Compute the following profitability ratios of the company for the most recent two years, show all values in the computations: 1.Asset Turnover 2.Profit margin ratio(Net Income/Net Sales) 3.Return on total assets (Net Income/Average Total Assets) 4.Return on stockholders’ equity 5.Basic Earnings per share (EPS) Based on the results above, what conclusions can you make about the company’s overall profitability and efficient use of assets?

Compute the following profitability ratios of the company for the most recent two years, show all values in the computations: 1.Asset Turnover 2.Profit margin ratio(Net Income/Net Sales) 3.Return on total assets (Net Income/Average Total Assets) 4.Return on stockholders’ equity 5.Basic Earnings per share (EPS) Based on the results above, what conclusions can you make about the company’s overall profitability and efficient use of assets?

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Compute the following profitability ratios of the company for the

most recent two years, show all values in the computations:

1.Asset Turnover

2.Profit margin ratio(Net Income/Net Sales)

3.Return on total assets (Net Income/Average Total Assets)

4.Return on stockholders’ equity

5.Basic Earnings per share (EPS)

Based on the results above, what conclusions can you make about the company’s overall profitability and efficient use of assets?

Transcribed Image Text:**Balance Sheet Overview (2019 vs. 2018)**

**Assets**

- **Current Assets:**

- Cash and cash equivalents: $19,079 (2019) | $10,019 (2018)

- Marketable securities: $35,776 (2019) | $31,095 (2018)

- Accounts receivable, net: $9,518 (2019) | $7,587 (2018)

- Prepaid expenses and other current assets: $1,852 (2019) | $1,779 (2018)

- Total current assets: $66,225 (2019) | $50,480 (2018)

- **Non-Current Assets:**

- Property and equipment, net: $35,323 (2019) | $24,683 (2018)

- Operating lease right-of-use assets, net: $9,460 (2019)

- Intangible assets, net: $894 (2019) | $1,294 (2018)

- Goodwill: $18,715 (2019) | $18,301 (2018)

- Other assets: $2,759 (2019) | $2,576 (2018)

- Total assets: $133,376 (2019) | $97,334 (2018)

**Liabilities and Stockholders' Equity**

- **Current Liabilities:**

- Accounts payable: $1,363 (2019) | $820 (2018)

- Partners payable: $886 (2019) | $541 (2018)

- Operating lease liabilities, current: $800 (2019)

- Accrued expenses and other current liabilities: $11,735 (2019) | $5,509 (2018)

- Deferred revenue and deposits: $269 (2019) | $147 (2018)

- Total current liabilities: $15,053 (2019) | $7,017 (2018)

- **Non-Current Liabilities:**

- Operating lease liabilities, non-current: $9,524 (2019)

- Other liabilities: $7,745 (2019) | $6,190 (2018)

- Total liabilities: $32,322 (2019) | $13,207 (2018)

- **Stockholders'

Transcribed Image Text:**Financial Summary for Years Ended December 31, 2019, 2018, and 2017**

**Revenue:**

- 2019: $70,697

- 2018: $55,838

- 2017: $40,653

**Costs and Expenses:**

1. **Cost of Revenue:**

- 2019: $12,770

- 2018: $9,355

- 2017: $3,454

2. **Research and Development:**

- 2019: $13,600

- 2018: $10,273

- 2017: $7,754

3. **Marketing and Sales:**

- 2019: $9,876

- 2018: $7,846

- 2017: $4,725

4. **General and Administrative:**

- 2019: $10,465

- 2018: $3,451

- 2017: $2,517

**Total Costs and Expenses:**

- 2019: $46,711

- 2018: $30,925

- 2017: $20,450

**Income from Operations:**

- 2019: $23,986

- 2018: $24,913

- 2017: $20,203

**Interest and Other Income, Net:**

- 2019: $826

- 2018: $448

- 2017: $391

**Income Before Provision for Income Taxes:**

- 2019: $24,812

- 2018: $25,361

- 2017: $20,594

**Provision for Income Taxes:**

- 2019: $6,327

- 2018: $3,249

- 2017: $4,660

**Net Income:**

- 2019: $18,485

- 2018: $22,112

- 2017: $15,934

This table provides a snapshot of financial performance over three years, detailing revenue and various cost components, as well as the resulting net income. Each line item represents key operational areas influencing overall financial health.

Expert Solution

Step 1

Ratio Analysis

It is a technique by which the financial position of a company is analyzed. This technique involves computing different ratios in order to compare the current position of the company with earlier period or to evaluate the current position.

Step 2

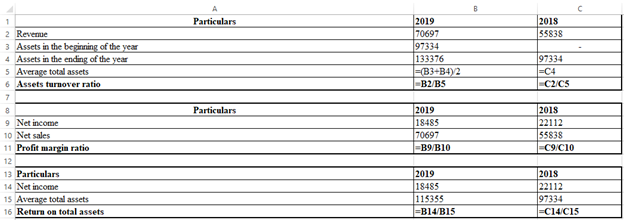

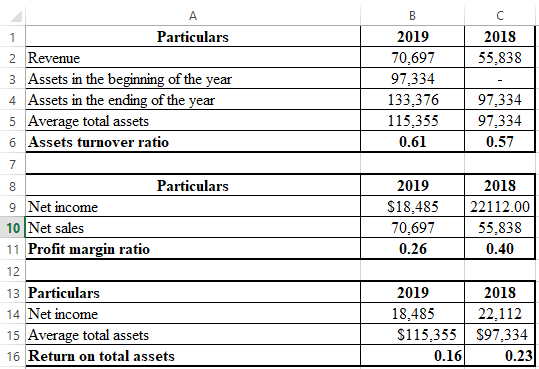

Requirement 1,2&3:

The asset turnover, profit margin, and return on total asset ratio are calculated as follows:

The resultant table is as follows:

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education