FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

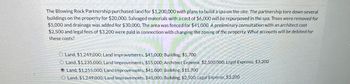

Transcribed Image Text:The Blowing Rock Partnership purchased land for $1,200,000 with plans to build a spa on the site. The partnership tore down several

buildings on the property for $20,000. Salvaged materials with a cost of $6,000 will be repurposed in the spa. Trees were removed for

$5,000 and drainage was added for $30,000. The area was fenced for $41,000. A preliminary consultation with an architect cost

$2,500 and legal fees of $3,200 were paid in connection with changing the zoning of the property. What accounts will be debited for

these costs?

O Land, $1,249,000; Land Improvements, $41,000; Building, $5,700

O Land, $1,235,000; Land Improvements, $55,000; Architect Expense, $2,500,000; Legal Expense, $3,200

Land, $1,255,000; Land Improvements, $41,000; Building, $11,700

O Land, $1,249,000; Land Improvements, $41,000; Building, $2,500; Legal Expense, $3,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sharkey's Fun Center contains a number of electronic games as well as a miniature golf course and various rides located outside the building. Paul Sharkey, the owner, would like to construct following information about the slide: water slide on one portion of his property. Mr. Sharkey gathered the a. Water slide equipment could be purchased and installed at a cost of $345,000. According to the manufacturer, the slide would be usable for 12 years after which it would have no salvage value. b. Mr. Sharkey would use straight-line depreciation on the slide equipment. c. To make room for the water slide, several rides would be dismantled and sold. These rides are fully depreciated, but they could be sold for $117,500 to an amusement park in a nearby city. d. Mr. Sharkey concluded that about 50,000 more people would use the water slide each year than have been using the rides. The admission price would be $3.80 per person (the same price the Fun Center has been charging for the old rides).…arrow_forwardA land developer purchased some farmland to build a suburb. The full cost was $2,000,000 and the package was appraised as follows: land: $1,200,000; buildings, $900,000; land improvements, $300,000. In addition, the developer spent $550,000 installing utilities, $1,300,000 preparing the streets and $300,000 building a parking lot. The developer received $100,000 when the topsoil was sold. What amount should be recorded in the Land Improvements account? A)$250,000 B)$2,300,000 C)$600,000 D) $2,400,000 Please explain how and why to calculate impairment, I have tried and used the formula : (Fair Value/Total Fair Value) x purchase price - amount recoverable. This was my calculation but it is incorrect (300000/2450000) x 2000000 - 100000 = 1448980 Please provide the correct formula and how to know where to input each number !arrow_forwardShelton Company purchased a parcel of land six years ago for $869,500. At that time, the firm invested $141,000 in grading the site so that it would be usable. Since the firm wasn't ready to use the site itself at that time, it decided to lease the land for $52,000 a year. The company is now considering building a warehouse on the site as the rental lease is expiring. The current value of the land is $921,000. What value should be included in the initial cost of the warehouse project for the use of this land? Multiple Choice A. $1,010,500 B. $869,500 C. $1,062,000 D. $921,000 E. SOarrow_forward

- Laramie Corporation has acquired a property that included both land and a building for $590,000. The corporation hired an appraiser who has determined that the market value of the land is $350,000 and that of the building is $470,000. At what amount should the corporation record the cost of the building? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)arrow_forwardCala Manufacturing purchases land for $297,000 as part of its plans to build a new plant. The company pays $40,200 to tear down an old building on the lot and $59,426 to fill and level the lot. It also pays construction costs of $1,767,800 for the new building and $111,589 for lighting and paving a parking area. Prepare a single journal entry to record these costs incurred by Cala, all of which are paid in cash.arrow_forwardTree Lovers Inc. purchased 100 acres of woodland in which the company intends to harvest the complete forest, leaving the land barren and worthless. Tree Lovers paid $3,000,000 for the land. Tree Lovers will sell the lumber as it is harvested and expects to deplete it over five years (23 acres in year one, 30 acres in year two, 24 acres in year three, 10 acres in year four, and 13 acres in year five). Calculate the depletion expense for the next five years. Year 1 $ Year 2 Year 3 $ Year 4 Year 5 Prepare the journal entry for year one. If an amount box does not require an entry, leave it blank. %24 %24 %24 %24 %24arrow_forward

