Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 18E

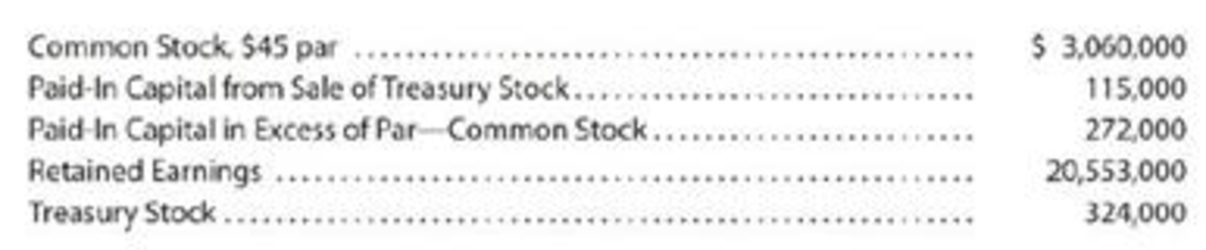

The following accounts and their balances appear in the ledger of Goodale Properties Inc. on June 30 of the current year:

Prepare the Stockholders’ Equity section of the balance sheet as of June 30. Eighty thousand shares of common stock are authorized, and 9,000 shares have been reacquired.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

"Stockholders' Equity" section of balance sheet

The following accounts and their balances appear in the ledger of Goodale Properties Inc. on June 30 of the current year:

Common Stock, $15 par

Paid-In Capital from Sale of Treasury Stock

Paid-In Capital in Excess of Par-Common Stock

Retained Earnings

Treasury Stock

Prepare the "Stockholders' Equity" section of the balance sheet as of June 30. Regarding the common stock, 50,000 shares are authorized,

and 450 shares have been reacquired.

Paid-In Capital:

$138,000

6,000

11,040

228,000

8,550

Line Item Description

Goodale Properties Inc.

Stockholders' Equity

June 30, 20XX

Paid-in capital, common stock

Treasury Stock (450 Shares at Cost)

Common Stock, $15 Par (50,000 Shares Authorized, 9,200 Shares Issued)

Excess of Issue Price Over Par

Amount

$ 138,000

Amount Amount

Prepare a statement of stockholders' equity for Al-Can Products, Inc.

Navigate to the Stockholders' Equity Statement tab in the spreadsheet.

Use the following information to prepare your statement:

a. January 1 balance of capital stock account of 9,000 shares issued at $6.00 per share was

$54,000.00.

b. No other stock was issued during the year.

c. January 1 balance of retained earnings account was $29,250.00.

d. Net Income was $41,106.00.

e. Dividends declared during the year were $19,200.00.

The following accounts and their balances appear in the ledger of Young Properties Inc. on November 30 of the current year:

$208,500

16,680

Common Stock, $15 par

Paid-In Capital in Excess of Par

Paid-In Capital from Sale of Treasury Stock

Retained Earnings

344,000

Treasury Stock

12,920

Prepare the Stockholders' Equity section of the balance sheet as of November 30. Fifty thousand shares of common stock are authorized, and 680 shares have been

reacquired.

Young Properties Inc.

Stockholders' Equity Section of the Balance Sheet

November 30

Paid-In Capital:

Total paid-in capital

Total

Total Stockholders' Equity

00000

9,000

Chapter 12 Solutions

Financial And Managerial Accounting

Ch. 12 - Of two corporations organized at approximately the...Ch. 12 - A stockbroker advises a client to buy preferred...Ch. 12 - A corporation with both preferred stock and common...Ch. 12 - Prob. 4DQCh. 12 - Prob. 5DQCh. 12 - Prob. 6DQCh. 12 - A corporation reacquires 60,000 shares of its own...Ch. 12 - Prob. 8DQCh. 12 - Prob. 9DQCh. 12 - Prob. 10DQ

