FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

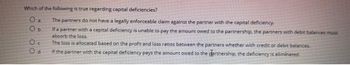

Transcribed Image Text:Which of the following is true regarding capital deficiencies?

O a

Ob

Oc

Od

The partners do not have a legally enforceable claim against the partner with the capital deficiency.

If a partner with a capital deficiency is unable to pay the amount owed to the partnership, the partners with debit balances must

absorb the loss.

The loss is allocated based on the profit and loss ratios between the partners whether with credit or debit balances.

if the partner with the capital deficiency pays the amount owed to the partnership, the deficiency is eliminated.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Choose the response that correctly completes the following sentence about an individual partner's outside basis in a partnership. A partner's outside basis: Can be less than zero. Does not change as long as the partner maintains their partnership interest. Is used to apply the basis limitation to losses from a partnership. Must be tracked by the partnership.arrow_forwardOrosco is an industrial partner. Besides his services, he also contributed capital to the partnership. There is no agreement as to the distribution of profits or losses. The share of Orosco in the profit is a. to be determined by the remaining partners. b. combination of c and d below. c. pro-rata to his contribution. d. such share as may be just and equitable under the circumstances.arrow_forwardUnder the goodwill method, a. declines in asset values prior to new partner admission are recorded, but not asset appreciation. b. the total capital of the new partnership must approximate the fair value of the entity. c. a new partner’s capital balance may be less than his or her contribution. d. All of the above.arrow_forward

- This answer is wrong . please give me the right answer.arrow_forwardWhich statement is FALSE when describing the withdrawal of a partner? O It can be paid for from partners' personal assets. O It can be paid for from partnership assets. O Paying with partnership assets affects only the remaining partners' capital accounts. O Paying with partners personal assets affects only the remaining partners' capital accounts.arrow_forward10. Before the allocation of loss, the following items are allocated first, except:A. Salaries to managing partner C. Interest on partnership’s bank loan B. Bonuses to partners D. Interest on partner’s capital 11. Statement 1. An industrial partner is not exempted from sharing in the loss of the partnership if he is also a capital partner.Statement 2. When a new partner is admitted in the existing partnership, there is no need the consent of all existing partners. Statement- 1 Statement- 2A. True FalseB. False FalseC. False TrueD. True True 12. Mark Javier is an active partner in the Javier & Dela Rosa partnership, receives an annual bonus of 25% the partnership profit after deducting a bonus. For the year ended, December 31, 2021, partnership income before the bonus amounted to 200,000. The amount of bonus given to Mark Javier for the year 2021 would be?Answer: P______________…arrow_forward

- Accounting type Question: As per the decision in the Garner vs Murray case, when the partner's capital accounts are fixed, any loss arising due to the capital deficiency in the insolvent partner's capital account is to be borne by solvent partners in the ratio of ..... A. profit sharing ratio B. last agreed capital ratio C. sacrificing ratio D. gaining ratioarrow_forwardWhich of the following is a disadvantage of general partnerships? a) A partner who withdraws from a partnership cannot be held liable for any debts the firm had at the time of withdrawal. b) Compared to the other forms of ownership, the paperwork and costs involved in forming a general partnership are the most extensive. c) All general partners have unlimited liability for the debts and obligations of their business. d) The partners in a general partnership are exposed to double taxation.arrow_forwardNOTE AI ANSWER EXPERT SOLUTIONarrow_forward

- Julie contributes, as part of her initial investment, accounts receivable with an allowance for doubtful accounts. Which of the following reflects a proper treatment? O The accounts receivable and allowance should not be recorded on the books of the partnership because a partner must invest cash in the business. O The balance of the accounts receivable account should be recorded on the books of the partnership at its net realizable value. O The allowance account may be set up on the books of the partnership because it relates to the existing accounts that are being contributed. O The allowance account should not be recorded in the books of the partnership.arrow_forwardAssess the truth of this statement: One of the rules of debits and credits and account balances for a partnership is that assets increase as debits. Group of answer choices This statement is true. This statement is false. There is not enough information to determine whether or not this statement is true. This statement is not applicable to accounting concepts.arrow_forwardDuring a liquidation, if a partner's capital account balance drops below zero, what should happen? Multiple Choice The partner with a deficit contributes enough assets to offset the deficit balance. The other partners file a legal suit against the partner with the deficit balance. The partner with the highest capital balance contributes sufficient assets to eliminate the deficit. The deficit balance is removed from the accounting records with only the remaining partners sharing in future gains and losses.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education