- Home Properties is developing a subdivision that includes 470 home lots. The 210 lots in the Canyon section are below a ridge and do not have views of the neighboring canyons and hills; the 260 lots in the Hilltop section offer unobstructed views. The expected selling price for each Canyon lot is $43,000 and for each Hilltop lot is $101,000. The developer acquired the land for $2,400,000 and spent another $2,400,000 on street and utilities improvements. Assign the joint land and improvement costs of $4,800,000 to the Canyon section and the Hilltop section using the value basis of allocation. (Do not round your intermediate calculations.) Canyon section Hilltop section Totals Sales Value Numerator Percent of Sales Value Denominator % of Sales Value 0 0 0 Cost to Allocate Allocated Cost Quantity of Lotsarrow_forwardThe city of Fairbanks donated land to the Big Oil Company on June 1, 2006, that originally cost the city $900,000. On June 1, 2006, the land was estimated to be worth $1,350,000, and on December 31, 2006, the land's value was estimated to be $1,400,00. On Big Oil Company's balance sheet at December 31, 2006, the land should be valued at a. $1,400,000 b. $1,350,000 c. $900,000 d. $0arrow_forwardBudget Hardware Consultants purchased a building for $800,000 and depreciated it on a straight-line basis over a 35-year period. The estimated residual value is $100,000. After using the building for 15 years, Budget realized that wear and tear on the building would wear it out before 35 years and that the estimated residual value should be $88,000. Starting with the 16th year, Budget began depreciating the building over a revised total life of 20 years using the new residual value. Journalize depreciation expense on the building for years 15 and 16. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing the depreciation on the building for year 15. Date Accounts and Explanation Debit Creditarrow_forward

- Jacobson Company purchased a parcel of land for a new office building. The cost of the land was $310,000. An old building on the property wad demolished and construction began on the new building. All of this activity occurred within the same year. Costs included demolition ($37,000), architect fees on the new building design ($64,000), legal fees for land title investigation ($3,100), and construction ($768,000). At what amount should Jacobson Company record the cost the cost of the building? A B C D $768,000 $832,000 $869,000 $1,078,000arrow_forwardHome Properties is developing a subdivision that includes 320 home lots. The 150 lots in the Canyon section are below a ridge and do not have views of the neighboring canyons and hills; the 170 lots in the Hilltop section offer unobstructed views. The expected selling price for each Canyon lot is $42,000 and for each Hilltop lot is $105,000. The developer acquired the land for $2,100,000 and spent another $3,000,000 on street and utilities improvements. Assign the joint land and improvement costs of $5,100,000 to the Canyon section and the Hilltop section using the value basis of allocation. (Do not round your intermediate calculations.) Canyon section Hilltop section Totals Sales Value Numerator Percent of Sales Value Denominator % of Sales Value 0 0 0 Cost to Allocate Allocated Cost Quantity of Lotsarrow_forwardHome Properties is developing a subdivision that includes 340 home lots. The 200 lots in the Canyon section are below a ridge and do not have views of the neighboring canyons and hills; the 140 lots in the Hilltop section offer unobstructed views. The expected selling price for each Canyon lot is $47,000 and for each Hilltop lot is $96,000. The developer acquired the land for $1.700,000 and spent another $2,700,000 on street and utilities improvements. Assign the joint land and improvement costs of $4,400,000 to the Canyon section and the Hilltop section using the value basis of allocation. (Do not round your intermediate calculations.) Canyon section Hilltop section Totals Sales Value Numerator Percent of Sales Value Denominator % of Sales Value 0 0 0 Cost to Allocate Allocated Cost Quantity of Lotsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education