FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

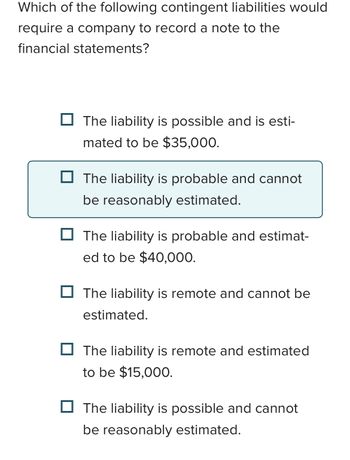

Transcribed Image Text:Which of the following contingent liabilities would

require a company to record a note to the

financial statements?

The liability is possible and is esti-

mated to be $35,000.

The liability is probable and cannot

be reasonably estimated.

The liability is probable and estimat-

ed to be $40,000.

The liability is remote and cannot be

estimated.

The liability is remote and estimated

to be $15,000.

The liability is possible and cannot

be reasonably estimated.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Maridell’s Fashions has a debt that has been properly reported as a long-term liabilityup to the present year (2018). Some of this debt comes due in 2018. If Maridell’s Fashionscontinues to report the current position as a long-term liability, the effect will be toa. understate the debt ratio.b. understate total liabilities.c. overstate the current ratio.d. overstate net income.arrow_forward3. a. List and describe three types of deferred credits? b. Do they meet the definition of a liability? Of short or long term? c. Why do some accountants not consider them to be a liability? d. Do deferred credits affect liquidity? 4. List and discuss four reasons a company would prefer to issue debt rather than equity securities. 5. When and why should liabilities for each of the following items be recorded on the books of an ordinary business corporation? a. Purchase of goods on account. b. Officers' salaries c. Dividends d. Interest e. Loss contingenciesarrow_forward1. Distinguish between a current liability and a long-term debt. 2. Why is the liabilities section of the balance sheet of primary significance to bankers? 3. What is the nature of a discount on notes payable? 4. Under what conditions must an employer accrue a liability for the cost of compensated absences? 5. Under what conditions should short-term obligation be excluded from current liabilities? 5.arrow_forward

- In 2-3 paragraphs complete the following: Define gain contingency. Describe the accounting requirements for a gain contingency. Define contingency. What exactly is the company uncertain about—whether a future event will take place and result in a liability or whether a future event will take place that will confirm that a liability exists from an event that has already taken place?arrow_forwardWhich of the following statements about "avoidable interest" is false? it is computed only on self-constructed assets. it is computed using a weighted-average interest rate on debt and equity financing. it increases assets on the balance sheet. O it is an approximation of the interest expense the firm would have incurred if it financed all construction through debt.arrow_forwardWarranty liability is an estimate based on past warranty claims. How might a company determine how much to accrue for warranty? Why might it change the accrual?arrow_forward

- Accounting for liabilities involves recording and managing obligations a company owes to external parties. Liabilities are classified based on their nature and timing of settlement. Common types include: Current Liabilities: Debts or obligations expected to be settled within one year or the operating cycle, whichever is longer. Examples include accounts payable, accrued expenses, and short-term loans. Long-Term Liabilities: Obligations not due within the next operating cycle or one year. Examples include long-term loans, bonds payable, and lease obligations. Contingent Liabilities: Potential obligations that depend on a future event, such as lawsuits or warranties. They are disclosed in the footnotes of financial statements unless the likelihood of payment is remote. Deferred Revenue: Payments received in advance for goods or services to be provided in the future. They are recorded as liabilities until the revenue recognition criteria are met. Accrued Liabilities: Expenses…arrow_forwardStar Company has a contingent liability that has a likelihood of actual occurrence that is classified as probable. Also, the amount of the liability can be reasonably estimated. Under these circumstances, Star is required to Multiple Choice O recognize a liability only. disclose but not recognize the liability or the expense. recognize a liability and an expense in its financial statements. recognize an expense only.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education