FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

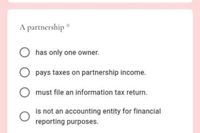

Transcribed Image Text:A partnership *

has only one owner.

pays taxes on partnership income.

must file an information tax return.

is not an accounting entity for financial

reporting purposes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 9. Explain the effect of guaranteed payments and ordinary business income, according to the status of the partner (general or limited), to calculate the self-employment earnings and the self-employment tax.arrow_forwardguaranteed payments made by a partnership to partners for services rendered to the partnership, that are deductible business expenses under the IRC code are: 1. Deductible expenses on the U.S. partnership return of income, form 1065 inorder to arrive at partnership income(loss). 2. Included on schedules K-1 to be taxed as ordinary income to the partners. 1 only 2 only Both 1 and 2 Neither 1 nor 2arrow_forwardWhich of the following items may be subject to the self-employment tax? a.Dividend income b.Interest income c.Capital gains d.A partner's distributive share of partnership incomearrow_forward

- Will you consider a partnership as a taxpayer? Yes or No.arrow_forwardPartnerships will often make guaranteed payments to the partners. What are guaranteed payments and how are they handled for tax purposes?arrow_forwardTax Drill - Effect of Partnership Operations on Basis Indicate whether the following items "Increase" or "Decrease" a partner's basis in the partnership. a. A partner's proportionate share of nondeductible expenses. b. A partner's proportionate share of any increase in partnership liabilities. c. A partner's proportionate share of partnership income. d. A partner's proportionate share of any reduction in partnership liabilities.arrow_forward

- Which statement is true with respect to the tax treatment of a partnership __________? A partnership files an annual information return and the income and expenses associated with the business are reported on the Partners' individual returns. A partnership is required to pay tax annually on its taxable business income A partnership is required to pay tax on gains from the sale of partnership owned assets None of the abovearrow_forwardWhich of the following apply to a partnership that consists solely of general partners? I. Double taxation of partnership profits. II. Limited partnership life. III. Active involvement in the firm by all the partners. IV. Unlimited personal liability for all partnership debts. Group of answer choices II and III only. II only. II, III, and IV only. I and II only. I, II, and IV only.arrow_forward1. What is KW Partnership’s ordinary business income (loss)? 2. Which of the following items are separately stated?arrow_forward

- What is the difference between the aggregate and entity theory of partnership taxation? Can you please provide two examples of how partnership tax rules reflect the aggregate theory and two examples of how they reflect the entity theory.arrow_forwardWhich of the following is an election or calculation made by the partner rather than the partnership? Calculation of a section 199A(qualified business income) deduction amount. Claiming a section 179 deduction related to property acquired by the partnership. Tax treatment (e.g., credit, amortization) of research and experimental costs. The partnership's accounting method (e.g.. cash, accrual).arrow_forwardWhich of the following is a disadvantage of general partnerships? a) A partner who withdraws from a partnership cannot be held liable for any debts the firm had at the time of withdrawal. b) Compared to the other forms of ownership, the paperwork and costs involved in forming a general partnership are the most extensive. c) All general partners have unlimited liability for the debts and obligations of their business. d) The partners in a general partnership are exposed to double taxation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education