FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

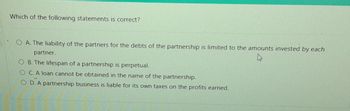

Transcribed Image Text:Which of the following statements is correct?

O A. The liability of the partners for the debts of the partnership is limited to the amounts invested by each

partner.

O B. The lifespan of a partnership is perpetual.

OC. A loan cannot be obtained in the name of the partnership.

OD. A partnership business is liable for its own taxes on the profits earned.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which statement is true with respect to the tax treatment of a partnership __________? A partnership files an annual information return and the income and expenses associated with the business are reported on the Partners' individual returns. A partnership is required to pay tax annually on its taxable business income A partnership is required to pay tax on gains from the sale of partnership owned assets None of the abovearrow_forwardWhich of the following apply to a partnership that consists solely of general partners? I. Double taxation of partnership profits. II. Limited partnership life. III. Active involvement in the firm by all the partners. IV. Unlimited personal liability for all partnership debts. Group of answer choices II and III only. II only. II, III, and IV only. I and II only. I, II, and IV only.arrow_forwardA partnership * has only one owner. pays taxes on partnership income. must file an information tax return. is not an accounting entity for financial reporting purposes.arrow_forward

- 1. What is KW Partnership’s ordinary business income (loss)? 2. Which of the following items are separately stated?arrow_forwardAssess the truth of this statement: One of the rules of debits and credits and account balances for a partnership is that increases in expense accounts are always debited to the expense account. This statement is true. O This statement is false. O There is not enough information to determine whether or not this statement is true. O This statement is not applicable to accounting concepts.arrow_forwardWhich statement is FALSE when describing the withdrawal of a partner? O It can be paid for from partners' personal assets. O It can be paid for from partnership assets. O Paying with partnership assets affects only the remaining partners' capital accounts. O Paying with partners personal assets affects only the remaining partners' capital accounts.arrow_forward

- Which of the following is a disadvantage of general partnerships? a) A partner who withdraws from a partnership cannot be held liable for any debts the firm had at the time of withdrawal. b) Compared to the other forms of ownership, the paperwork and costs involved in forming a general partnership are the most extensive. c) All general partners have unlimited liability for the debts and obligations of their business. d) The partners in a general partnership are exposed to double taxation.arrow_forwardFor partnerships, the qualified business income (QBI) items reported on Schedule K-1 should include the Section 199A business income, the W-2 wages of any qualified trade or business, and: Guaranteed payments made to the partners in lieu of salary. Recapture of investment credit. The unadjusted basis of qualified property. The adjusted basis of qualified property.arrow_forwardWhich of the following is true regarding capital deficiencies? O a Ob Oc Od The partners do not have a legally enforceable claim against the partner with the capital deficiency. If a partner with a capital deficiency is unable to pay the amount owed to the partnership, the partners with debit balances must absorb the loss. The loss is allocated based on the profit and loss ratios between the partners whether with credit or debit balances. if the partner with the capital deficiency pays the amount owed to the partnership, the deficiency is eliminated.arrow_forward

- Which of the following statements regarding partnerships is true? a. Partnership income is taxed in the partnership. b. Partnership losses cannot be offset against the partners other income c. Partnership income is included in a partners income in the year of disbursement. d. Partnerships may earn business income, property income, and capital gains.arrow_forwardJulie contributes, as part of her initial investment, accounts receivable with an allowance for doubtful accounts. Which of the following reflects a proper treatment? O The accounts receivable and allowance should not be recorded on the books of the partnership because a partner must invest cash in the business. O The balance of the accounts receivable account should be recorded on the books of the partnership at its net realizable value. O The allowance account may be set up on the books of the partnership because it relates to the existing accounts that are being contributed. O The allowance account should not be recorded in the books of the partnership.arrow_forwardWhich of the following regarding partnership taxation is INCORRECT? Question 16 options: A partnership is a tax paying entity for Federal income tax purposes. Partnership income is comprised of ordinary partnership income or loss and separately stated items A partnership is required to file a return with the IRS. A partner’s profit-sharing percent may differ from the partner’s loss-sharing percent. All of these statements are correct.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education