Problem 1 2-93B Accounting Alternatives and Financial Analysis

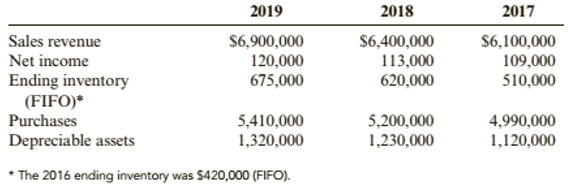

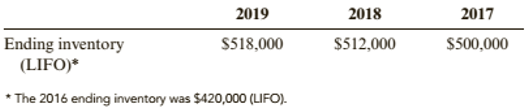

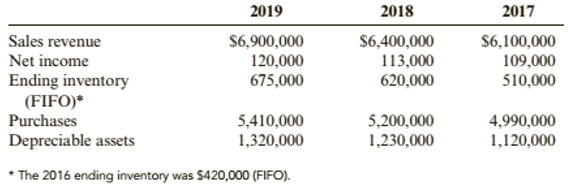

Affordable Autos Inc. has asked your bank for a SlOO.000 loan to expand its sales facility. Affordable Autos provides you with the following data:

Your inspection of the financial statements of other automobiles sales firms indicates that most of these firms adopted the LIFO method in the late 1970s. You further note that Afford able Autos has used 10% of

Required:

1. Compute cost of goods sold for 2017-2019. using both the FIFO and the LIFO methods.

2. Compute depreciation expense for Affordable Autos for 2017-2019. using both 10% and 20% of the cost of depreciable assets.

3. Recompute Affordable Autos's net income for 2017-2019. using LIFO and 20% depreciation. (Do&t forget the tax impact of the increases in cost of goods sold and depreciation expense.)

4. CONCEPTUAL CONNECTiON Does Affordable Autos appear to have materially changed its financial statements by the selection of FIFO (rather than LIFO) and l0% (rather than 20%) depreciation?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Cornerstones of Financial Accounting

- Problem 4:03 (Algorithmic) The employee credit union at State University is planning the allocation of funds for the coming year. The credit union makes four types of loans to its members. In addition, the credit union invests in risk-free securities to stabilize income. The various revenueproducing investments together with annual rates of return are as follows: Type of Loan/Investment Annual Rate of Return (%) Automobile loans 8 Furniture loans Other secured loans Signature loans Risk-free securities The credit union will have $1.4 million available for investment during the coming year. State laws and credit union policies impose the following restrictions on the composition of the loans and investments. . 10 11 . Risk-free securities may not exceed 30% of the total funds available for investment. Signature loans may not exceed 10% of the funds invested in all loans (automobile, furniture, other secured, and signature loans). • Furniture loans plus other secured loans may not exc…arrow_forwardUse the information in Problem A-1 to solve this problem. Assume that the van is five-year property for tax purposes. Required Prepare a schedule of depreciation under MACRS. Round figures to the nearest whole dollar. PROBLEM A-1 A delivery van was bought for 18,000. The estimated life of the van is four years. The trade-in value at the end of four years is estimated to be 2,000. Check Figure Year 3 depreciation, 3,456arrow_forwardSale of Equipment Instructions Chart of Accounts First Questions Journal Instructions Equipment was acquired at the beginning of the year at a cost of $562,500. The equipment was depreciated using the double-declining-balance method based on an estimated useful life of 9 years and an estimated residual value of $49,785. Chart of Accounts CHART OF ACCOUNTS Required: a. What was the depreciation for the first year? Round your intermediate calculations to 4 decimal places. Round the depreciation for the year to the nearest whole dollar. b. Assuming that the equipment was sold at the end of the second year for $557,317, determine the gain or loss on the sale of the equipment. c. Journalize the entry on Dec. 31 to record the sale. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a…arrow_forward

