the year 2019 (year 2), UMPI should record

depreciation expense on this machinery of

✓ 96,000

57,600

☐ 68,400

48,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Crane Company purchased a machine on July 1, 2020, for $900000. The machine has an estimated useful life of five years and a salvage value of $190000. The machine is being depreciated from the date of acquisition by the 150% declining-balance method. For the year ended December 31, 2020, Crane should record depreciation expense on this machine of O $106500. O $180000. O $270000. O $135000.arrow_forwardFreedom Co. purchased a new machine on July 2, 2019, at a total installed cost of $48,000. The machine has an estimated life of five years and an estimated salvage value of $6,600. Required: a. Calculate the depreciation expense for each year of the asset's life using: 1. Straight-line depreciation. 2. Double-declining-balance depreciation. b. How much depreciation expense should be recorded by Freedom Co. for its fiscal year ended December 31, 2019, under each method? (Note: The machine will have been used for one-half of its first year of life.) c. Calculate the accumulated depreciation and net book value of the machine at December 31, 2020, under each method. Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required B Required C Calculate the depreciation expense for each year of the asset's life using Straight-line depreciation. Depreciation Expense Year 1 2 3 4 5arrow_forwardLegislate Company purchased equipment for $80,000 on January 1, 2017, and will use the double-declining-balance method of depreciation. It is estimated that the equipment will have a 5-year life and a $4,000 salvage value at the end of its useful life. The amount of depreciation expense recognized in the year 2019 will be: Group of answer choices $11,520 $18,240 $10,944 $19,200arrow_forward

- Bonita Industries purchased a depreciable asset for $591000 on April 1, 2018. The estimated salvage value is $51000, and the estimated total useful life is 5 years. The straight-line method is used for depreciation. What is the balance in accumulated depreciation on May 1, 2021 when the asset is sold? $297000 $333000 $288000 $252000arrow_forwardABC Co. purchased machinery that was installed and ready for use on January 3, 2020, at a total cost of P69,000. Salvage value was estimated at P9,000. The machinery will be depreciated over five years using the double-declining balance method. For the year 2021, ABC should record depreciation expense on this machinery of O P18,000 O P14,400 O Answer not given O P27,600 O P16,560arrow_forwardWildhorse Company purchaseda hot tub for $ 11,790 on January 1, 2016. Straight-line depreciation is used, based on a 6-year life and a $ 1,890 salvage value. In 2018, the estimates are revised. Wildhorse now feels the hot tub will be used until December 31, 2020, when it can be sold for $ 885. Compute the 2018 depreciation. Depreciation expense, 2018 %24arrow_forward

- Speedbag, Incorporated purchased equipment at a cost of $60,000 on July 1, 2023. The expected useful life is 4 years and the asset is expected to have salvage value of $10,000. Speedbag depreciates its assets using the straight-line method. What is the accumulated depreciation for this asset on December 31, 2024? Multiple Choice $30,000 $12,500 $25,000 $18,750arrow_forwardCarla Vista Corporation purchased a truck at the beginning of 2025 for $110100. The truck is estimated to have a salvage value of $4000 and a useful life of 118000 miles. It was driven 22000 miles in 2025 and 30000 miles in 2026. Depreciation expense for 2025 is (Round intermediate calculations to 3 decimal places, e.g. 0.245 and final answer to O decimal places, e.g. 1,525.) O $21273. O $26970. O $46748. O $19778.arrow_forwardOn July 1, 2020, Concord Corporation purchased factory equipment for $28300O. Salvage value was estimated to be $7900. The equipment will be depreciated over five years using the double-declining balance method. Counting the year of acquisition as one-half year, Concord should record depreciation expense for 2021 on this equipment of O $58180. O $67920. O $90560. O $113200.arrow_forward

- Swifty Corporation purchased a delivery truck for $28,000 on January 1, 2020. The truck has an expected salvage value of $2,000, and is expected to be driven 100,000 miles over its estimated useful life of 8 years. Actual miles driven were 14,500 in 2020 and 11,000 in 2021. PArt1: Calculate depreciation expense per mile under units-of-activity method. (Round answer to 2 decimal places, e.g. 0.50.) Depreciation expense $ ? per mile PART 2: Compute depreciation expense for 2020 and 2021 using (1) the straight-line method, (2) the units-of-activity method, and (3) the double-declining-balance method. (Round depreciation cost per unit to 2 decimal places, e.g. 0.50 and depreciation rate to 0 decimal places, e.g. 15%. Round final answers to 0 decimal places, e.g. 2,125.) Depreciation Expense 2020 2021 (1) Straight-line method $ ? $ ? (2) Units-of-activity method $ ? $ ? (3) Double-declining-balance method $ ? $ ?…arrow_forwardSandhill Company owns equipment that cost $61,200 when purchased on January 1. 2019. It has been depreciated using the straight-line method based on estimated salvage value of $4,200 and an estimated useful life of 5 years. Prepare Sandhill Company's journal entries to record the sale of the equipment in these four independent situations. Sold for $29,200 on January 1.2022. Sold for $29,200 on May 1, 2022. Sold for $10,200 on January 1, 2022. Sold for $ 10,200 on October 1, 2022arrow_forwardWhispering Company owns equipment that cost $100,000 when purchased on January 1, 2019. It has been depreciated using the straight-line method based on an estimated salvage value of $10,000 and an estimated useful life of 5 years. Depreciation expense adjustments are recognized annually. Instructions: Prepare Whispering Company's journal entries to record the sale of the equipment in these four independent situations. Update depreciation on assets disposed of at time of sale. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (a) (b) (c) (d) (e) (f) (a) Sold for $59,000 on January 1, 2022. Sold for $59,000 on April 1, 2022. SR. Account Titles and Explanation (b) Sold for $21,000 on January 1, 2022. Sold for $21,000 on September 1, 2022. Repeat (a), assuming Whispering uses double-declining…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education