Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 2MAD

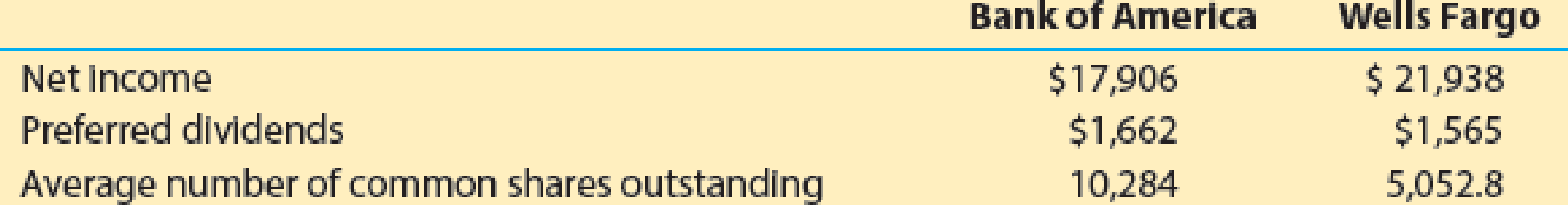

Analyze and compare Bank of America and Wells Fargo

Bank of America Corporation (BAC) and Wells Fargo & Company (WFC) are two large financial services companies. The following data (in millions) were taken from a recent year’s financial statements for both companies:

- a. Compute the earnings per share for both companies. Round to the nearest cent.

- a. Which company appears to be more profitable on an earnings-per-share basis?

- b. Which company would you expect to have the larger quoted market price?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Profitability ratios help in the analysis of the combined impact of liquidity ratios, asset management ratios, and debt management ratios on the operating performance of a firm.

Your boss has asked you to calculate the profitability ratios of Diusitech Inc. and make comments on its second-year performance as compared with its first-year performance.

The following shows Diusitech Inc.’s income statement for the last two years. The company had assets of $10,575 million in the first year and $16,916 million in the second year. Common equity was equal to $5,625 million in the first year, and the company distributed 100% of its earnings out as dividends during the first and the second years. In addition, the firm did not issue new stock during either year.

Diusitech Inc. Income Statement For the Year Ending on December 31 (Millions of dollars)

Year 2

Year 1

Net Sales

5,715

4,500

Operating costs except depreciation and amortization

1,365

1,268

Depreciation and…

Profitability ratios help in the analysis of the combined impact of liquidity ratios, asset management ratios, and debt management ratios on the operating performance of a firm.

Your boss has asked you to calculate the profitability ratios of Dernham Inc. and make comments on its second-year performance as compared with its first-year performance.

The following shows Dernham Inc. ’s income statement for the last two years. The company had assets of $3,525 million in the first year and $5,639 million in the second year. Common equity was equal to $1,875 million in the first year, and the company distributed 100% of its earnings out as dividends during the first and the second years. In addition, the firm did not issue new stock during either year.

Dernham Inc. Income Statement For the Year Ending on December 31 (Millions of dollars)

Year 2

Year 1

Net Sales

1,905

1,500

Operating costs except depreciation and amortization

1,855

1,723

Depreciation and amortization

95

60…

Profitability ratios help in the analysis of the combined impact of liquidity ratios, asset management ratios, and debt management ratios on the operating performance of a firm.

Your boss has asked you to calculate the profitability ratios of Spandust Industries Inc. and make comments on its second-year performance as compared with its first-year performance.

The following shows Spandust Industries Inc.’s income statement for the last two years. The company had assets of $7,050 million in the first year and $11,278 million in the second year. Common equity was equal to $3,750 million in the first year, and the company distributed 100% of its earnings out as dividends during the first and the second years. In addition, the firm did not issue new stock during either year.

Spandust Industries Inc. Income Statement For the Year Ending on December 31 (Millions of dollars)

Year 2

Year 1

Net Sales

3,810

3,000

Operating costs except depreciation and amortization

1,855

1,723…

Chapter 12 Solutions

Financial And Managerial Accounting

Ch. 12 - Of two corporations organized at approximately the...Ch. 12 - A stockbroker advises a client to buy preferred...Ch. 12 - A corporation with both preferred stock and common...Ch. 12 - Prob. 4DQCh. 12 - Prob. 5DQCh. 12 - Prob. 6DQCh. 12 - A corporation reacquires 60,000 shares of its own...Ch. 12 - Prob. 8DQCh. 12 - Prob. 9DQCh. 12 - Prob. 10DQ

Ch. 12 - Dividends per share Zero Calories Company has...Ch. 12 - Entries for issuing stock On January 22, Zentric...Ch. 12 - Entries for cash dividends The declaration,...Ch. 12 - Entries for stock dividends Alpine Energy...Ch. 12 - Entries for treasury stock On May 27, Hydro...Ch. 12 - Reporting stockholders equity Using the following...Ch. 12 - Statement of stockholders equity Noric Cruises...Ch. 12 - Earnings per share Financial statement data for...Ch. 12 - Dividends per share Seventy-Two Inc., a developer...Ch. 12 - Prob. 2ECh. 12 - Prob. 3ECh. 12 - Entries for issuing no-par stock On May 15, Helena...Ch. 12 - Issuing stock for assets other than cash On...Ch. 12 - Selected stock transactions Alpha Sounds Corp., an...Ch. 12 - Issuing stock Willow Creek Nursery, with an...Ch. 12 - Issuing stock Professional Products Inc., a...Ch. 12 - Entries for cash dividends The declaration,...Ch. 12 - Prob. 10ECh. 12 - Prob. 11ECh. 12 - Prob. 12ECh. 12 - Selected dividend transactions, stock split...Ch. 12 - Treasury stock transactions Mystic Lake Inc....Ch. 12 - Prob. 15ECh. 12 - Treasury stock transactions Biscayne Bay Water...Ch. 12 - Reporting paid-in capital The following accounts...Ch. 12 - Stockholders' Equity section of balance sheet The...Ch. 12 - Stockholders' Equity section of balance sheet...Ch. 12 - Retained earnings statement Sumter Pumps...Ch. 12 - Prob. 21ECh. 12 - Statement of stockholders equity The stockholders...Ch. 12 - Dividends on preferred and common stock Pecan...Ch. 12 - Stock transactions for corporate expansion On...Ch. 12 - Selected stock transactions The following selected...Ch. 12 - Entries for selected corporate transactions Morrow...Ch. 12 - Prob. 5PACh. 12 - Dividends on preferred and common stock Yosemite...Ch. 12 - Stock transaction for corporate expansion Pulsar...Ch. 12 - Selected stock transactions Diamondback Welding ...Ch. 12 - Entries for selected corporate transactions Nav-Go...Ch. 12 - Prob. 5PBCh. 12 - Selected transactions completed by Equinox...Ch. 12 - Analyze and compare Amazon.com and Wal-Mart...Ch. 12 - Analyze and compare Bank of America and Wells...Ch. 12 - Analyze Pacific Gas and Electric Company Pacific...Ch. 12 - Prob. 4MADCh. 12 - Prob. 5MADCh. 12 - Ethics in Action Tommy Gunn is a division manager...Ch. 12 - Prob. 2TIFCh. 12 - Communications Motion Designs Inc. has paid...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The average liabilities, average stockholders' equity, and average total assets are as follows: 1. Determine the following ratios for both companies, rounding ratios and percentagesto one decimal place: a. Return on total assets b. Return on stockholders' equity c. Times interest earned d. Ratio of total liabilities to stockholders' equity 2. Based on the information in (1), analyze and compare the two companies'solvency and profitability. Comprehensive profitability and solvency analysis Marriott International, Inc., and Hyatt Hotels Corporation are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in millions): Balance sheet information is as follows:arrow_forwardAnalyze and compare Zynga, Electronic Arts, and Take-Two Data (in millions) from recent financial statements of Zynga Inc. (ZNGA), Electronic Arts Inc. (EA), and Take-Two Interactive Software, Inc. (TTWO) are as follows: a. Compute the working capital for Year 2 and Year 1 for each company. b. Which company has the largest working capital? c. Compute the current ratio for Year 2 and Year 1 for each company. Round to one decimal place. d. For Year 2, rank the companies from most liquid to least liquid based upon the current ratio.arrow_forwardMike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture of office supplies. To be able to assess the financial capabilities of the company, Mike has been given the companys financial statements for the 2 most recent years. Required: Note: Round all answers to two decimal places. 1. Compute the following for each year: (a) return on assets, (b) return on stockholders equity, (c) earnings per share, (d) price-earnings ratio, (e) dividend yield, and (f ) dividend payout ratio. 2. CONCEPTUAL CONNECTION Based on the analysis in Requirement 1, would you invest in the common stock of Kepler?arrow_forward

- Grammatico Company has just completed its third year of operations. The income statement is as follows: Selected information from the balance sheet is as follows: Required: Note: Round answers to two decimal places. 1. Compute the times-interest-earned ratio. 2. Compute the debt ratio. 3. CONCEPTUAL CONNECTION Assume that the lower quartile, median, and upper quartile values for debt and times-interest-earned ratios in Grammaticos industry are as follows: How does Grammatico compare with the industrial norms? Does it have too much debt?arrow_forwardANALY SIS OF PROFITABILITY Based on the financial statement data in Exercise 24-1A, compute the following profitability measures for 20-2 (round all calculations to two decimal places): (a) Profit margin ratio (b) Return on assets (c) Return on common stockholders equity (d) Earnings per share of common stockarrow_forwardProfitability ratios help in the analysis of the combined impact of liquidity ratios, asset management ratios, and debt management ratios on the operating performance of a firm. Your boss has asked you to calculate the profitability ratios of Diusitech Inc. and make comments on its second-year performance as compared with its first-year performance. The following shows Diusitech Inc.'s income statement for the last two years. The company had assets of $8,225 million in the first year and $13,157 million in the second year. Common equity was equal to $4,375 million in the first year, and the company distributed 100% of its earnings out as dividends during the first and the second years. In addition, the firm did not issue new stock during either year. Diusitech Inc. Income Statement For the Year Ending on December 31 (Millions of dollars) Year 2 Year 1 4,445 1,120 222 1,342 3,103 310 2,793 698 2,095 Net Sales Operating costs except depreciation and amortization Depreciation and…arrow_forward

- Profitability ratios help in the analysis of the combined impact of liquidity ratios, asset management ratios, and debt management ratios on the operating performance of a firm. Your boss has asked you to calculate the profitability ratios of Petroxy Oil Co. and make comments on its second-year performance as compared with its first-year performance. The following shows Petroxy Oll Co.'s Income statement for the last two years. The company had assets of $9,400 million in the first year and $15,037 million in the second year. Common equity was equal to $5,000 million in the first year, and the company distributed 100% of its earnings out as dividends during the first and the second years. In addition, the firm did not issue new stock during either year. Petroxy Oil Co. Income Statement For the Year Ending on December 31 (Millions of dollars) Year 2 Year 1 4,000 1,268 Net Sales Operating costs except depreciation and amortization Depreciation and amortization Total Operating Costs…arrow_forwardDuPont system of analysis Use the following financial information for AT&T and Verizon to conduct a DuPont system of analysis for each company. Sales Earnings available for common stockholders Total assets Stockholders' equity a. Which company has the higher net profit margin? Higher asset turnover? b. Which company has the higher ROA? The higher ROE? c. Which company has the higher financial leverage multiplier? a. Net profit margin (Round to three decimal places.) AT&T Net profit margin AT&T $164,000 13,333 403,921 201,934 Verizon Verizon $126,280 13,608 244,280 24,232arrow_forwardRequirement 1. Compute the following ratios for both companies for the current year, and decide which company’s stock better fits your investment strategy. a. Acid-test ratio b. Inventory turnover c. Days’ sales in receivables d. Debt ratio e. Earnings per share of common stock f. Price/earnings ratio g. Dividend payoutarrow_forward

- Profitability ratios help in the analysis of the combined impact of liquidity ratios, asset management ratios, and debt management ratios on the operating performance of a firm. Your boss has asked you to calculate the profitability ratios of Petroxy Oil Co. and make comments on its second-year performance as compared with its first-year performance. The following shows Petroxy Oil Co.’s income statement for the last two years. The company had assets of $4,700 million in the first year and $7,518 million in the second year. Common equity was equal to $2,500 million in the first year, and the company distributed 100% of its earnings out as dividends during the first and the second years. In addition, the firm did not issue new stock during either year. Petroxy Oil Co. Income Statement For the Year Ending on December 31 (Millions of dollars) Year 2 Year 1 Net Sales 2,540 2,000 Operating costs except depreciation and amortization 1,610 1,495 Depreciation and…arrow_forwardCompute the following profitability ratios of the company for the most recent two years, show all values in the computations: 1.Asset Turnover 2.Profit margin ratio(Net Income/Net Sales) 3.Return on total assets (Net Income/Average Total Assets) 4.Return on stockholders’ equity 5.Basic Earnings per share (EPS) Based on the results above, what conclusions can you make about the company’s overall profitability and efficient use of assets?arrow_forward5. Profitability ratios Profitability ratios help in the analysis of the combined impact of liquidity ratios, asset management ratios, and debt management ratios on the operating performance of a firm. Your boss has asked you to calculate the profitability ratios of Diusitech Inc. and make comments on its second-year performance as compared with its first-year performance. The following shows Diusitech Inc.'s income statement for the last two years. The company had assets of $4,700 million in the first year and $7,518 million in the second year. Common equity was equal to $2,500 million in the first year, and the company distributed 100% of its earnings out as dividends during the first and the second years. In addition, the firm did not issue new stock during either year. Diusitech Inc. Income Statement For the Year Ending on December 31 (Millions of dollars) Year 2 Year 1 2,540 2,000 1,610 1,495 127 80 1,737 803 80 723 181 542 Net Sales Operating costs except depreciation and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License