Ch. 12 - Dividends per share Zero Calories Company has...Ch. 12 - Entries for issuing stock On January 22, Zentric...Ch. 12 - Entries for cash dividends The declaration,...Ch. 12 - Entries for stock dividends Alpine Energy...Ch. 12 - Entries for treasury stock On May 27, Hydro...Ch. 12 - Reporting stockholders equity Using the following...Ch. 12 - Statement of stockholders equity Noric Cruises...Ch. 12 - Earnings per share Financial statement data for...Ch. 12 - Dividends per share Seventy-Two Inc., a developer...Ch. 12 - Prob. 2ECh. 12 - Prob. 3ECh. 12 - Entries for issuing no-par stock On May 15, Helena...Ch. 12 - Issuing stock for assets other than cash On...Ch. 12 - Selected stock transactions Alpha Sounds Corp., an...Ch. 12 - Issuing stock Willow Creek Nursery, with an...Ch. 12 - Issuing stock Professional Products Inc., a...Ch. 12 - Entries for cash dividends The declaration,...Ch. 12 - Prob. 10ECh. 12 - Prob. 11ECh. 12 - Prob. 12ECh. 12 - Selected dividend transactions, stock split...Ch. 12 - Treasury stock transactions Mystic Lake Inc....Ch. 12 - Prob. 15ECh. 12 - Treasury stock transactions Biscayne Bay Water...Ch. 12 - Reporting paid-in capital The following accounts...Ch. 12 - Stockholders' Equity section of balance sheet The...Ch. 12 - Stockholders' Equity section of balance sheet...Ch. 12 - Retained earnings statement Sumter Pumps...Ch. 12 - Prob. 21ECh. 12 - Statement of stockholders equity The stockholders...Ch. 12 - Dividends on preferred and common stock Pecan...Ch. 12 - Stock transactions for corporate expansion On...Ch. 12 - Selected stock transactions The following selected...Ch. 12 - Entries for selected corporate transactions Morrow...Ch. 12 - Prob. 5PACh. 12 - Dividends on preferred and common stock Yosemite...Ch. 12 - Stock transaction for corporate expansion Pulsar...Ch. 12 - Selected stock transactions Diamondback Welding ...Ch. 12 - Entries for selected corporate transactions Nav-Go...Ch. 12 - Prob. 5PBCh. 12 - Selected transactions completed by Equinox...Ch. 12 - Analyze and compare Amazon.com and Wal-Mart...Ch. 12 - Analyze and compare Bank of America and Wells...Ch. 12 - Analyze Pacific Gas and Electric Company Pacific...Ch. 12 - Prob. 4MADCh. 12 - Prob. 5MADCh. 12 - Ethics in Action Tommy Gunn is a division manager...Ch. 12 - Prob. 2TIFCh. 12 - Communications Motion Designs Inc. has paid...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- STOCKHOLDERS EQUITY SECTION After closing its books on December 31, 20, Merrill Corporations stockholders equity accounts have the following balances: REQUIRED Prepare the stockholders equity section of the balance sheet for Merrill Corporation for the year ended December 31, 20--.arrow_forwardFortuna Company is authorized to issue 1,000,000 shares of $1 par value common stock. In its first year, the company has the following transactions: Journalize the transactions and calculate how many shares of stock are outstanding at August 3.arrow_forwardSTOCKHOLDERS EQUITY SECTION After closing its books on December 31, 20--, Jackson Corporations stockholders equity accounts had the following balances: REQUIRED Prepare the stockholders equity section of the balance sheet for Jackson for the year ended December 31, 20--.arrow_forward

- The following selected accounts appear in the ledger of EJ Construction Inc. at the beginning of the current fiscal year: During the year, the corporation completed a number of transactions affecting the stockholders equity. They are summarized as follows: a. Issued 500,000 shares of common stock at 8, receiving cash. b. Issued 10,000 shares of preferred 1% stock at 60. c. Purchased 50,000 shares of treasury common for 7 per share. d. Sold 20,000 shares of treasury common for 9 per share. e. Sold 5,000 shares of treasury common for 6 per share. f. Declared cash dividends of 0.50 per share on preferred stock and 0.08 per share on common stock. g. Paid the cash dividends. Instructions Journalize the entries to record the transactions. Identify each entry by letter.arrow_forwardAnslo Fabricating, Inc. is authorized to issue 10,000,000 shares of $5 stated value common stock. During the year, the company has the following transactions: Journalize the transactions.arrow_forwardNutritious Pet Food Companys board of directors declares a cash dividend of $1.00 per common share on November 12. On this date, the company has issued 12,000 shares but 2,000 shares are held as treasury shares. The company pays the dividend on December 14. What is the journal entry to record the payment of the dividend?arrow_forward

- James Incorporated is authorized to issue 5,000,000 shares of $1 par value common stock. In its second year of business, the company has the following transactions: Journalize the transactions.arrow_forwardNelson Corporation issued 9,000 shares of $3 stated value common stock for $11 per share on July 7. Record the stock issuance. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Jul. 7arrow_forwardPrepare all journal entries and adjusting journal entries necessary to record all of Red Robin’s transactions related to its stockholders’ equity. See information below: Stockholders’ Equity On January 1 of the current year, Red Robin had 441,100 shares of $1 par value common stock issued (i.e., the shares had been issued prior to the current year). They have 1,245,000 shares authorized and 400,200 shares outstanding. Red Robin has had only one stock repurchase transaction in its history. On August 1 of the current year, Red Robin reissued 6,650 shares for$24 per share. On December 1 of the current year, Red Robin reissued 11,700 shares at $12 per share. Red Robin declared dividends of 18 cents per share on the last day of each calendar quarter and paid them on the 5th day of the 1st month of each calendar quarter. For the sake of simplicity, assume the date of record is also the last day of each calendar quarter. Red Robin did not declare any dividends in the prior year.arrow_forward

- ssarrow_forwardPrepare Journal Entires: A company reported the following stockholders’ equity on January 1 of the current year:arrow_forwardThe following accounts and their balances appear in the ledger of Young Properties Inc. on November 30 of the current year: Common Stock, $15 par $168,000 Paid-In Capital in Excess of Par 13,440 Paid-In Capital from Sale of Treasury Stock 7,300 Retained Earnings 277,000 Treasury Stock 10, 450 Prepare the Stockholders' Equity section of the balance sheet as of November 30. Fifty thousand shares of common stock are authorized, and 550 shares have been reacquired.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Stockholders Equity: How to Calculate?; Author: Accounting University;https://www.youtube.com/watch?v=2jZk1T5GIlw;License: Standard Youtube License