- ANSWER QUICK!! JUST THE ANSWER PLEASE NO EXPLANATION 7.8.9 For the following operation, choose the correct accounting entry Purchase of land for $120,000, payment of $10,000 in cash, the balance is applied to a 15-year mortgage loan taken out with a local bankQuestion 7 options: Debit “Land” for $120,000 / Debit “Cash” for $10,000 / Credit “Loan” for $100,000 Debit “Land” for $120,000 / Credit “Cash” for $10,000 / Credit “Loan” for $110,000 Credit “Land” for $120,000 / Credit “Cash” for $10,000 / Debit “Loan” for $130,000 Credit “Land” for $120,000 / Debit “Cash” for $10,000 / Debit “Loan” for $110,000 On May 1, 2023, Goldenberg Incorporated signed a note payable for $211,000, with a term of one year and a rate of 3%. The principal and interest will be paid on June 30, 2024. What is the amount of interest expense to be included in the income statement for the year ending December 31, 2023? 6330 791 0 4220 Assume that a company's financial position on January 1, 2022 was:…arrow_forwardQUESTION 4 Abba, Inc is considering the purchase of some new equipment that costs $191100. The new equipment is expected to increase revenues by $94700 annually. Cash expenses are expected to be $44700 and depreciation expense is $19300. The accounting rate of return of the equipment is % Enter your answer as a whole number rounded to 2 decimal places. If your calculation is .1234, answer as 12.34arrow_forwardQUESTION 3 FICO scores to assess the creditworthiness of individuals include the following except Credit History Length of credit history Education Amounts owed QUESTION 4 A bank is in the processing of rescheduling a $10 million loan paying 14% interest. If liquidated, it expects to receive $8.4 million. The rescheduling terms are as follows: Amount $10,000,000 in year 0 New maturity in years 5 Interest rate 8% Principal payments in millions $5,000,000 each in years 4 and 5 Upfront-fee 1.00% Cost of capital after rescheduling 14.00% Should the bank reschedule the loan? Yes, reschedule the loan because the NPV is greater than liquidation value No, do not reschedule the loan because the liquidation value is lower than the NPV Reschedule the loan only if the cost of capital after rescheduling is 12%…arrow_forward

- Analyze Home Depot The Home Depot (HD) reported the following data (in millions) in its recent financial statements: a. Determine the asset turnover ratio for Home Depot for Year 2 and Year 1. Round to two decimal places. b. What conclusions can be drawn from these ratios concerning the change in the ability of Home Depot to effectively use its assets to generate sales?arrow_forwardQuestion Content Area Ralston Consulting, Inc., has a $48,000 overdue debt with Supplier No. 1. The company is low on cash, with only $13,440 in the checking account and does not want to borrow any more cash. Supplier No. 1 agrees to settle the account in one of two ways: Option 1: Pay $13,440 now and $45,600 when some large projects are finished, two years from today. Option 2: Pay $67,200 three years from today, when even larger projects are finished. Assuming that the only factor in the decision is the cost of money (10%). (Click here to see present value and future value tables) A. Calculate the present value of each option. Round your present value factor to three decimal places and final answer to the nearest dollar. Present value of Option 1 $fill in the blank 1 Present value of Option 2 $fill in the blank 2 B. Which option should Ralston choose?arrow_forwardHomework, Chapter 26 Net Present Value Method The following data are accumulated by Geddes Company in evaluating the purchase of $105,900 of equipment, having a four-year useful life: Net Income Net Cash Flow Year 1 $32,000 $55,000 Year 2 20,000 42,000 Year 3 10,000 32,000 Year 4 (1,000) 21,000 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5. 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 0.665 0.513 0.452 0.376 0.279 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 a. Assuming that the desired rate of return is 15%, determine the net present value for the proposal. Use the table of the present value of $1 presented above. If required, round to the nearest dollar. If required, use the minus sign to indicate a negative net present value. Present value of net cash flow Amount to be…arrow_forward

- Net present value method The following data are accumulated by Geddes Company in evaluating the purchase of $140,000 of equipment, having a four-year useful life: Net Income Net Cash Flow Year 1 $42,500 $77,500 Year 2 21,500 56,500 Year 3 15,500 50,500 Year 4 6,500 41,500 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Assuming that the desired rate of return is 6%, determine the net present value for the proposal. If required, round to the nearest dollar. Net present value $fill in the blank 2 Would management be likely to look with favor on the proposal? , the net present value indicates that the return on the proposal is than the minimum desired rate of return of 6%.arrow_forwardVarious Contingency Issues Skinner Company has the following contingencies: 1. Potential costs due to the discovery of a possible defect related to one of its products. These costs are probable and can be reasonably estimated. 2. A potential claim for damages to be received from a lawsuit filed this year against another company. It is probable that proceeds from the claim will be received by Skinner next year. 3. Potential costs due to a promotional campaign in which a cash refund is sent to customers when coupons are redeemed. Skinner estimated, based on past experience, that 70% of the coupons would be redeemed. Forty percent of the coupons were actually redeemed and the cash refunds sent this year. The remaining 30% of the coupons are expected to be redeemed next year. Required: 1. How should Skinner report the potential costs due to the discovery of a possible product defect? Explain why. 2. How should Skinner report this year the potential claim for damages that may be received next year? Explain why. 3. This year, how should Skinner account for the potential costs and obligations due to the promotional campaign?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage